Bed Bath & Beyond Results Presentation Deck

APPENDIX

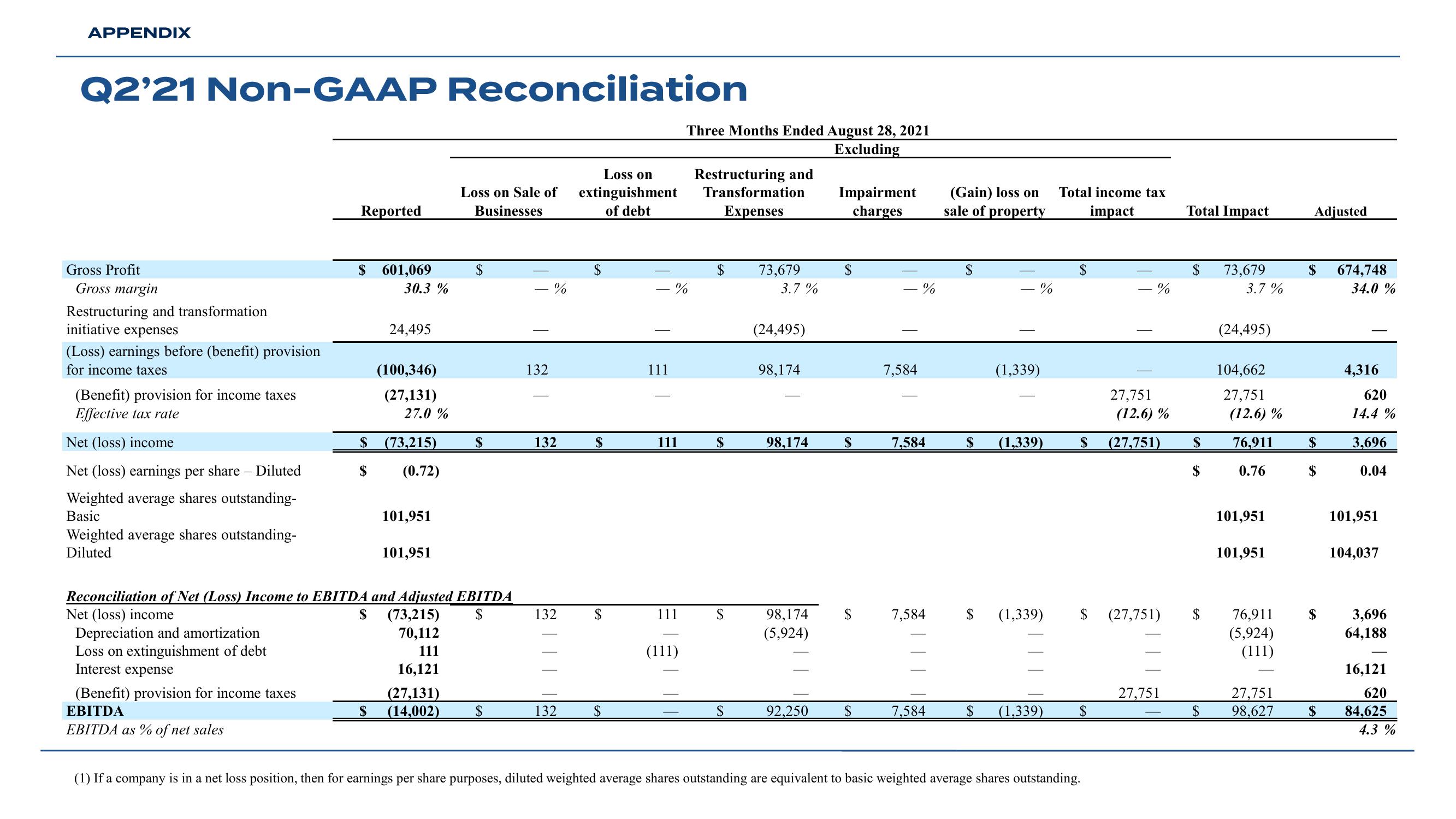

Q2'21 Non-GAAP Reconciliation

Gross Profit

Gross margin

Restructuring and transformation

initiative expenses

(Loss) earnings before (benefit) provision

for income taxes

(Benefit) provision for income taxes

Effective tax rate

Net (loss) income

Net (loss) earnings per share - Diluted

Weighted average shares outstanding-

Basic

Weighted average shares outstanding-

Diluted

Depreciation and amortization

Loss on extinguishment of debt

Interest expense

Reported

(Benefit) provision for income taxes

EBITDA

EBITDA as % of net sales

$ 601,069

30.3 %

24,495

(100,346)

(27,131)

27.0%

$

(73,215)

$ (0.72)

101,951

101,951

Reconciliation of Net (Loss) Income to EBITDA and Adjusted EBITDA

Net (loss) income

$

Loss on Sale of

Businesses

$ (73,215)

70,112

111

16,121

(27,131)

$ (14,002)

$

$

-%

T

132

132

132

132

Loss on

extinguishment

of debt

$

$

$

111

%

111

Three Months Ended August 28, 2021

Excluding

111

Restructuring and

Transformation

Expenses

$

$

73,679

3.7%

(24,495)

98,174

98,174

Impairment

charges

92,250

$

$

-%

7,584

7,584

98,174 $ 7,584

(5,924)

7,584

(Gain) loss on

sale of property

$

- %

(1,339)

$ (1,339)

Total income tax

impact

(1,339)

$

%

$ (1,339) $ (27,751)

(1) If a company is in a net loss position, then for earnings per share purposes, diluted weighted average shares outstanding are equivalent to basic weighted average shares outstanding.

27,751

(12.6) %

(27,751)

27,751

Total Impact

$ 73,679

$

$

$

3.7%

(24,495)

104,662

27,751

(12.6) %

76,911

0.76

101,951

101,951

76,911

(5,924)

(111)

27,751

98,627

Adjusted

$ 674,748

$

$

$

$

34.0%

4,316

620

14.4%

3,696

0.04

101,951

104,037

3,696

64,188

16,121

620

84,625

4.3 %View entire presentation