Kin SPAC Presentation Deck

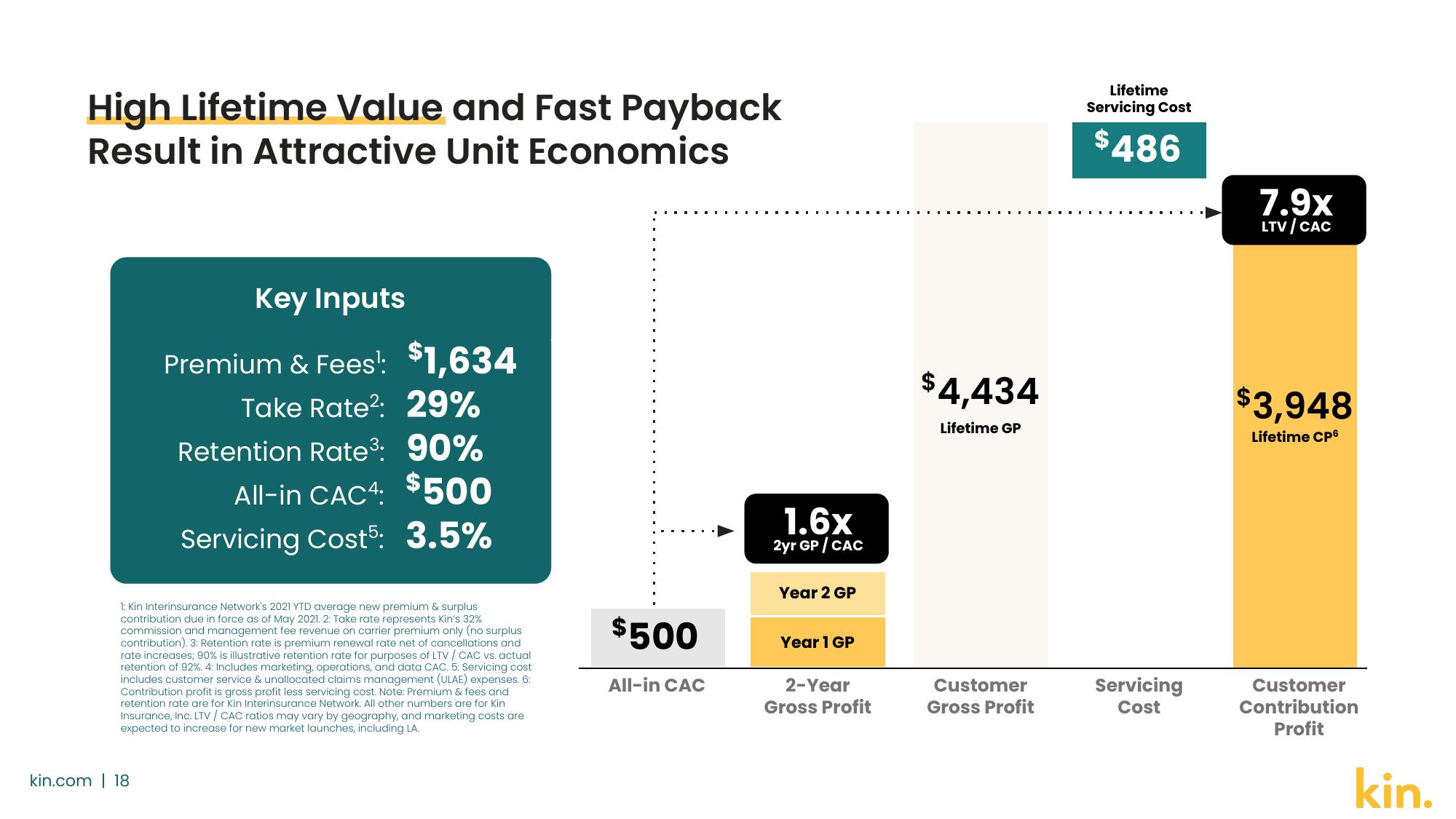

High Lifetime Value and Fast Payback

Result in Attractive Unit Economics

Key Inputs

Premium & Fees¹: $1,634

Take Rate²: 29%

Retention Rate³: 90%

All-in CAC4: $500

Servicing Cost: 3.5%

1: Kin Interinsurance Network's 2021 YTD average new premium & surplus

contribution due in force as of May 2021. 2: Take rate represents Kin's 32%

commission and management fee revenue on carrier premium only (no surplus

contribution). 3: Retention rate is premium renewal rate net of cancellations and

rate increases; 90% is illustrative retention rate for purposes of LTV / CAC vs. actual

retention of 92%. 4: Includes marketing, operations, and data CAC. 5: Servicing cost

includes customer service & unallocated claims management (ULAE) expenses. 6:

Contribution profit is gross profit less servicing cost. Note: Premium & fees and

retention rate are for Kin Interinsurance Network. All other numbers are for Kin

Insurance, Inc. LTV / CAC ratios may vary by geography, and marketing costs are

expected to increase for new market launches, including LA.

kin.com | 18

$500

All-in CAC

1.6x

2yr GP / CAC

Year 2 GP

Year 1 GP

2-Year

Gross Profit

$4,434

Lifetime GP

Customer

Gross Profit

Lifetime

Servicing Cost

$486

Servicing

Cost

7.9x

LTV/CAC

$3,948

Lifetime CP6

Customer

Contribution

Profit

kin.View entire presentation