Q2 2018 Fixed Income Investor Conference Call

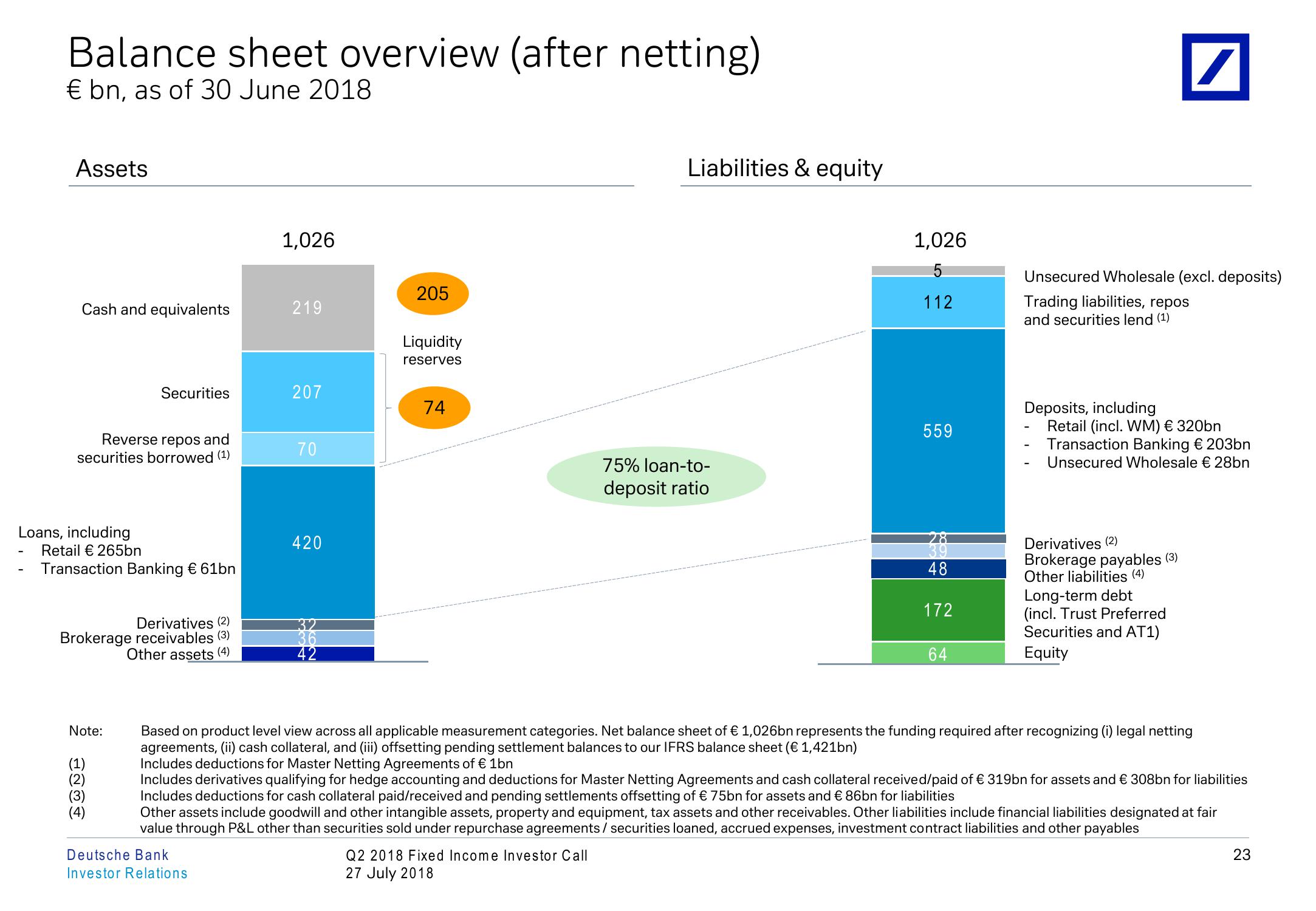

Balance sheet overview (after netting)

€ bn, as of 30 June 2018

Assets

1,026

205

Cash and equivalents

219

Liquidity

reserves

Securities

207

74

Reverse repos and

70

securities borrowed (1)

Loans, including

420

Retail € 265bn

Transaction Banking € 61bn

Derivatives (2)

Brokerage receivables (3)

Other assets (4)

32

42

Liabilities & equity

75% loan-to-

deposit ratio

1,026

112

559

Unsecured Wholesale (excl. deposits)

Trading liabilities, repos

and securities lend (1)

-

Deposits, including

Retail (incl. WM) € 320bn

Transaction Banking € 203bn

Unsecured Wholesale € 28bn

28

48

Derivatives (2)

Brokerage payables (3)

Other liabilities (4)

Long-term debt

172

(incl. Trust Preferred

Securities and AT1)

64

Equity

Note:

(1)

Based on product level view across all applicable measurement categories. Net balance sheet of € 1,026bn represents the funding required after recognizing (i) legal netting

agreements, (ii) cash collateral, and (iii) offsetting pending settlement balances to our IFRS balance sheet (€ 1,421bn)

Includes deductions for Master Netting Agreements of € 1bn

Includes derivatives qualifying for hedge accounting and deductions for Master Netting Agreements and cash collateral received/paid of € 319bn for assets and € 308bn for liabilities

Includes deductions for cash collateral paid/received and pending settlements offsetting of € 75bn for assets and € 86bn for liabilities

Other assets include goodwill and other intangible assets, property and equipment, tax assets and other receivables. Other liabilities include financial liabilities designated at fair

value through P&L other than securities sold under repurchase agreements / securities loaned, accrued expenses, investment contract liabilities and other payables

Deutsche Bank

Investor Relations

Q2 2018 Fixed Income Investor Call

27 July 2018

23

23View entire presentation