Analyst Day Presentation

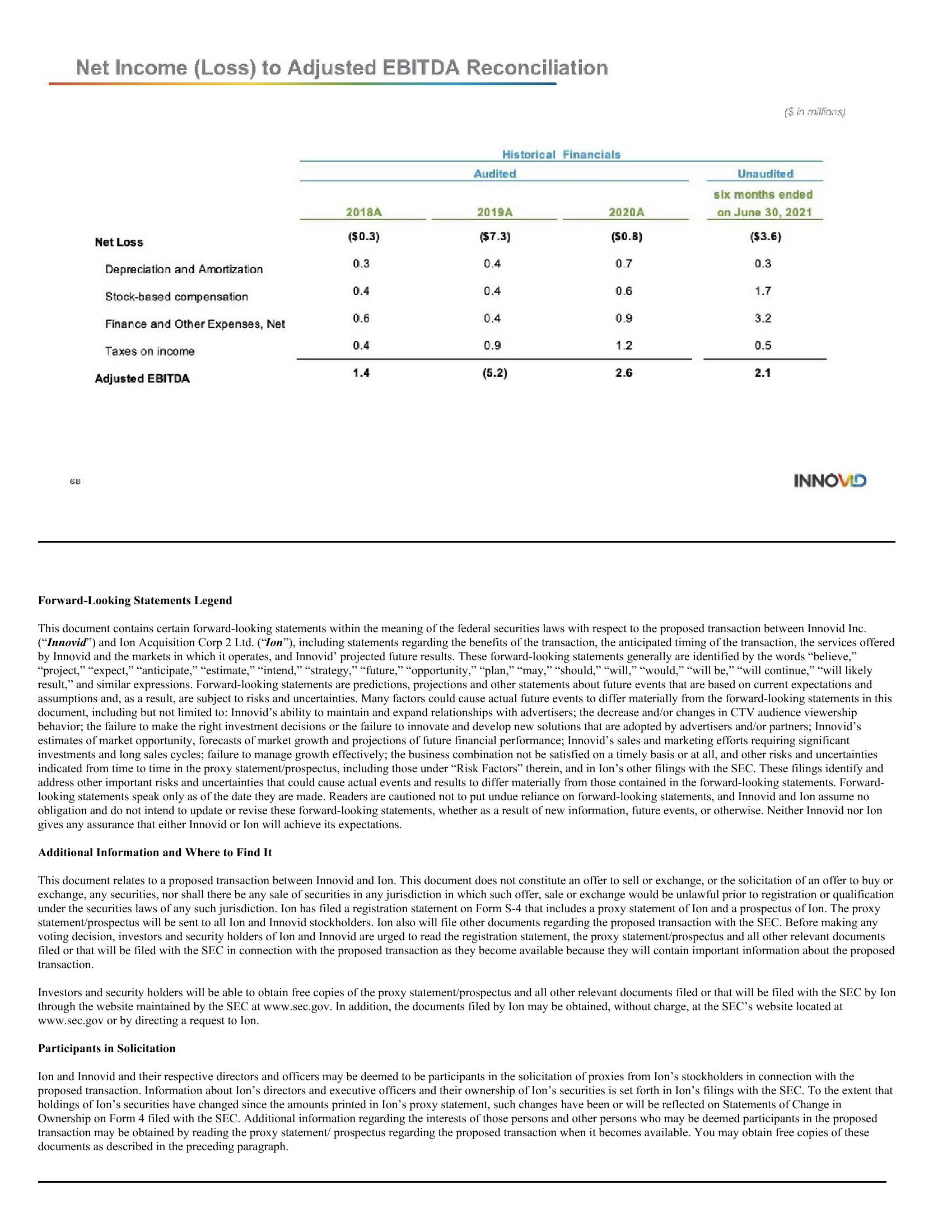

Net Income (Loss) to Adjusted EBITDA Reconciliation

68

Net Loss

Depreciation and Amortization

Stock-based compensation

Finance and Other Expenses, Net

Taxes on income

Adjusted EBITDA

2018A

($0.3)

Additional Information and Where to Find It

0.3

0.4

0.6

0.4

1.4

Audited

2019A

($7.3)

0.4

0.4

Historical Financials

0.4

0.9

(5.2)

2020A

($0.8)

0.7

0.6

0.9

1.2

2.6

Unaudited

six months ended

on June 30, 2021

($3.6)

0.3

1.7

3.2

0.5

($ in millions)

2.1

INNOVID

Forward-Looking Statements Legend

This document contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Innovid Inc.

("Innovid') and Ion Acquisition Corp 2 Ltd. ("Ion"), including statements regarding the benefits of the transaction, the anticipated timing of the transaction, the services offered

by Innovid and the markets in which it operates, and Innovid' projected future results. These forward-looking statements generally are identified by the words "believe,"

"project," "expect," "anticipate," "estimate," "intend," "strategy," "future," "opportunity," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely

result," and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and

assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this

document, including but not limited to: Innovid's ability to maintain and expand relationships with advertisers; the decrease and/or changes in CTV audience viewership

behavior; the failure to make the right investment decisions or the failure to innovate and develop new solutions that are adopted by advertisers and/or partners; Innovid's

estimates of market opportunity, forecasts of market growth and projections of future financial performance; Innovid's sales and marketing efforts requiring significant

investments and long sales cycles; failure to manage growth effectively; the business combination not be satisfied on a timely basis or at all, and other risks and uncertainties

indicated from time to time in the proxy statement/prospectus, including those under "Risk Factors" therein, and in Ion's other filings with the SEC. These filings identify and

address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-

looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Innovid and Ion assume no

obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Innovid nor Ion

gives any assurance that either Innovid or Ion will achieve its expectations.

This document relates to a proposed transaction between Innovid and Ion. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or

exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. Ion has filed a registration statement on Form S-4 that includes a proxy statement of Ion and a prospectus of Ion. The proxy

statement/prospectus will be sent to all Ion and Innovid stockholders. Ion also will file other documents regarding the proposed transaction with the SEC. Before making any

voting decision, investors and security holders of Ion and Innovid are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents

filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed

transaction.

Investors and security holders will be able to obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Ion

through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Ion may be obtained, without charge, at the SEC's website located at

www.sec.gov or by directing a request to Ion.

Participants in Solicitation

Ion and Innovid and their respective directors and officers may be deemed to be participants in the solicitation of proxies from Ion's stockholders in connection with the

proposed transaction. Information about Ion's directors and executive officers and their ownership of Ion's securities is set forth in Ion's filings with the SEC. To the extent that

holdings of Ion's securities have changed since the amounts printed in Ion's proxy statement, such changes have been or will be reflected on Statements of Change in

Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed

transaction may be obtained by reading the proxy statement/ prospectus regarding the proposed transaction when it becomes available. You may obtain free copies of these

documents as described in the preceding paragraph.View entire presentation