GMS Results Presentation Deck

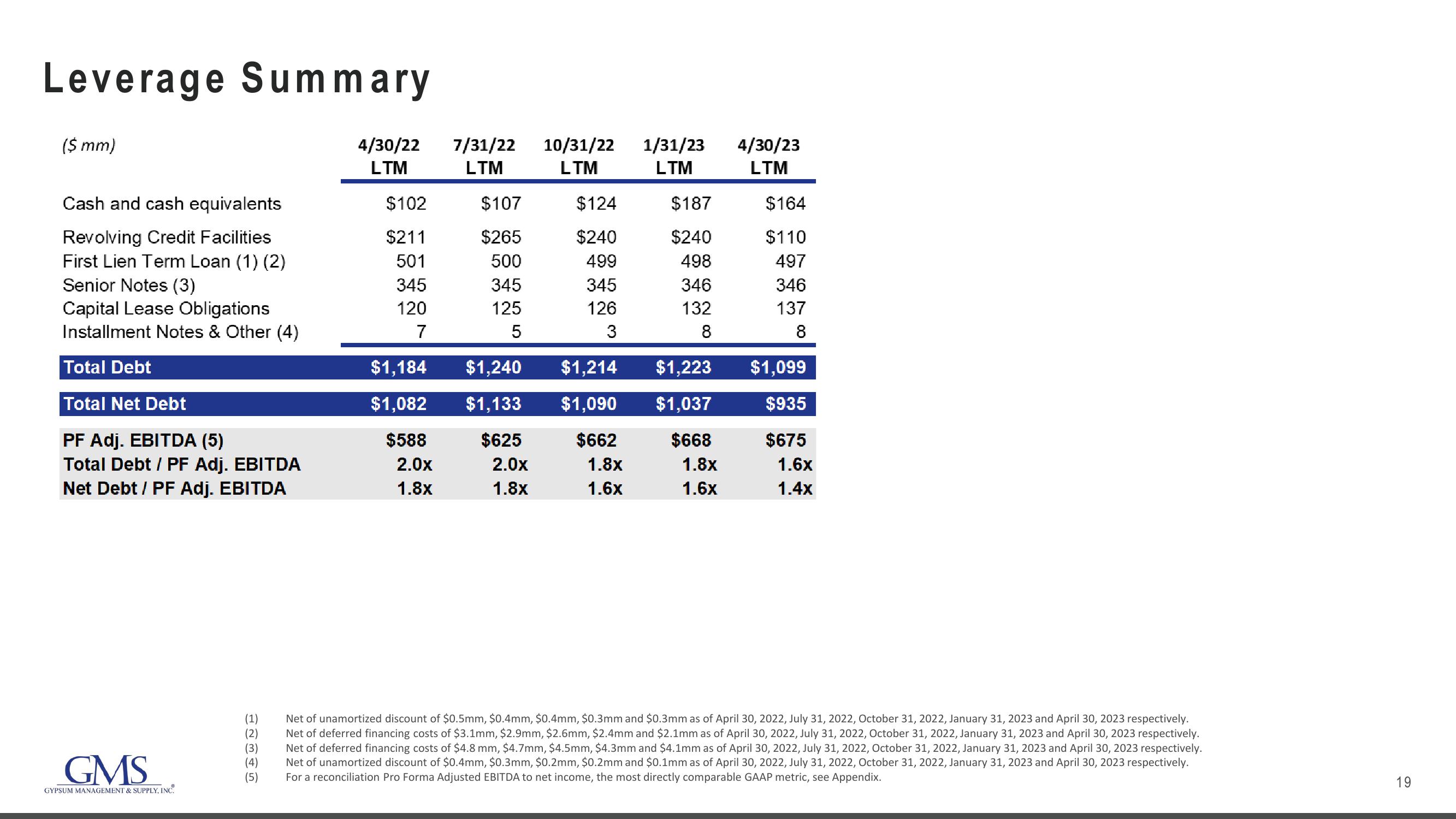

Leverage Summary

($ mm)

Cash and cash equivalents

Revolving Credit Facilities

First Lien Term Loan (1) (2)

Senior Notes (3)

Capital Lease Obligations

Installment Notes & Other (4)

Total Debt

Total Net Debt

PF Adj. EBITDA (5)

Total Debt / PF Adj. EBITDA

Net Debt / PF Adj. EBITDA

GMS

GYPSUM MANAGEMENT & SUPPLY, INC.

JEWNE

4/30/22

LTM

(4)

(5)

$102

$211

501

345

120

7

$1,184

$1,082

$588

2.0x

1.8x

7/31/22 10/31/22 1/31/23 4/30/23

LTM

LTM

LTM

LTM

$107

$265

500

345

125

5

$1,240

$1,133

$625

2.0x

1.8x

$124

$240

499

345

126

3

$1,214

$1,090

$662

1.8x

1.6x

$187

$240

498

346

132

8

$1,223

$1,037

$668

1.8x

1.6x

$164

$110

497

346

137

8

$1,099

$935

$675

(1) Net of unamortized discount of $0.5mm, $0.4mm, $0.4mm, $0.3mm and $0.3mm as of April 30, 2022, July 31, 2022, October 31, 2022, January 31, 2023 and April 30, 2023 respectively.

Net of deferred financing costs of $3.1mm, $2.9mm, $2.6mm, $2.4mm and $2.1mm as of April 30, 2022, July 31, 2022, October 31, 2022, January 31, 2023 and April 30, 2023 respectively.

Net of deferred financing costs of $4.8 mm, $4.7mm, $4.5mm, $4.3mm and $4.1mm as of April 30, 2022, July 31, 2022, October 31, 2022, January 31, 2023 and April 30, 2023 respectively.

Net of unamortized discount of $0.4mm, $0.3mm, $0.2mm, $0.2mm and $0.1mm as of April 30, 2022, July 31, 2022, October 31, 2022, January 31, 2023 and April 30, 2023 respectively.

For a reconciliation Pro Forma Adjusted EBITDA to net income, the most directly comparable GAAP metric, see Appendix.

1.6x

1.4x

19View entire presentation