Grab Results Presentation Deck

FY 2021 Results

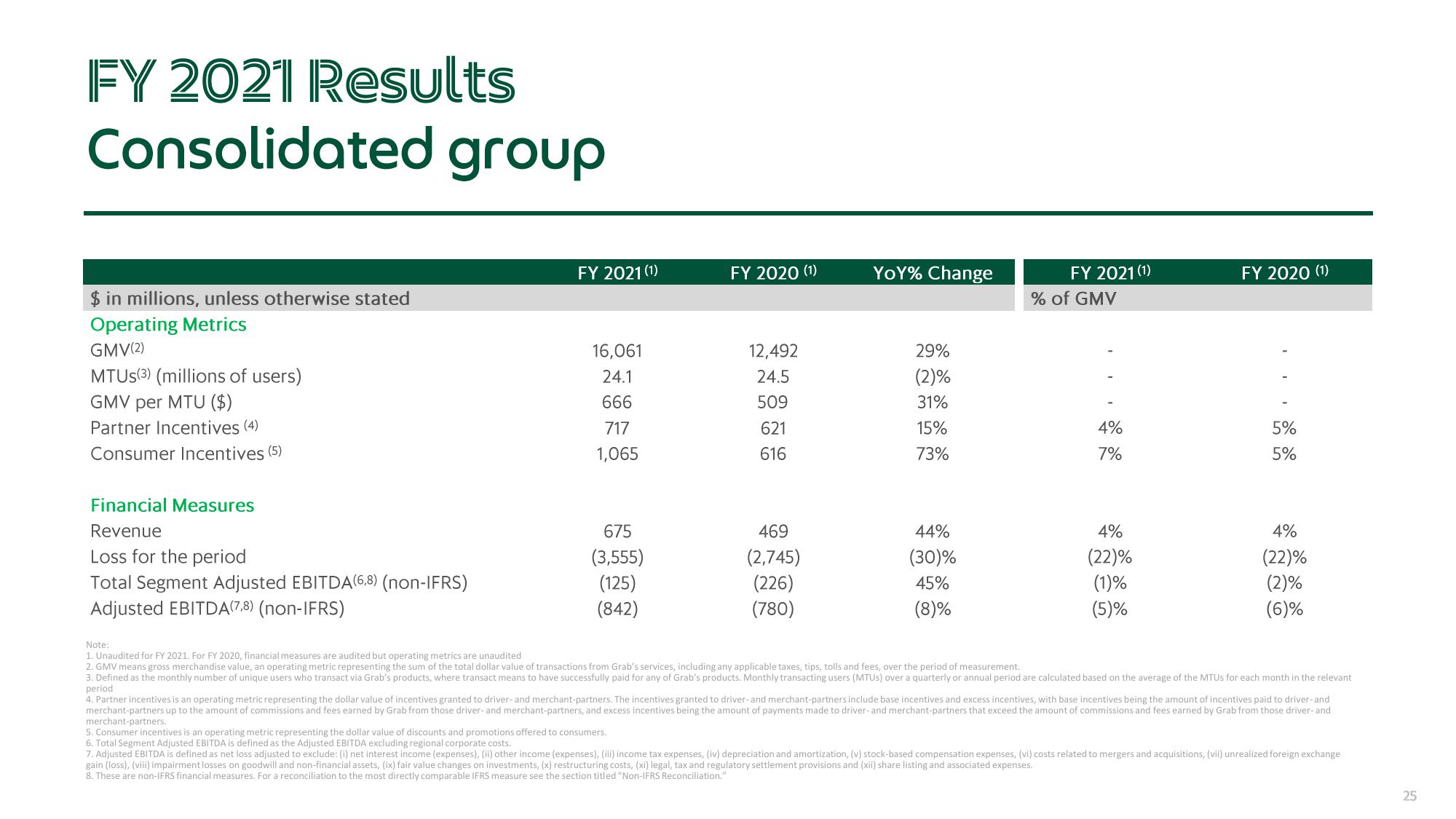

Consolidated group

$ in millions, unless otherwise stated

Operating Metrics

GMV(2)

MTUS(3) (millions of users)

GMV per MTU ($)

Partner Incentives (4)

Consumer Incentives (5)

Financial Measures

Revenue

Loss for the period

Total Segment Adjusted EBITDA(6,8) (non-IFRS)

Adjusted EBITDA(7,8) (non-IFRS)

FY 2021 (1)

16,061

24.1

666

717

1,065

675

(3,555)

(125)

(842)

FY 2020 (1)

12,492

24.5

509

621

616

469

(2,745)

(226)

(780)

YOY% Change

29%

(2)%

31%

15%

73%

44%

(30)%

45%

(8)%

FY 2021 (1)

% of GMV

4%

7%

4%

(22)%

(1)%

(5)%

FY 2020 (1)

5%

5%

4%

(22)%

(2)%

(6)%

Note:

1. Unaudited for FY 2021. For FY 2020, financial measures are audited but operating metrics are unaudited

2. GMV means gross merchandise value, an operating metric representing the sum of the total dollar value of transactions from Grab's services, including any applicable taxes, tips, tolls and fees, over the period of measurement.

3. Defined as the monthly number of unique users who transact via Grab's products, where transact means to have successfully paid for any of Grab's products. Monthly transacting users (MTUS) over a quarterly or annual period are calculated based on the average of the MTUs for each month in the relevant

period

4. Partner incentives is an operating metric representing the dollar value of incentives granted to driver- and merchant-partners. The incentives granted to driver- and merchant-partners include base incentives and excess incentives, with base incentives being the amount of incentives paid to driver-and

merchant-partners up to the amount of commissions and fees earned by Grab from those driver-and merchant-partners, and excess incentives being the amount of payments made to driver- and merchant-partners that exceed the amount of commissions and fees earned by Grab from those driver- and

merchant-partners.

5. Consumer incentives is an operating metric representing the dollar value of discounts and promotions offered to consumers.

6. Total Segment Adjusted EBITDA is defined as the Adjusted EBITDA excluding regional corporate costs.

7. Adjusted EBITDA is defined as net loss adjusted to exclude: (i) net interest income (expenses), (ii) other income (expenses), (iii) income tax expenses, (iv) depreciation and amortization, (v) stock-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii) unrealized foreign exchange

gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and (xii) share listing and associated expenses.

8. These are non-IFRS financial measures. For a reconciliation to the most directly comparable IFRS measure see the section titled "Non-IFRS Reconciliation."

25View entire presentation