Disney Investor Presentation Deck

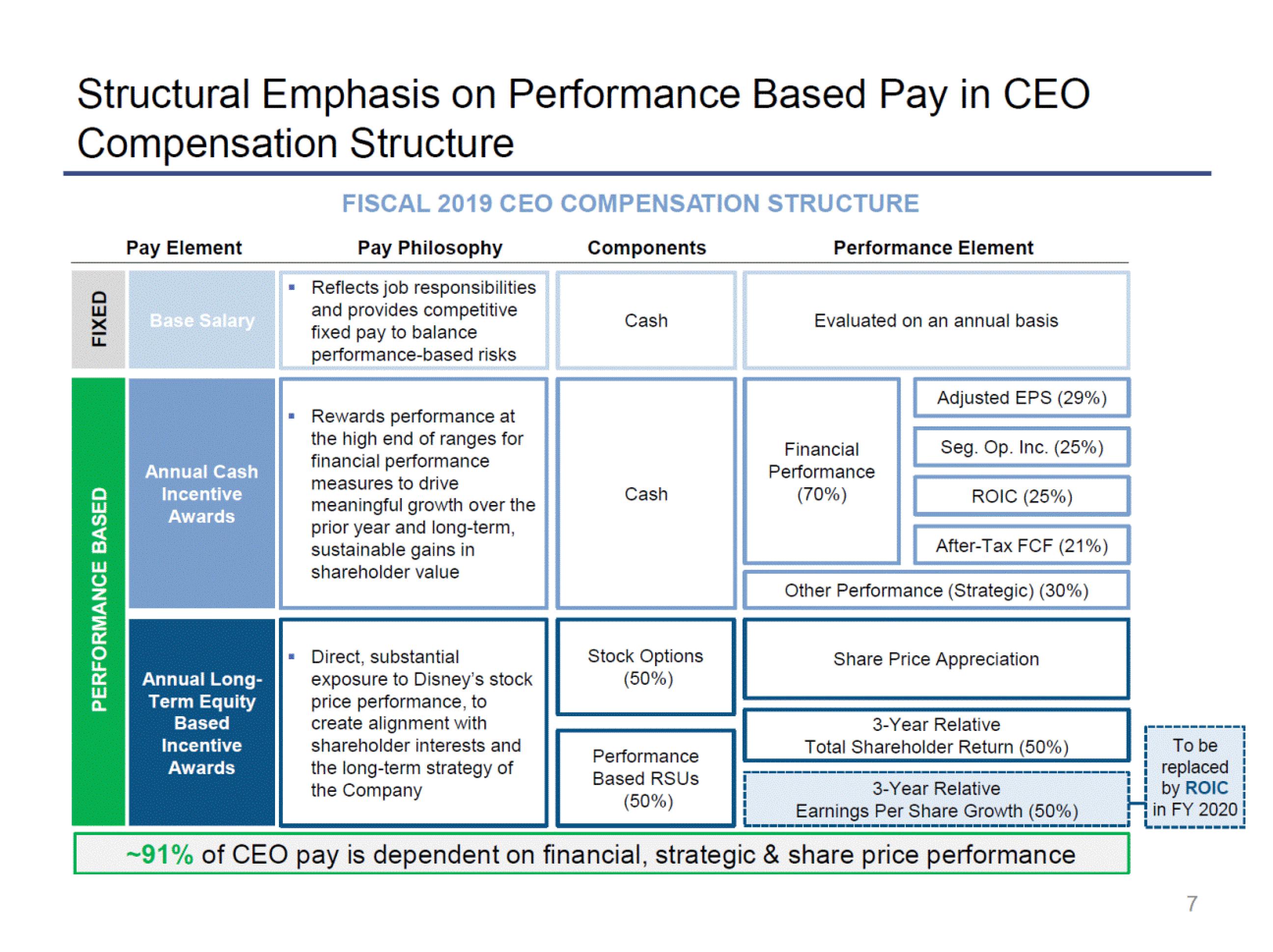

Structural Emphasis on Performance Based Pay in CEO

Compensation Structure

FIXED

PERFORMANCE BASED

Pay Element

Base Salary

Annual Cash

Incentive

Awards

Annual Long-

Term Equity

Based

Incentive

Awards

FISCAL 2019 CEO COMPENSATION STRUCTURE

Pay Philosophy

Components

Reflects job responsibilities

and provides competitive

fixed pay to balance

performance-based risks

Rewards performance at

the high end of ranges for

financial performance

measures to drive

meaningful growth over the

prior year and long-term,

sustainable gains in

shareholder value

Direct, substantial

exposure to Disney's stock

price performance, to

create alignment with

shareholder interests and

the long-term strategy of

the Company

Cash

Cash

Stock Options

(50%)

Performance

Based RSUS

(50%)

Performance Element

Evaluated on an annual basis

Financial

Performance

(70%)

Adjusted EPS (29%)

Seg. Op. Inc. (25%)

ROIC (25%)

After-Tax FCF (21%)

Other Performance (Strategic) (30%)

Share Price Appreciation

3-Year Relative

Total Shareholder Return (50%)

3-Year Relative

Earnings Per Share Growth (50%)

~91% of CEO pay is dependent on financial, strategic & share price performance

To be

replaced

by ROIC

in FY 2020

7View entire presentation