Antofagasta Results Presentation Deck

800

600

400

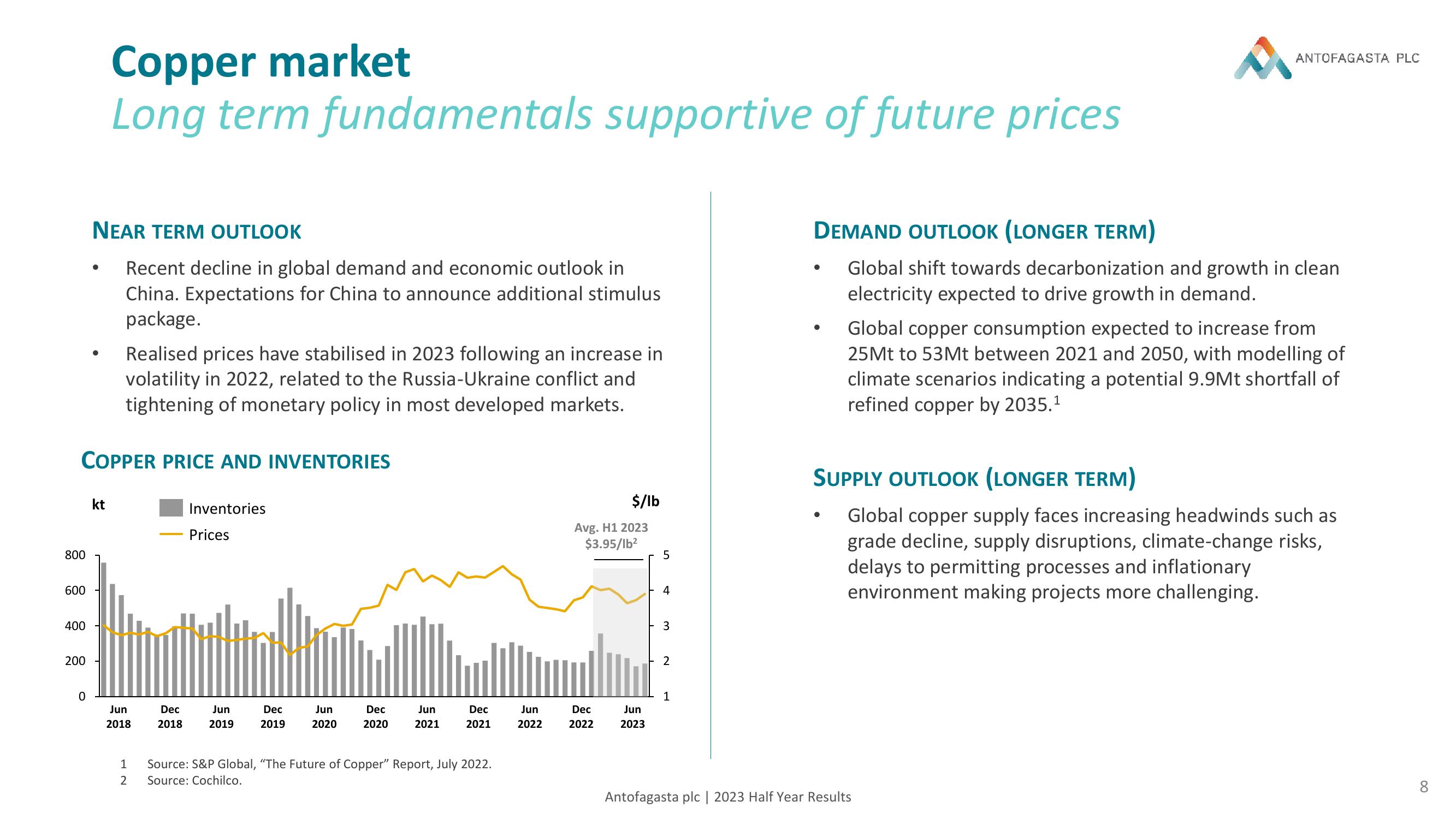

COPPER PRICE AND INVENTORIES

Inventories

Prices

200

O

NEAR TERM OUTLOOK

Recent decline in global demand and economic outlook in

China. Expectations for China to announce additional stimulus

package.

●

Copper market

Long term fundamentals supportive of future prices

kt

Realised prices have stabilised in 2023 following an increase in

volatility in 2022, related to the Russia-Ukraine conflict and

tightening of monetary policy in most developed markets.

Jun

2018

12

Dec

2018

Jun

2019

Dec

2019

Jun

2020

Dec

2020

Jun

2021

Dec

2021

Source: S&P Global, "The Future of Copper" Report, July 2022.

Source: Cochilco.

Jun

2022

$/lb

Avg. H1 2023

$3.95/1b²

Dec

2022

Jun

2023

LO

5

4

3

2

1

DEMAND OUTLOOK (LONGER TERM)

Global shift towards decarbonization and growth in clean

electricity expected to drive growth in demand.

●

●

●

ANTOFAGASTA PLC

Global copper consumption expected to increase from

25Mt to 53Mt between 2021 and 2050, with modelling of

climate scenarios indicating a potential 9.9Mt shortfall of

refined copper by 2035.¹

SUPPLY OUTLOOK (LONGER TERM)

Global copper supply faces increasing headwinds such as

grade decline, supply disruptions, climate-change risks,

delays to permitting processes and inflationary

environment making projects more challenging.

Antofagasta plc | 2023 Half Year Results

8View entire presentation