FY 2023 Second Quarter Earnings Call

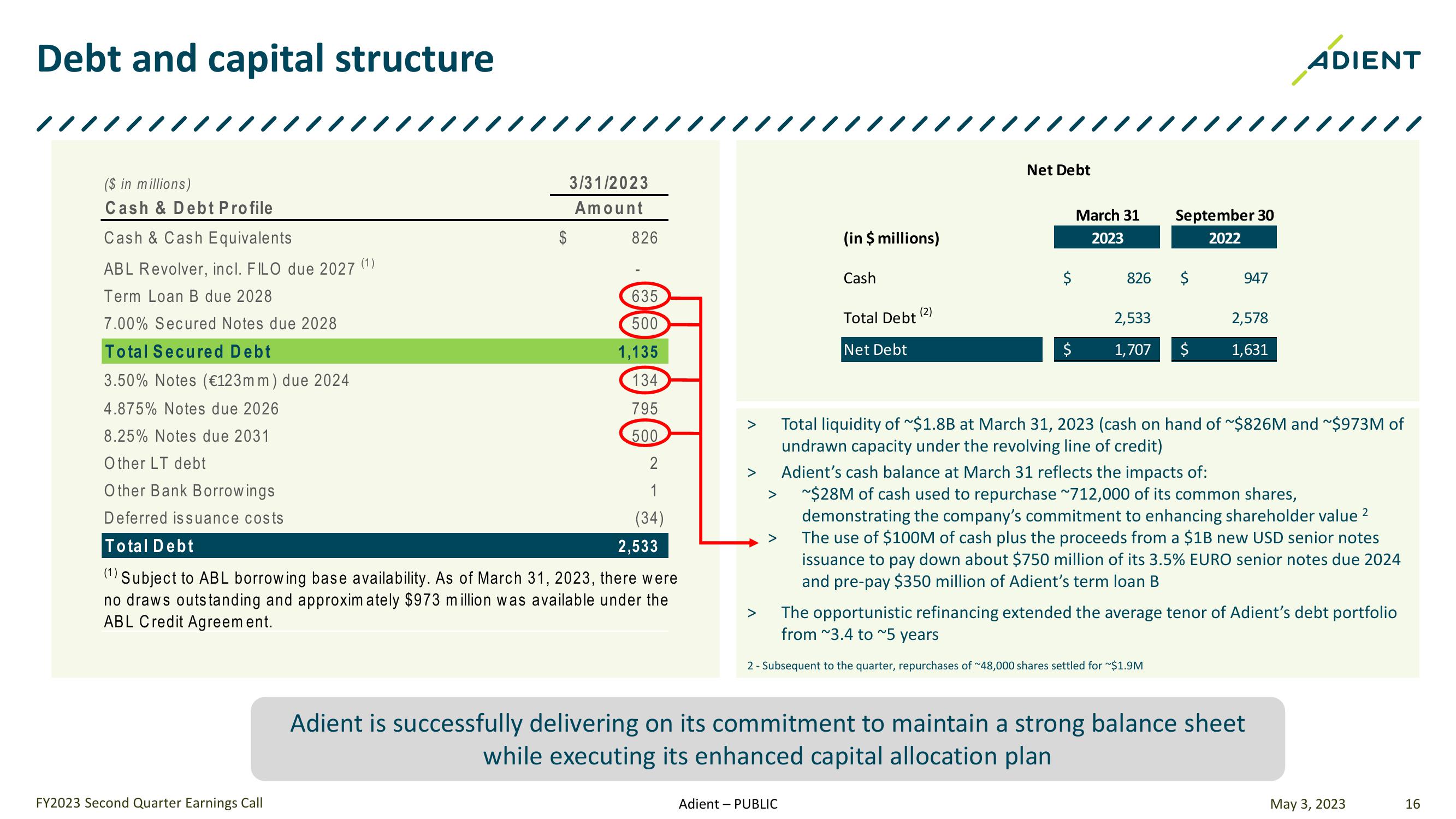

Debt and capital structure

Net Debt

ADIENT

////

($ in millions)

Cash & Debt Profile

Cash & Cash Equivalents

ABL Revolver, incl. FILO due 2027 (1)

Term Loan B due 2028

7.00% Secured Notes due 2028

Total Secured Debt

3.50% Notes (€123mm) due 2024

4.875% Notes due 2026

8.25% Notes due 2031

Other LT debt

Other Bank Borrowings

Deferred issuance costs

Total Debt

March 31

2023

September 30

2022

3/31/2023

Amount

$

826

(in $ millions)

Cash

$

826

$

947

635

(2)

Total Debt

2,533

2,578

500

1,135

Net Debt

1,707

$

1,631

134

795

>

500

2

1

>

(34)

>

2,533

(1) Subject to ABL borrowing base availability. As of March 31, 2023, there were

no draws outstanding and approximately $973 million was available under the

ABL Credit Agreement.

Total liquidity of ~$1.8B at March 31, 2023 (cash on hand of ~$826M and ~$973M of

undrawn capacity under the revolving line of credit)

Adient's cash balance at March 31 reflects the impacts of:

~$28M of cash used to repurchase ~712,000 of its common shares,

demonstrating the company's commitment to enhancing shareholder value 2

The use of $100M of cash plus the proceeds from a $1B new USD senior notes

issuance to pay down about $750 million of its 3.5% EURO senior notes due 2024

and pre-pay $350 million of Adient's term loan B

The opportunistic refinancing extended the average tenor of Adient's debt portfolio

from ~3.4 to ~5 years

2- Subsequent to the quarter, repurchases of ~48,000 shares settled for ~$1.9M

FY2023 Second Quarter Earnings Call

Adient is successfully delivering on its commitment to maintain a strong balance sheet

while executing its enhanced capital allocation plan

Adient PUBLIC

May 3, 2023

16View entire presentation