Evercore Investment Banking Pitch Book

Valuation Perspectives

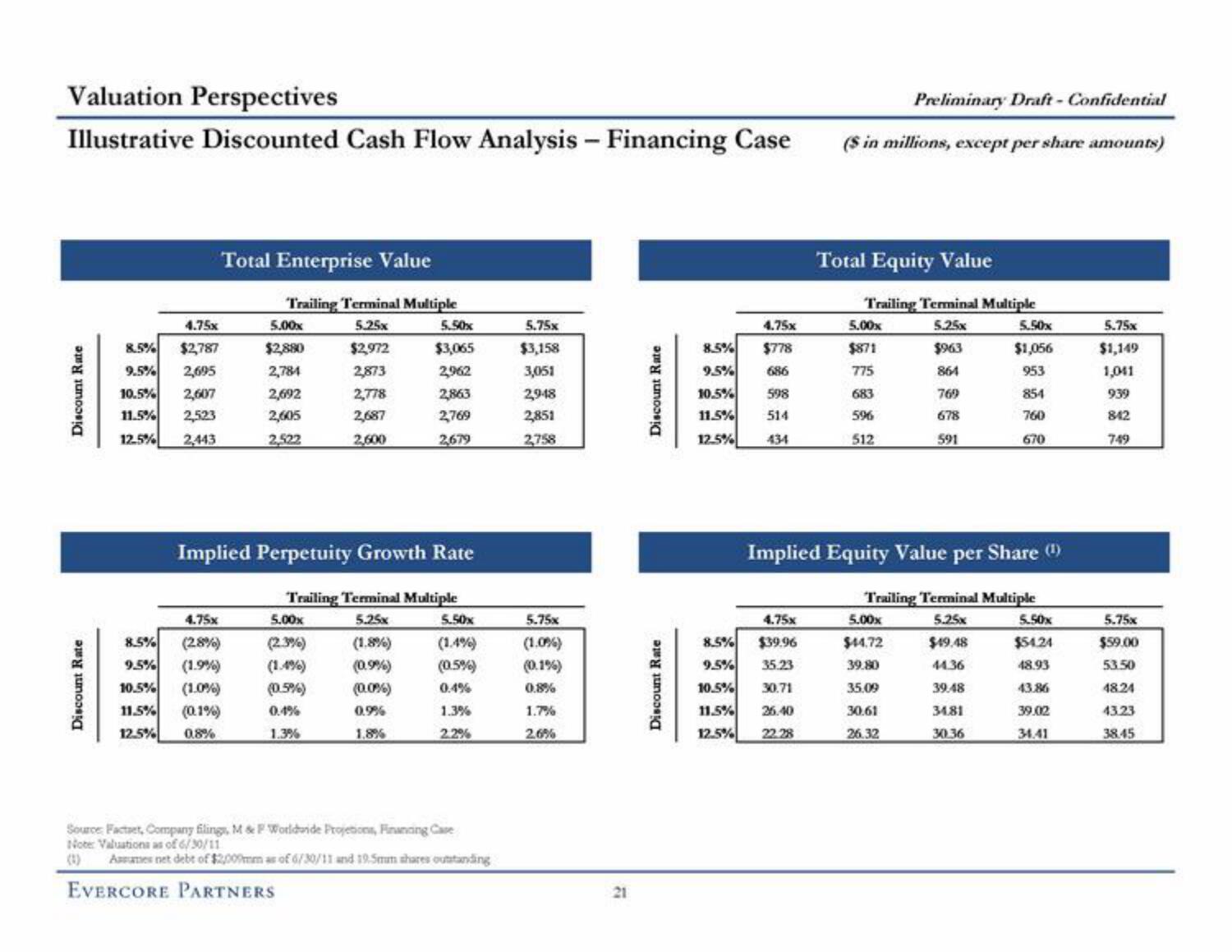

Illustrative Discounted Cash Flow Analysis - Financing Case

Discount Rate

Discount Rate

4.75x

8.5% $2,787

9.5% 2,695

10.5% 2,607

11.5% 2,523

12.5% 2,443

Total Enterprise Value

4.75x

8.5% (2.8%)

9.5% (1.9%)

10.5%

(1.0%)

11.5%

(0.1%)

12.5%

0.8%

Trailing Terminal Multiple

5.25x

5.00x

$2,880

2,784

2,692

2,605

2,522

$2,972

2,873

2,778

2,687

2,600

Implied Perpetuity Growth Rate

5.00x

(2.3%)

(1.4%)

(0.5%)

0.4%

1.3%

EVERCORE PARTNERS

5.50x

$3,065

2,962

2,863

2,769

2,679

Trailing Terminal Multiple

5.25x

(1.8%)

(0.9%)

(0,0%)

0.9%

1,89%

5.50x

(1.4%)

(0.5%)

0.4%

1.3%

2.2%

Source: Factaet, Company filings, M & F Worldwide Projetions, Financing Case

Note Valuations as of 6/30/11

Assumes net debt of $2,009mm as of 6/30/11 and 19.5mm shares outstanding

5.75x

$3,158

3,051

2,948

2,851

2,758

5.75x

(1.0%)

(0.1%)

0.8%

1.7%

2.6%

21

Discount Rate

Discount Rate

8.5%

9.5%

10.5%

11.5%

12.5%

4.75x

$778

686

598

514

434

Preliminary Draft - Confidential

($ in millions, except per share amounts)

4.75x

8.5% $39.96

9.5% 35.23

10.5%

30.71

11.5%

26.40

12.5% 22.28

Total Equity Value

Trailing Terminal Multiple

5.25x

5.00x

$871

775

683

596

512

$963

864

769

678

591

Implied Equity Value per Share (¹)

5.00x

$44.72

39.80

35.09

30.61

26.32

5.50x

$1,056

953

854

760

670

Trailing Terminal Multiple

5.25x

$49.48

44.36

39.48

34.81

30.36

5.50x

$54.24

48.93

43.86

39.02

34.41

5.75x

$1,149

1,041

939

842

749

5.75x

$59.00

53.50

48.24

43.23

38.45View entire presentation