Blackwells Capital Activist Presentation Deck

STRONG EXPECTED E-COMMERCE PERFORMANCE TO DRIVE

DEMAND FOR INDUSTRIAL SPACE

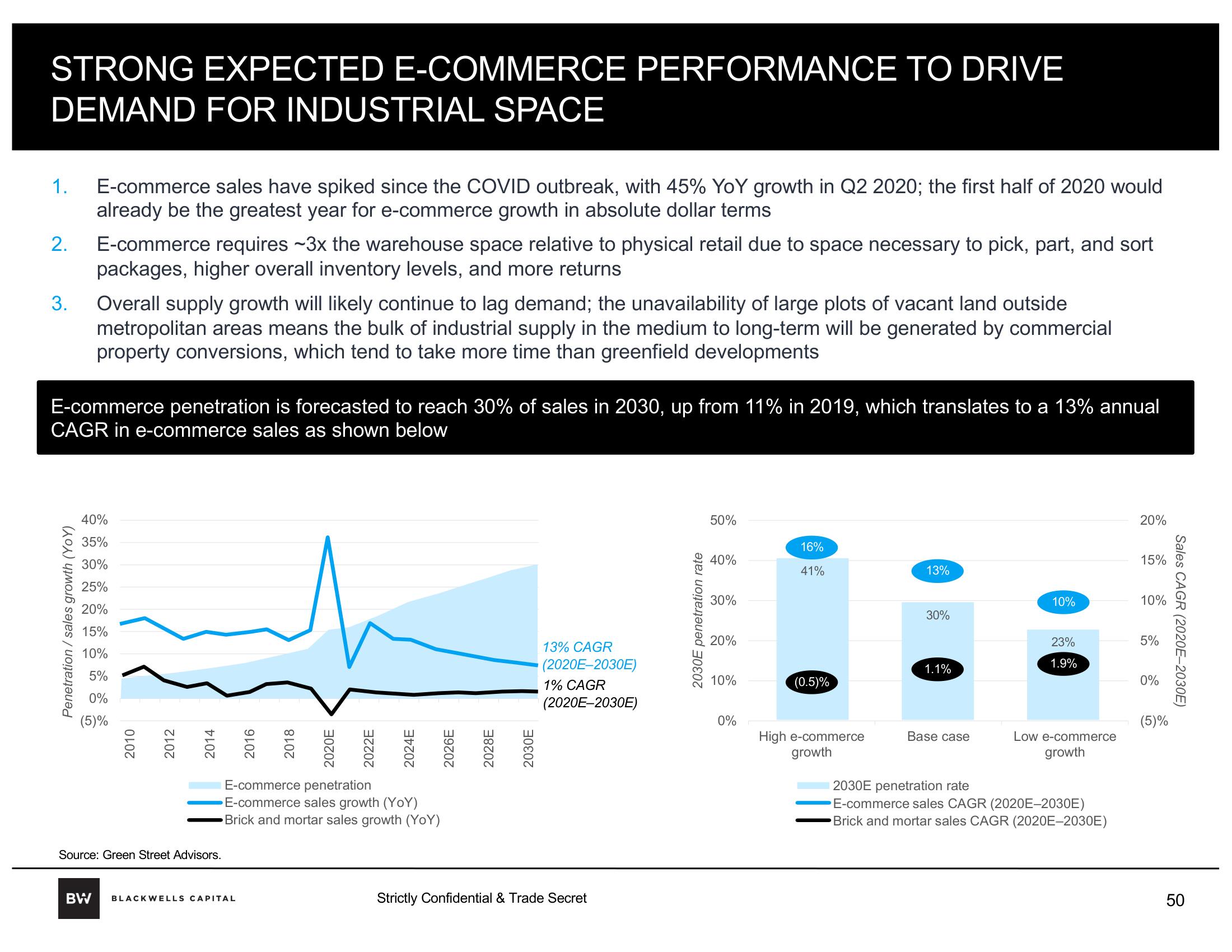

1. E-commerce sales have spiked since the COVID outbreak, with 45% YoY growth in Q2 2020; the first half of 2020 would

already be the greatest year for e-commerce growth in absolute dollar terms

2. E-commerce requires ~3x the warehouse space relative to physical retail due to space necessary to pick, part, and sort

packages, higher overall inventory levels, and more returns

3. Overall supply growth will likely continue to lag demand; the unavailability of large plots of vacant land outside

metropolitan areas means the bulk of industrial supply in the medium to long-term will be generated by commercial

property conversions, which tend to take more time than greenfield developments

E-commerce penetration is forecasted to reach 30% of sales in 2030, up from 11% in 2019, which translates to a 13% annual

CAGR in e-commerce sales as shown below

Penetration / sales growth (YoY)

40%

35%

30%

25%

20%

15%

10%

5%

0%

(5)%

2010

2012

2014

Source: Green Street Advisors.

2016

BW BLACKWELLS CAPITAL

2018

2020E

2022E

2024E

E-commerce penetration

E-commerce sales growth (YoY)

Brick and mortar sales growth (YoY)

2026E

2028E

2030E

13% CAGR

(2020E-2030E)

1% CAGR

(2020E-2030E)

Strictly Confidential & Trade Secret

2030E penetration rate

50%

40%

30%

20%

10%

0%

16%

41%

(0.5)%

High e-commerce

growth

13%

30%

1.1%

Base case

10%

23%

1.9%

Low e-commerce

growth

2030E penetration rate

E-commerce sales CAGR (2020E-2030E)

Brick and mortar sales CAGR (2020E-2030E)

20%

15%

10%

5%

0%

(5)%

Sales CAGR (2020E-2030E)

50View entire presentation