Credit Suisse Investor Event Presentation Deck

Creating a new Credit Suisse

A new Credit

Suisse

Decisive actions

Benefitting all

stakeholders

Build on a respected franchise and a blue-chip client base

A simpler, more focused and more stable bank centered around Wealth Management and our Swiss home market supported by

strong capabilities in Asset Management and Markets

Led by a new team with very relevant experience and clear accountability

Reallocate capital to Wealth Management and Swiss Bank businesses – more stable

revenues, less capital intensive

Radically restructure the Investment Bank

Highly connected Markets business with industry-leading Investor Products franchise

• Carve out CS First Boston as an independent Capital Markets and Advisory bank

Capital release from exits and significant exposure reduction for Securitized Products

Accelerate cost reduction

Strengthen our capital ratio through divestments, exits and capital actions, whilst

creating more value from existing assets

For our clients, a bank built around their needs

For our shareholders, sustainable returns and value creation

For our employees, a global platform and a unified culture for entrepreneurial talent

For our regulators and other stakeholders, a reliable and trustworthy partner

6

1 In CHF unless otherwise stated, please refer to later pages for detailed definition

release from Securitized Products

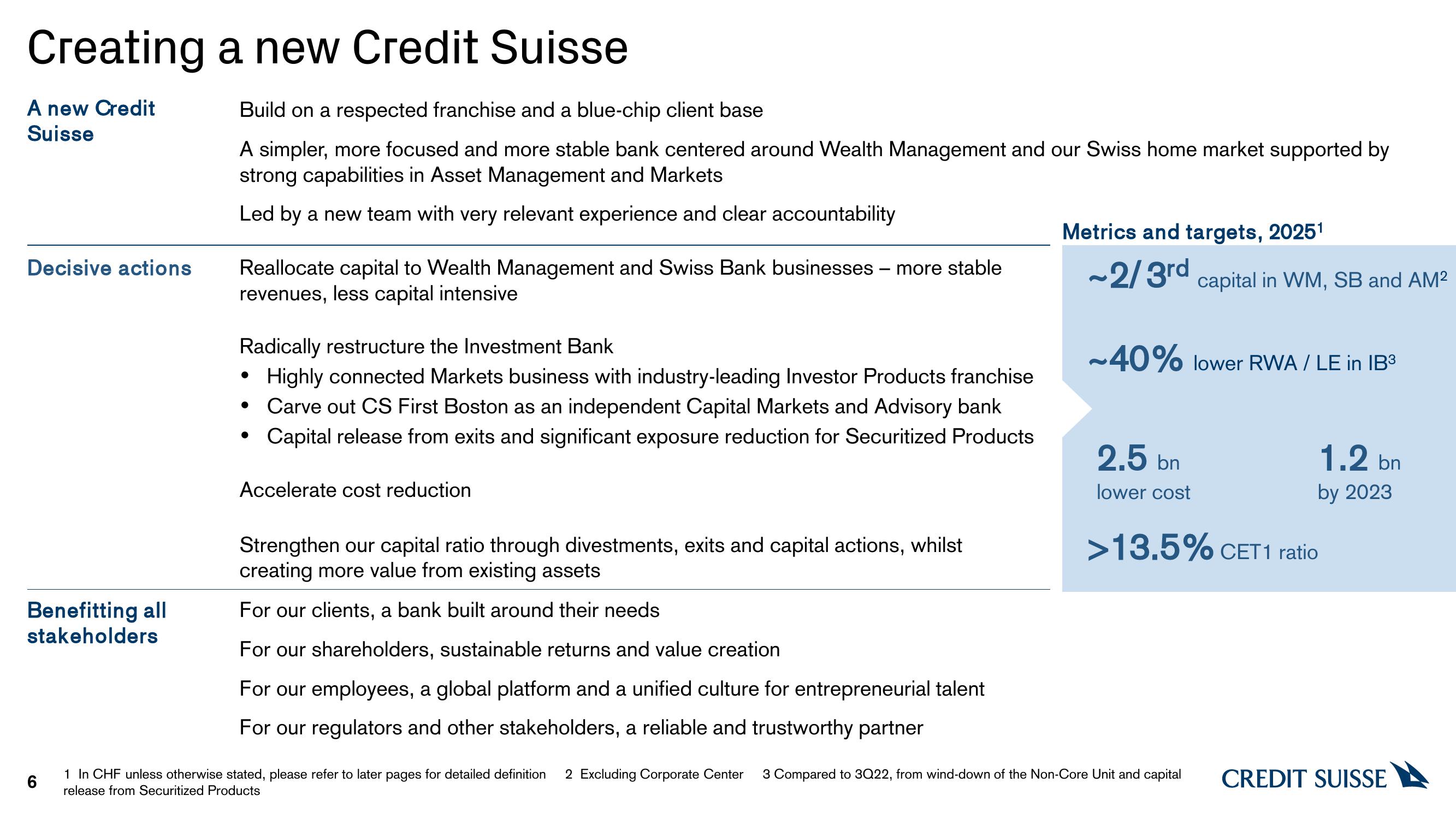

Metrics and targets, 2025¹

~2/3rd capital in WM, SB and AM²

~40% lower RWA/LE in IB³

2.5 bn

lower cost

1.2 bn

by 2023

>13.5% CET1 ratio

2 Excluding Corporate Center 3 Compared to 3Q22, from wind-down of the Non-Core Unit and capital

CREDIT SUISSEView entire presentation