Endeavour Mining Investor Presentation Deck

LAFIGUÉ PROJECT

Côte D'Ivoire

ATTRACTIVE PROJECT

ECONOMICS

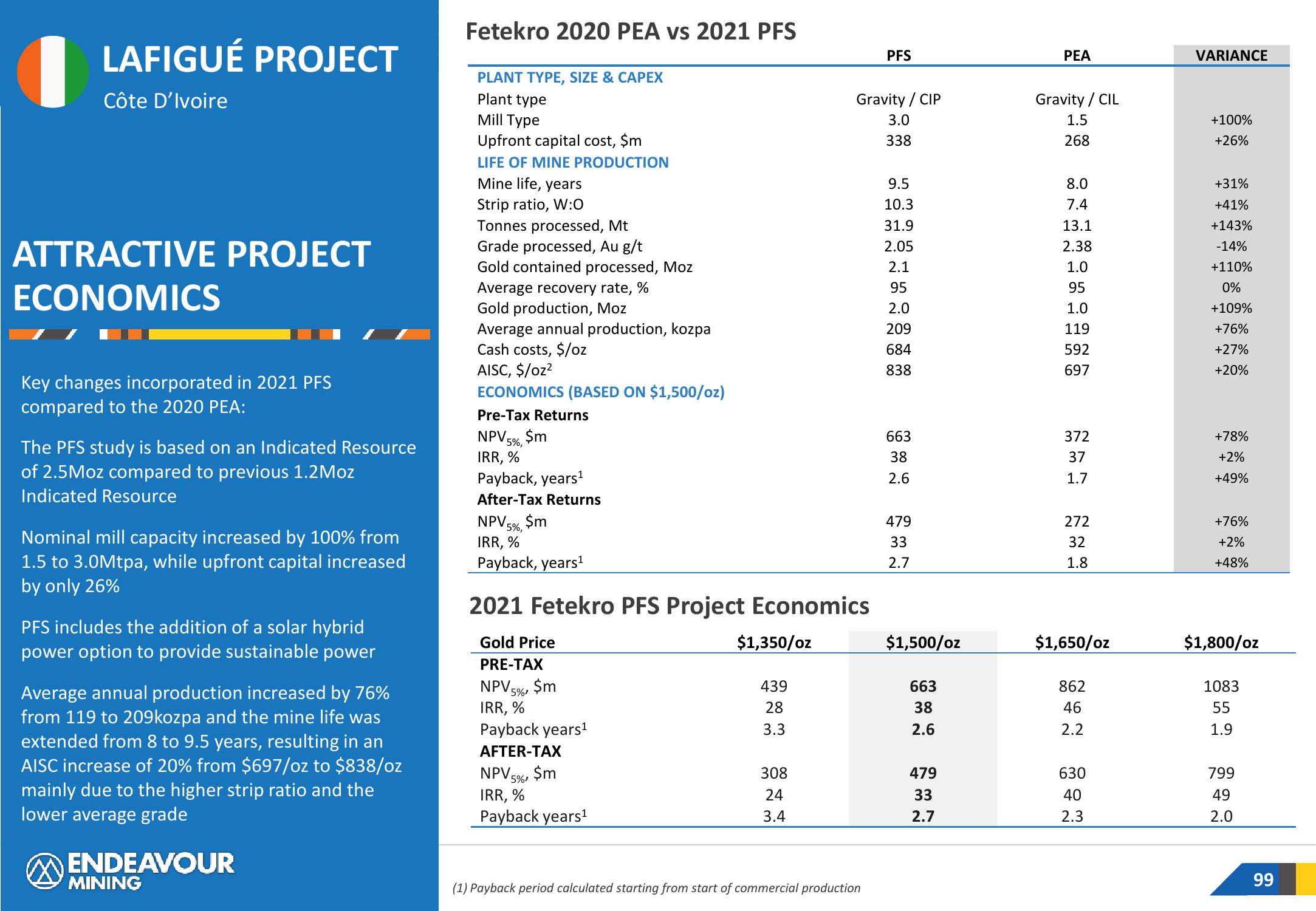

Key changes incorporated in 2021 PFS

compared to the 2020 PEA:

The PFS study is based on an Indicated Resource

of 2.5Moz compared to previous 1.2 Moz

Indicated Resource

Nominal mill capacity increased by 100% from

1.5 to 3.0Mtpa, while upfront capital increased

by only 26%

PFS includes the addition of a solar hybrid

power option to provide sustainable power

Average annual production increased by 76%

from 119 to 209kozpa and the mine life was

extended from 8 to 9.5 years, resulting in an

AISC increase of 20% from $697/oz to $838/oz

mainly due to the higher strip ratio and the

lower average grade

ENDEAVOUR

MINING

Fetekro 2020 PEA vs 2021 PFS

PLANT TYPE, SIZE & CAPEX

Plant type

Mill Type

Upfront capital cost, $m

LIFE OF MINE PRODUCTION

Mine life, years

Strip ratio, W:0

Tonnes processed, Mt

Grade processed, Au g/t

Gold contained processed, Moz

Average recovery rate, %

Gold production, Moz

Average annual production, kozpa

Cash costs, $/oz

AISC, $/oz²

ECONOMICS (BASED ON $1,500/oz)

Pre-Tax Returns

NPV 5%,

IRR, %

$m

Payback, years¹

After-Tax Returns

NPV 5%, $m

IRR, %

Payback, years¹

2021 Fetekro PFS Project Economics

Gold Price

PRE-TAX

NPV5%, $m

IRR, %

Payback years¹

AFTER-TAX

NPV5%, $m

IRR, %

Payback years¹

$1,350/oz

439

28

3.3

308

24

3.4

Gravity / CIP

3.0

338

PFS

(1) Payback period calculated starting from start of commercial production

9.5

10.3

31.9

2.05

2.1

95

2.0

209

684

838

663

38

2.6

479

33

2.7

$1,500/oz

663

38

2.6

479

33

2.7

PEA

Gravity / CIL

1.5

268

8.0

7.4

13.1

2.38

1.0

95

1.0

119

592

697

372

37

1.7

272

32

1.8

$1,650/oz

862

46

2.2

630

40

2.3

VARIANCE

+100%

+26%

+31%

+41%

+143%

-14%

+110%

0%

+109%

+76%

+27%

+20%

+78%

+2%

+49%

+76%

+2%

+48%

$1,800/oz

1083

55

1.9

799

49

2.0

99View entire presentation