Main Street Investor Presentation

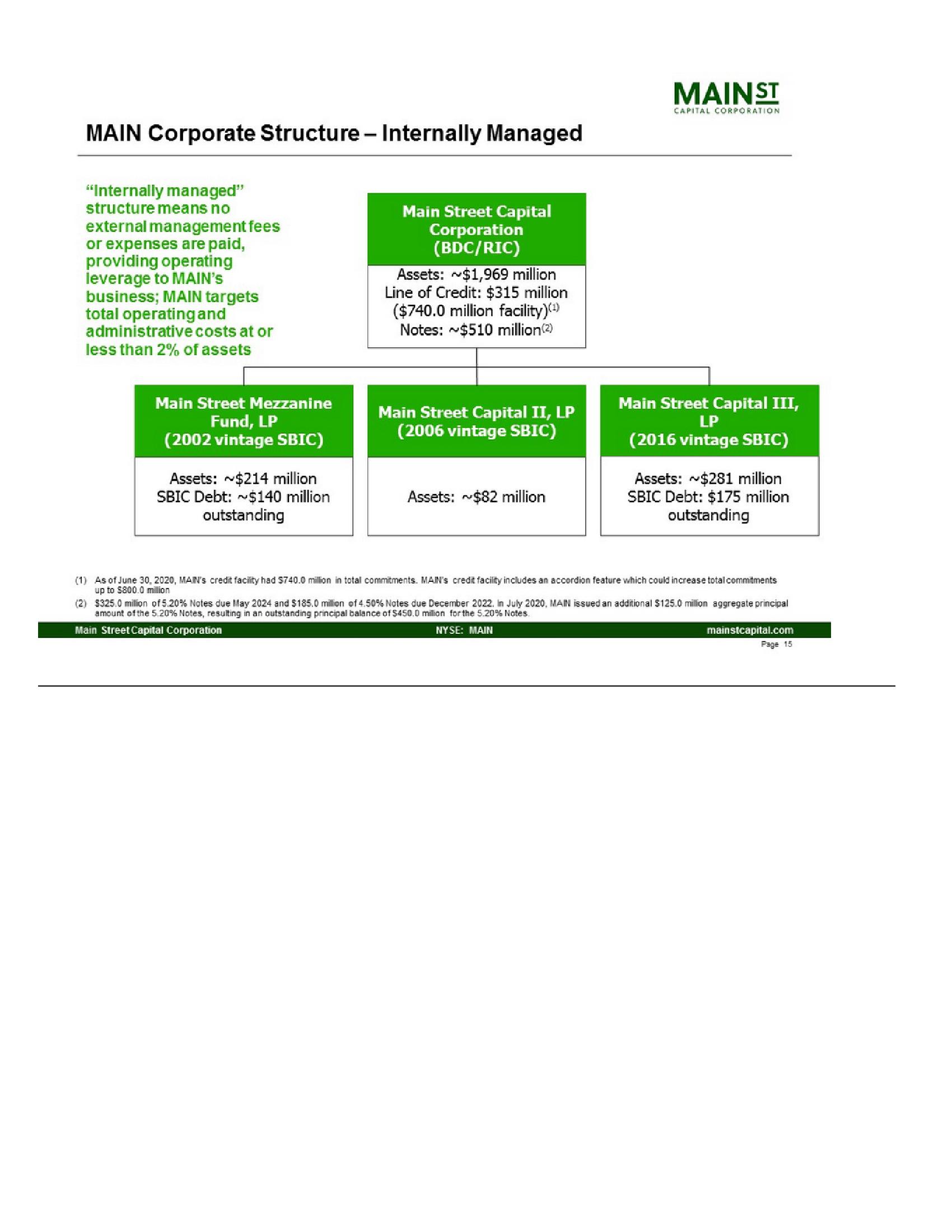

MAIN Corporate Structure - Internally Managed

"Internally managed"

structure means no

external management fees

or expenses are paid,

providing operating

leverage to MAIN'S

business; MAIN targets

total operating and

administrative costs at or

less than 2% of assets

Main Street Capital

Corporation

(BDC/RIC)

Assets: $1,969 million

Line of Credit: $315 million

($740.0 million facility)(¹)

Notes: $510 million(2)

MAINST

CAPITAL CORPORATION

Main Street Mezzanine

Fund, LP

(2002 vintage SBIC)

Assets:

SBIC Debt:

Main Street Capital II, LP

(2006 vintage SBIC)

$214 million

$140 million

outstanding

Assets: $82 million

Main Street Capital III,

LP

(2016 vintage SBIC)

Assets: $281 million

SBIC Debt: $175 million

outstanding

(1) As of June 30, 2020, MAIN's credit facility had $740.0 million in total commitments. MAIN's credit facility includes an accordion feature which could increase total commitments

up to $800.0 million

(2) $325.0 million of 5.20% Notes due May 2024 and $185.0 million of 4.50% Notes due December 2022. In July 2020, MAIN issued an additional $125.0 million aggregate principal

amount of the 5.20% Notes, resulting in an outstanding principal balance of $450.0 million for the 5.20% Notes.

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.com

Page 15View entire presentation