Summer 2023 Solar Industry Update

PV Annual Installations (GWdc)

70

50

40

262220

30

10

IRA-Induced Growth

Projections

2022

Pre-IRA

2023P

2024P

IImmediately Post-IRA

11

2025P

I Current Post-IRA

2026P

2027P

SFS (Decarb+E)

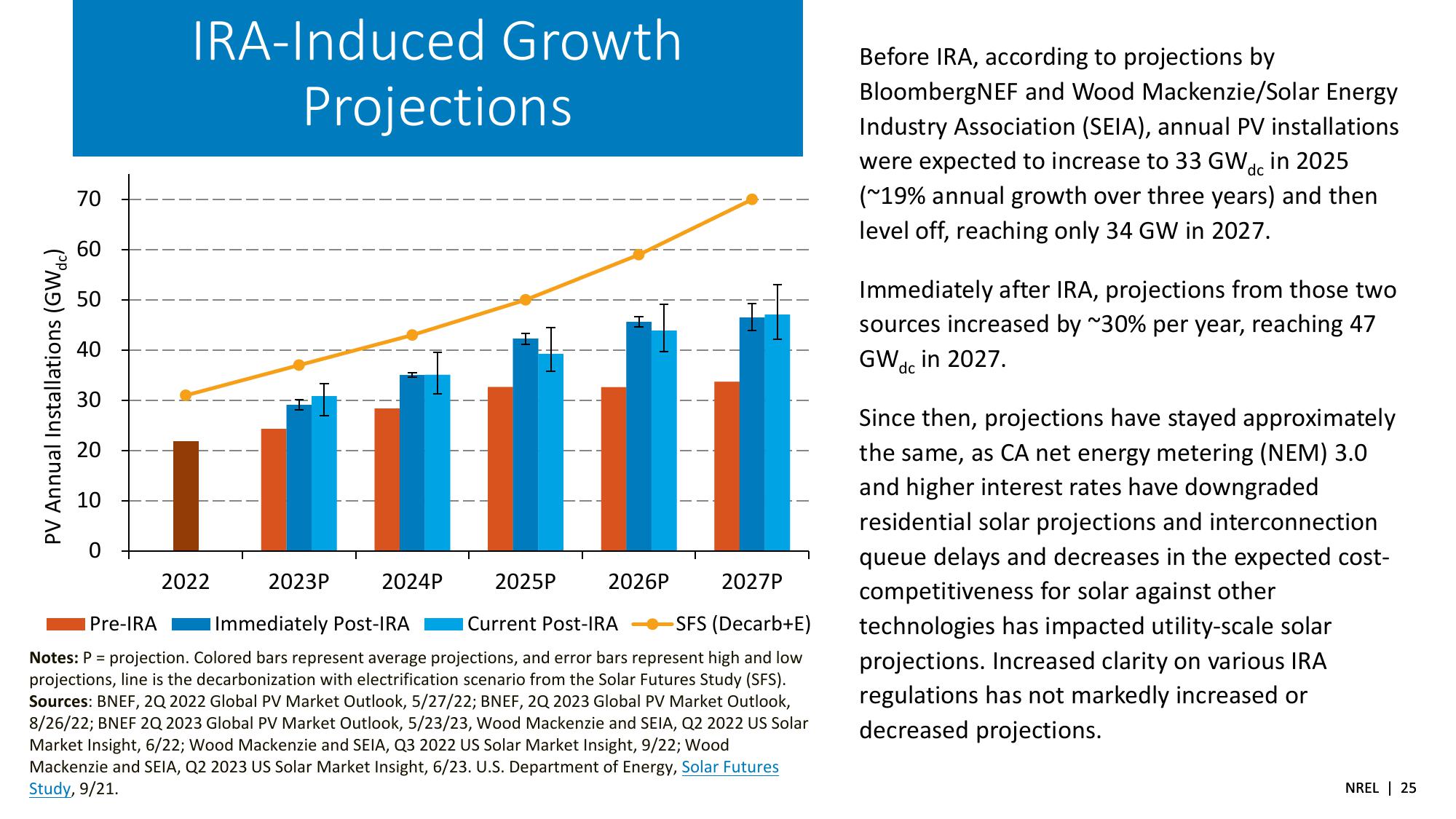

Notes: P = projection. Colored bars represent average projections, and error bars represent high and low

projections, line is the decarbonization with electrification scenario from the Solar Futures Study (SFS).

Sources: BNEF, 2Q 2022 Global PV Market Outlook, 5/27/22; BNEF, 2Q 2023 Global PV Market Outlook,

8/26/22; BNEF 2Q 2023 Global PV Market Outlook, 5/23/23, Wood Mackenzie and SEIA, Q2 2022 US Solar

Market Insight, 6/22; Wood Mackenzie and SEIA, Q3 2022 US Solar Market Insight, 9/22; Wood

Mackenzie and SEIA, Q2 2023 US Solar Market Insight, 6/23. U.S. Department of Energy, Solar Futures

Study, 9/21.

Before IRA, according to projections by

BloombergNEF and Wood Mackenzie/Solar Energy

Industry Association (SEIA), annual PV installations

were expected to increase to 33 GW in 2025

(~19% annual growth over three years) and then

level off, reaching only 34 GW in 2027.

dc

Immediately after IRA, projections from those two

sources increased by ~30% per year, reaching 47

GWd in 2027.

dc

Since then, projections have stayed approximately

the same, as CA net energy metering (NEM) 3.0

and higher interest rates have downgraded

residential solar projections and interconnection

queue delays and decreases in the expected cost-

competitiveness for solar against other

technologies has impacted utility-scale solar

projections. Increased clarity on various IRA

regulations has not markedly increased or

decreased projections.

NREL | 25View entire presentation