PV Modules: Bifacial technology

go PV

Current status

Bankability

The uncertainty of PV production of bifacial systems means more investment risk.

•

More investment risk implies higher interest rates.

•

Weighted Average Capital Cost (WACC) is related to the interest rate and is crucial for PV projects development.

•

The more bifacial installations, projects and studies there are, the less bifacial production uncertainty.

•

Simulation tools are a key part of the bifacial technology deployment.

140

130

120

110

100

ㅁ

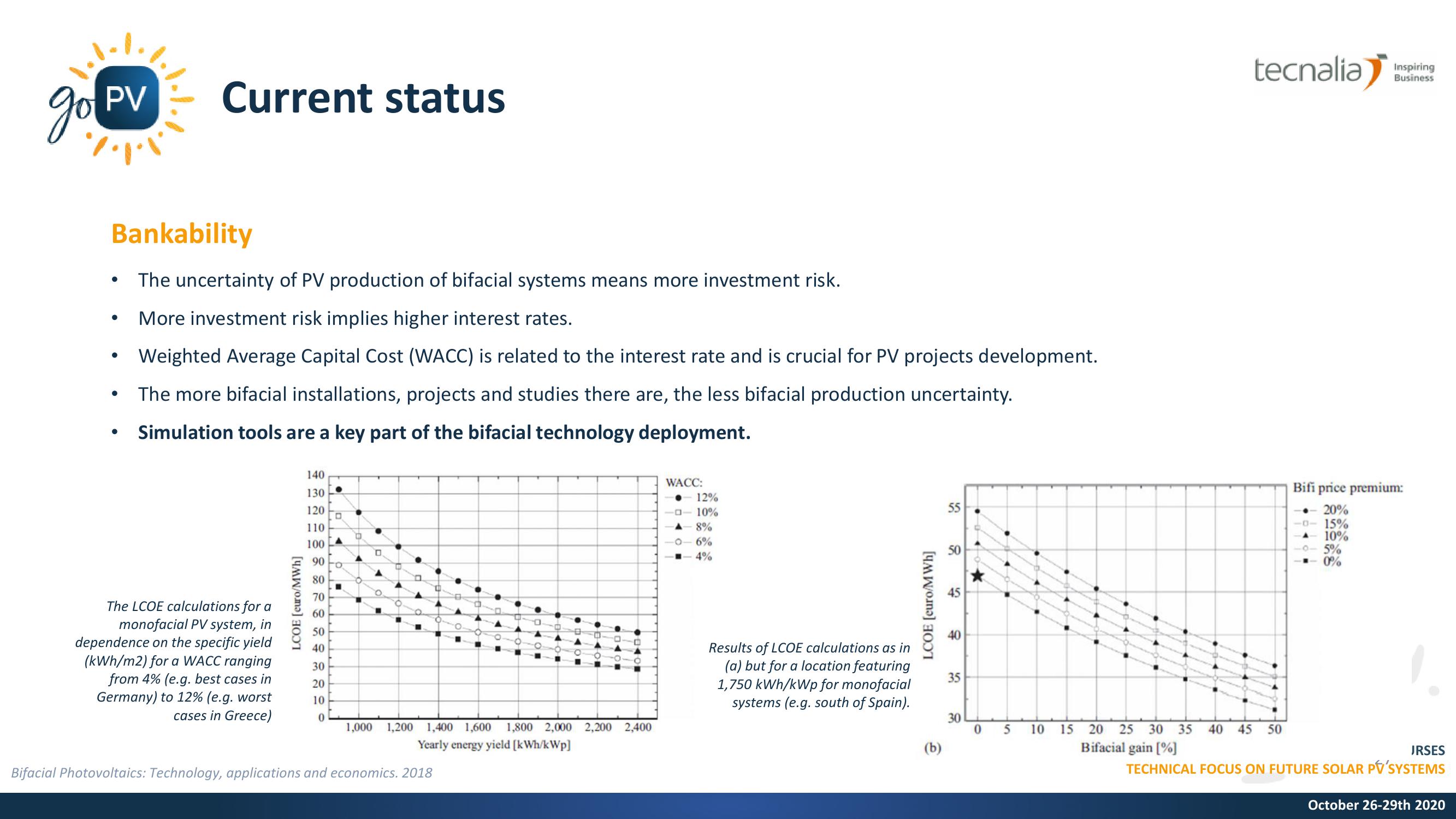

The LCOE calculations for a

monofacial PV system, in

dependence on the specific yield

LCOE [euro/MWh]

90

80

70

60

50

40

(kWh/m2) for a WACC ranging

30

from 4% (e.g. best cases in

20

Germany) to 12% (e.g. worst

10

cases in Greece)

0

1,000

1,200 1,400 1,600 1,800 2,000 2,200 2,400

Yearly energy yield [kWh/kWp]

Bifacial Photovoltaics: Technology, applications and economics. 2018

WACC:

12%

ーロー 10%

8%

6%

■-4%

55

LCOE [euro/MWh]

40

55

45

Results of LCOE calculations as in

(a) but for a location featuring

1,750 kWh/kWp for monofacial

systems (e.g. south of Spain).

35

30

30

0

5

10

(b)

tecnalia

Bifi price premium:

20%

-0-15%

10%

5%

0%

Inspiring

Business

15 20 25 30 35 40 45 50

Bifacial gain [%]

JRSES

TECHNICAL FOCUS ON FUTURE SOLAR PV'SYSTEMS

October 26-29th 2020View entire presentation