First Quarter 2017 Financial Review

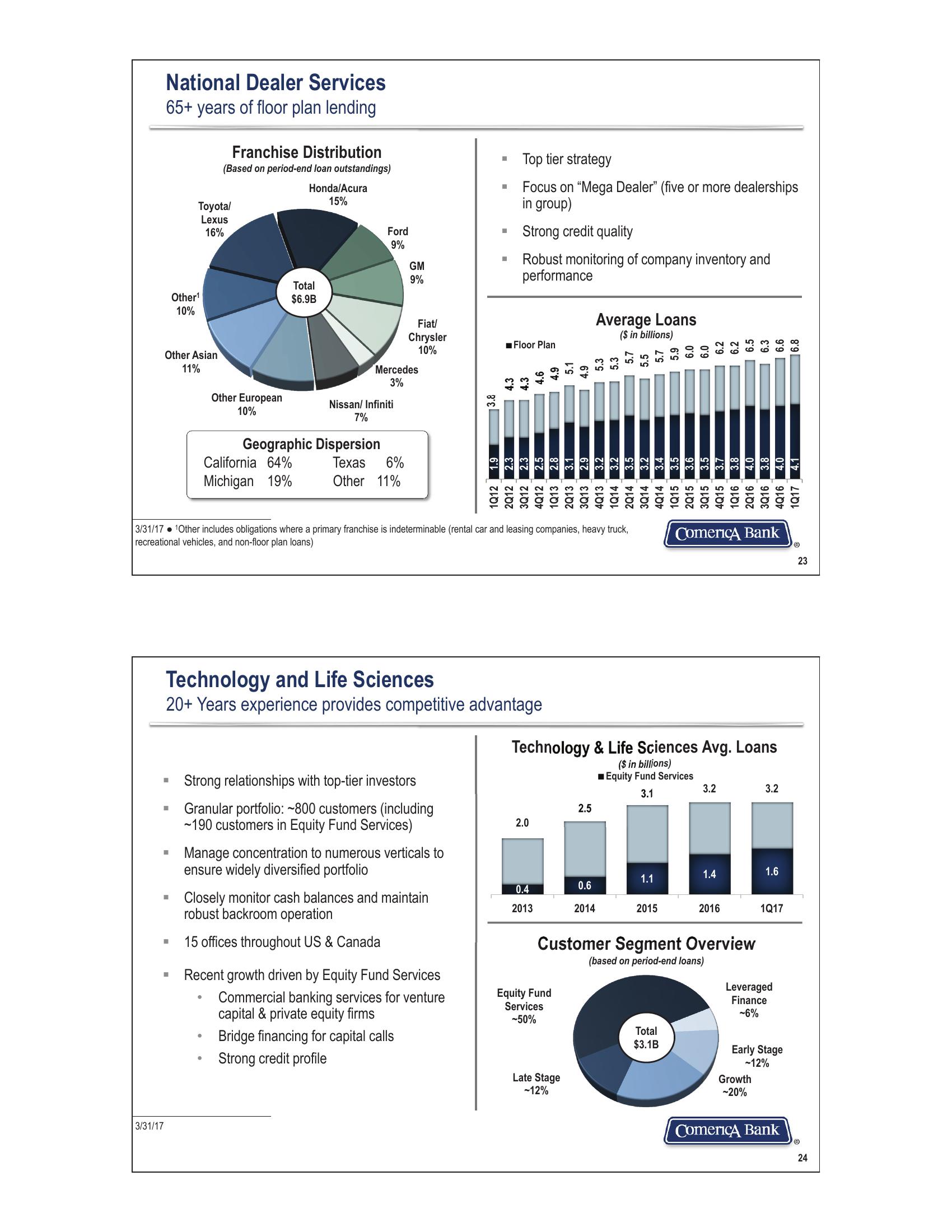

National Dealer Services

65+ years of floor plan lending

Franchise Distribution

(Based on period-end loan outstandings)

Toyota/

Lexus

16%

Honda/Acura

15%

Ford

9%

Other¹

10%

Total

$6.9B

GM

៩៖

9%

Fiat/

Chrysler

☐

■

Top tier strategy

Focus on "Mega Dealer" (five or more dealerships

in group)

Strong credit quality

Robust monitoring of company inventory and

performance

Other Asian

10%

■Floor Plan

11%

Mercedes

3%

Other European

10%

3333

Nissan/Infiniti

7%

3.8

Geographic Dispersion

California 64%

Texas

6%

Michigan 19%

Other 11%

Average Loans

($ in billions)

1Q12

1.9 -

2Q12

2.3

3Q12

2.3

4Q12 2.5

1Q13

2.8

2Q13

3.1

5.1

3Q13 2.9

4.9

4Q13 3.2

1Q14 3.2

5.3

2Q14 3.5

5.7

3Q14 3.2

5.5

4Q14 3.4

5.7

1Q15 3.5

5.9

2Q15 3.6

6.0

3Q15 3.5

6.0

4Q15

3.7

6.2

1Q16 3.8

6.2

2Q16 4.0

6.5

3Q16 3.8

6.3

4Q16 | 4.0

6.6

1Q17

4.1

16.8

3/31/17 1Other includes obligations where a primary franchise is indeterminable (rental car and leasing companies, heavy truck,

recreational vehicles, and non-floor plan loans)

3/31/17

Technology and Life Sciences

Comerica Bank

23

20+ Years experience provides competitive advantage

Technology & Life Sciences Avg. Loans

Strong relationships with top-tier investors

Granular portfolio: ~800 customers (including

~190 customers in Equity Fund Services)

Manage concentration to numerous verticals to

ensure widely diversified portfolio

■ Closely monitor cash balances and maintain

robust backroom operation

2.5

2.0

($ in billions)

■Equity Fund Services

3.2

3.2

3.1

1.4

1.6

1.1

0.4

2013

0.6

2014

2015

2016 1Q17

Customer Segment Overview

(based on period-end loans)

15 offices throughout US & Canada

Recent growth driven by Equity Fund Services

•

Commercial banking services for venture

capital & private equity firms

Equity Fund

Services

-50%

•

Bridge financing for capital calls

Strong credit profile

Late Stage

-12%

Total

$3.1B

Leveraged

Finance

-6%

Early Stage

-12%

Growth

-20%

Comerica Bank

Ⓡ

24View entire presentation