Massachusetts Water Resources Authority (“MWRA”) Employees’ Retirement System

Data & Analytics Case Study

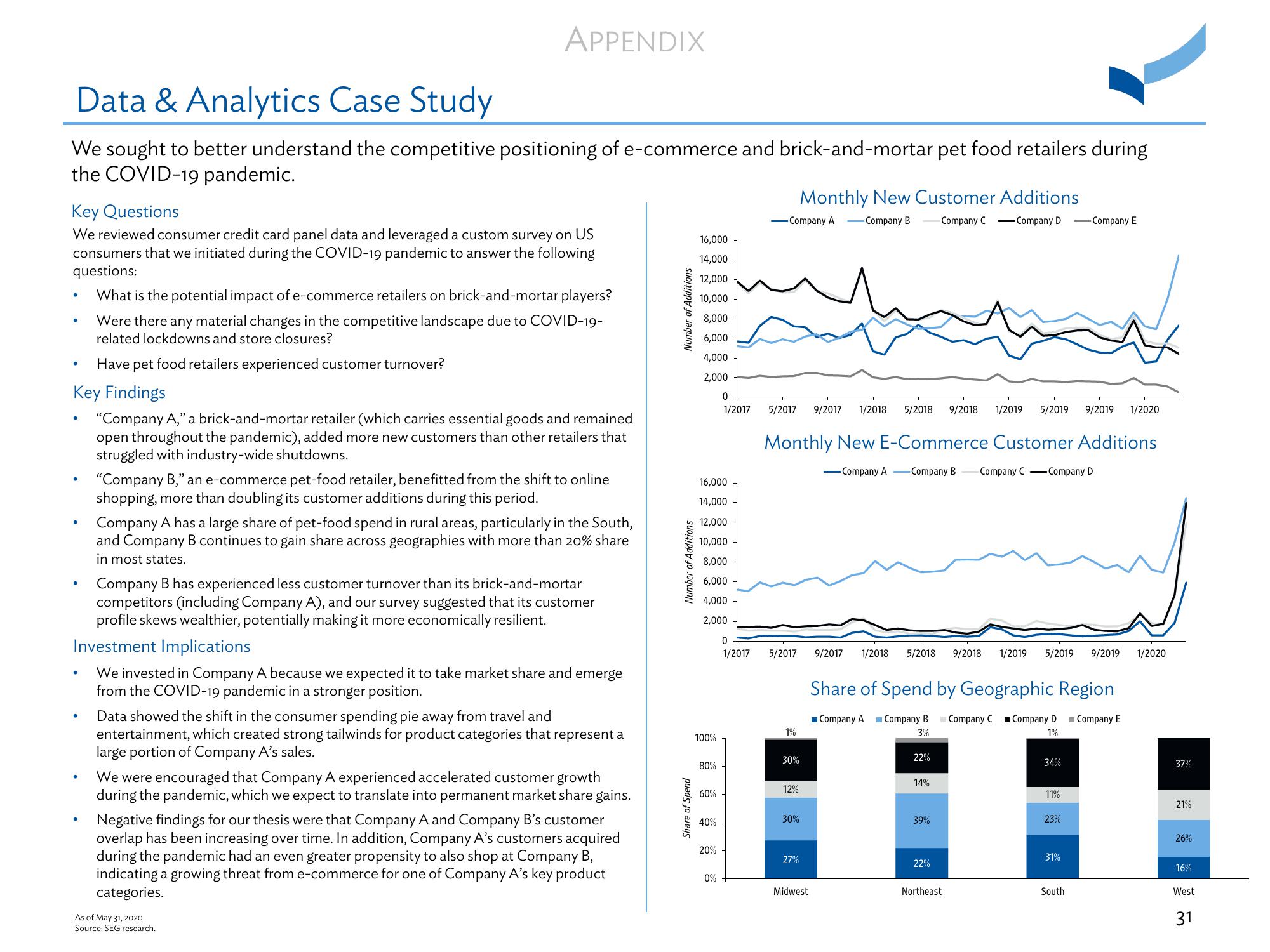

We sought to better understand the competitive positioning of e-commerce and brick-and-mortar pet food retailers during

the COVID-19 pandemic.

Key Questions

We reviewed consumer credit card panel data and leveraged a custom survey on US

consumers that we initiated during the COVID-19 pandemic to answer the following

questions:

●

What is the potential impact of e-commerce retailers on brick-and-mortar players?

Were there any material changes in the competitive landscape due to COVID-19-

related lockdowns and store closures?

Have pet food retailers experienced customer turnover?

Key Findings

"Company A," a brick-and-mortar retailer (which carries essential goods and remained

open throughout the pandemic), added more new customers than other retailers that

struggled with industry-wide shutdowns.

APPENDIX

●

●

"Company B," an e-commerce pet-food retailer, benefitted from the shift to online

shopping, more than doubling its customer additions during this period.

Company A has a large share of pet-food spend in rural areas, particularly in the South,

and Company B continues to gain share across geographies with more than 20% share

in most states.

Company B has experienced less customer turnover than its brick-and-mortar

competitors (including Company A), and our survey suggested that its customer

profile skews wealthier, potentially making it more economically resilient.

Investment Implications

We invested in Company A because we expected it to take market share and emerge

from the COVID-19 pandemic in a stronger position.

Data showed the shift in the consumer spending pie away from travel and

entertainment, which created strong tailwinds for product categories that represent a

large portion of Company A's sales.

We were encouraged that Company A experienced accelerated customer growth

during the pandemic, which we expect to translate into permanent market share gains.

Negative findings for our thesis were that Company A and Company B's customer

overlap has been increasing over time. In addition, Company A's customers acquired

during the pandemic had an even greater propensity to also shop at Company B,

indicating a growing threat from e-commerce for one of Company A's key product

categories.

As of May 31, 2020.

Source: SEG research.

Number of Additions

Number of Additions

Share of Spend

16,000

14,000

12,000

10,000

8,000

6,000

4,000

2,000

16,000

14,000

12,000

10,000

8,000

6,000

4,000

2,000

100%

80%

60%

40%

20%

0

1/2017

0%

0

1/2017

Monthly New Customer Additions

-Company A -Company B

5/2017 9/2017 1/2018 5/2018 9/2018 1/2019 5/2019 9/2019 1/2020

Monthly New E-Commerce Customer Additions

-Company A Company B Company C-Company D

5/2017

1%

30%

12%

30%

27%

Midwest

9/2017 1/2018 5/2018 9/2018 1/2019 5/2019 9/2019

Share of Spend by Geographic Region

Company A Company B

3%

Company D Company E

1%

22%

Company C-Company D-Company E

14%

39%

22%

Northeast

Company C

34%

11%

23%

31%

South

1/2020

37%

21%

26%

16%

West

31View entire presentation