Allwyn Results Presentation Deck

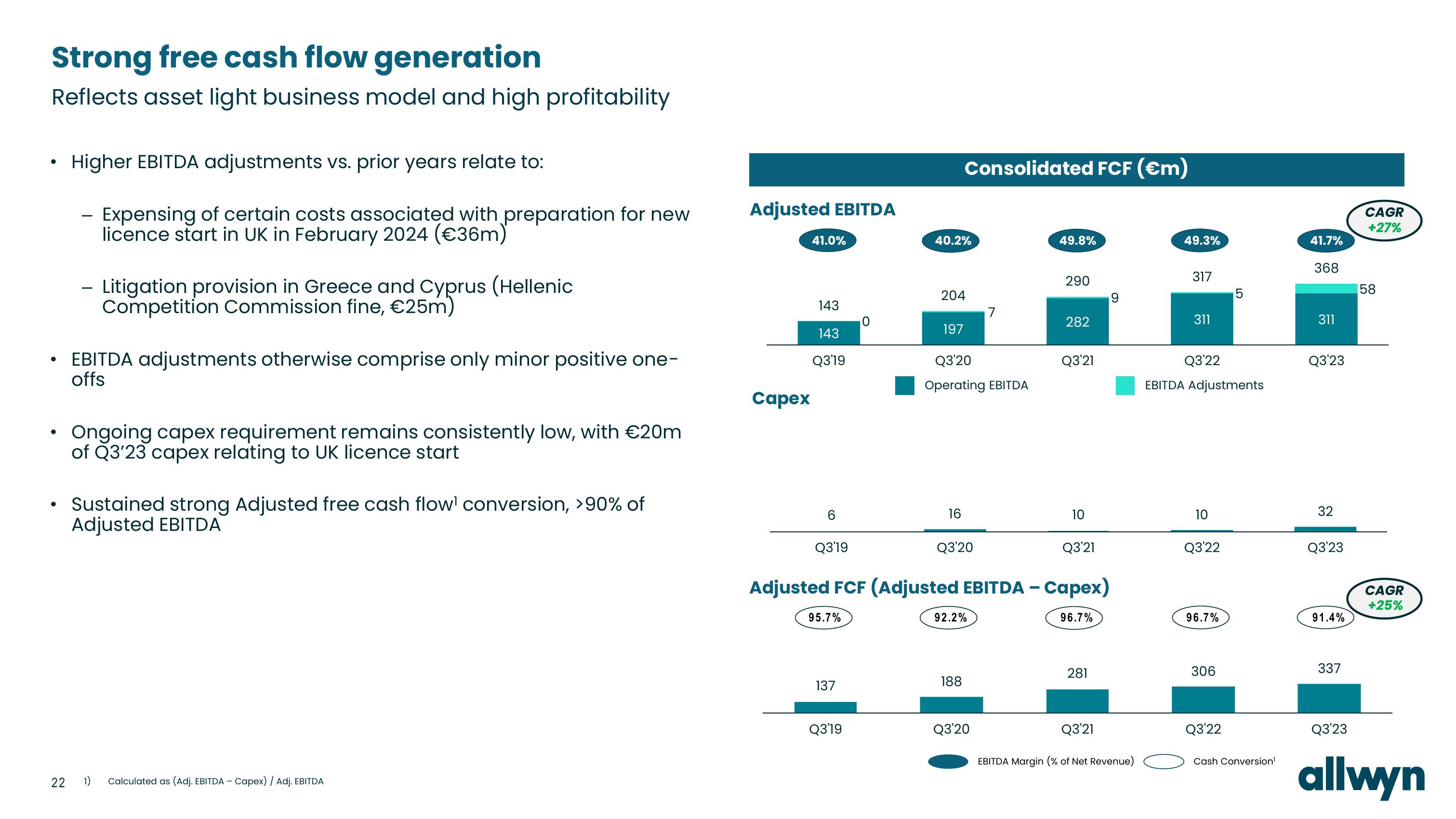

Strong free cash flow generation

Reflects asset light business model and high profitability

●

Higher EBITDA adjustments vs. prior years relate to:

Expensing of certain costs associated with preparation for new

licence start in UK in February 2024 (€36m)

- Litigation provision in Greece and Cyprus (Hellenic

Competition Commission fine, €25m)

• EBITDA adjustments otherwise comprise only minor positive one-

offs

●

• Ongoing capex requirement remains consistently low, with €20m

of Q3'23 capex relating to UK licence start

Sustained strong Adjusted free cash flow conversion, >90% of

Adjusted EBITDA

22 1)

Calculated as (Adj. EBITDA - Capex) / Adj. EBITDA

Adjusted EBITDA

Capex

41.0%

143

143

Q3'19

6

Q3'19

95.7%

137

0

Q3'19

40.2%

204

197

Consolidated FCF (€m)

16

Q3'20

Operating EBITDA

Q3'20

92.2%

188

7

Q3'20

49.8%

Adjusted FCF (Adjusted EBITDA - Capex)

96.7%

290

282

Q3'21

10

Q3'21

281

9

Q3'21

EBITDA Margin (% of Net Revenue)

49.3%

317

311

Q3'22

EBITDA Adjustments

10

Q3'22

96.7%

306

5

Q3'22

Cash Conversion¹

41.7%

368

311

Q3'23

32

Q3'23

91.4%

337

Q3'23

CAGR

+27%

58

CAGR

+25%

allwynView entire presentation