Asos Mergers and Acquisitions Presentation Deck

1

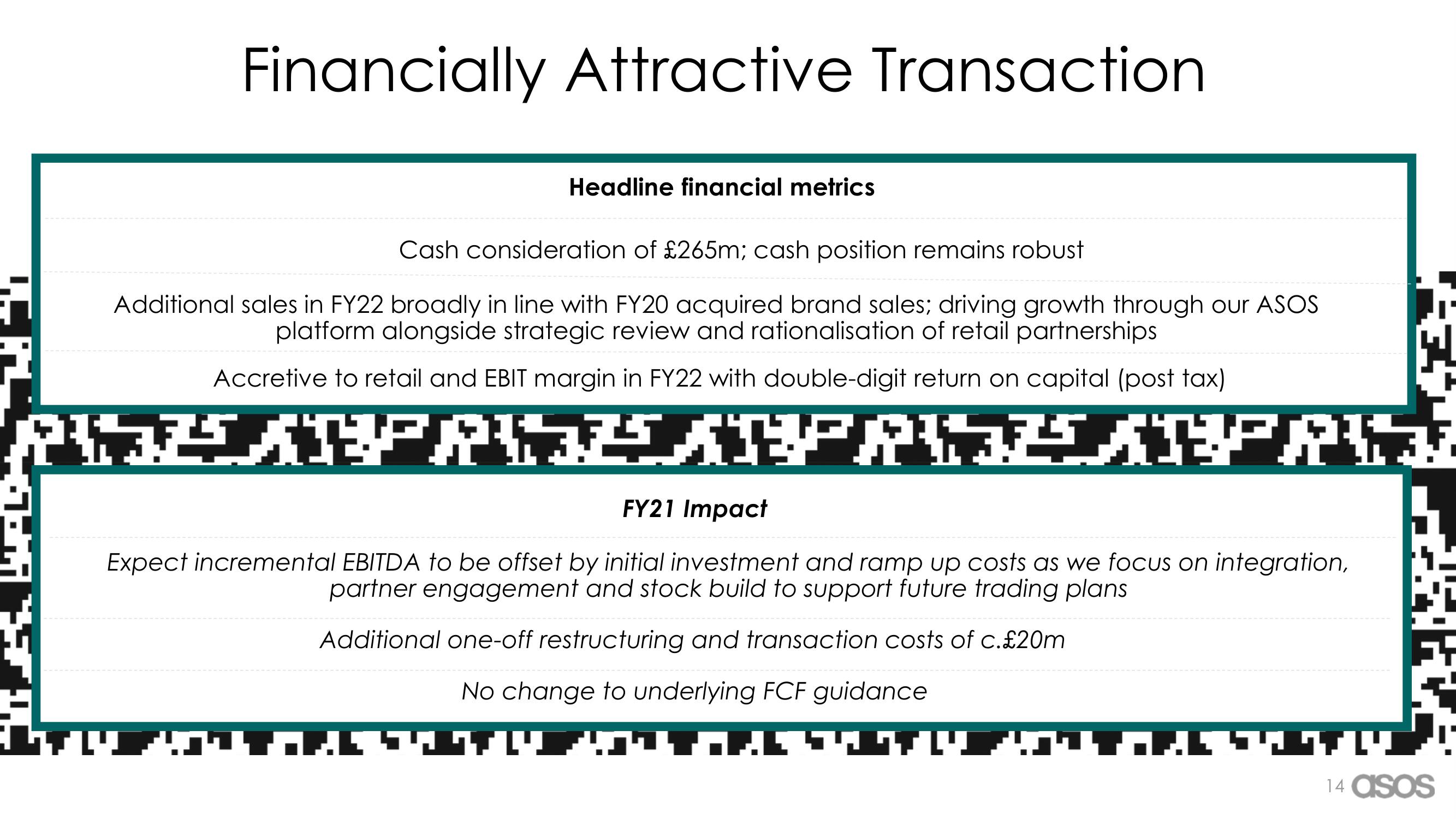

Financially Attractive Transaction

Cash consideration of £265m; cash position remains robust

Additional sales in FY22 broadly in line with FY20 acquired brand sales; driving growth through our ASOS

platform alongside strategic review and rationalisation of retail partnerships

Accretive to retail and EBIT margin in FY22 with double-digit return on capital (post tax)

PLAZZATEPALAZARPALIZIABFAL.

FY21 Impact

Expect incremental EBITDA to be offset by initial investment and ramp up costs as we focus on integration,

partner engagement and stock build to support future trading plans

Additional one-off restructuring and transaction costs of c.£20m

No change to underlying FCF guidance

["

Headline financial metrics

MTAHLIETU

TANLIGTUNAYANLIEGTU

WW

14 asosView entire presentation