SmileDirectClub Investor Presentation Deck

Q1 2022 Results.

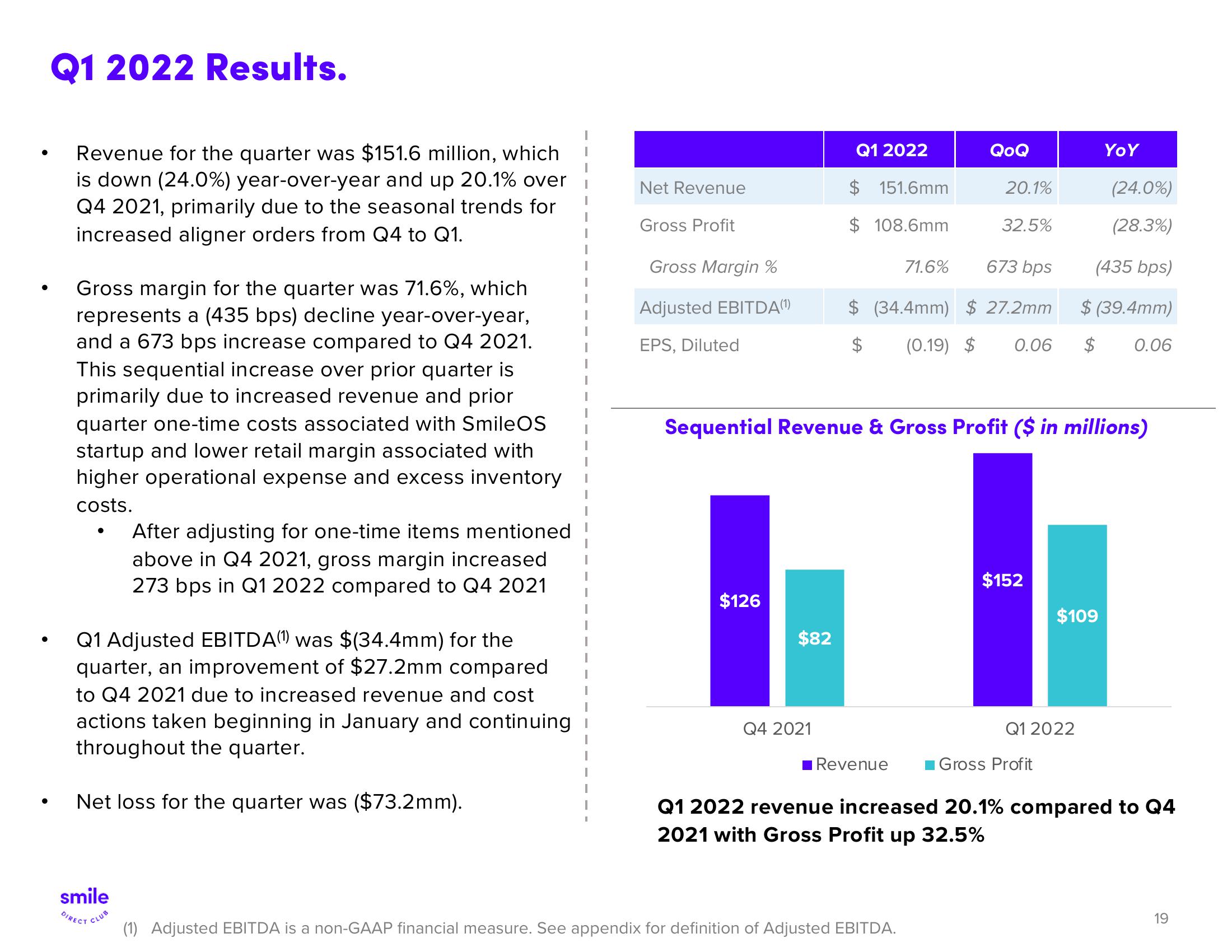

Revenue for the quarter was $151.6 million, which

is down (24.0%) year-over-year and up 20.1% over

Q4 2021, primarily due to the seasonal trends for

increased aligner orders from Q4 to Q1.

Gross margin for the quarter was 71.6%, which

represents a (435 bps) decline year-over-year,

and a 673 bps increase compared to Q4 2021.

This sequential increase over prior quarter is

primarily due to increased revenue and prior

quarter one-time costs associated with SmileOS

startup and lower retail margin associated with

higher operational expense and excess inventory

costs.

●

Q1 Adjusted EBITDA) was $(34.4mm) for the

quarter, an improvement of $27.2mm compared

to Q4 2021 due to increased revenue and cost

actions taken beginning in January and continuing

throughout the quarter.

Net loss for the quarter was ($73.2mm).

smile

DIRECT

After adjusting for one-time items mentioned

above in Q4 2021, gross margin increased

273 bps in Q1 2022 compared to Q4 2021

CLUB

Net Revenue

Gross Profit

Gross Margin %

Adjusted EBITDA(¹)

EPS, Diluted

$126

$82

Q1 2022

Q4 2021

$ 151.6mm

$ 108.6mm

■Revenue

QoQ

71.6%

673 bps

(34.4mm) $ 27.2mm

$ (0.19) $ 0.06

20.1%

Sequential Revenue & Gross Profit ($ in millions)

(1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for definition of Adjusted EBITDA.

32.5%

$152

Q1 2022

Gross Profit

YOY

(24.0%)

(28.3%)

(435 bps)

$ (39.4mm)

$ 0.06

$109

Q1 2022 revenue increased 20.1% compared to Q4

2021 with Gross Profit up 32.5%

19View entire presentation