Pershing Square Activist Presentation Deck

D

A Revised Proposal for Creating Value

at McDonald's

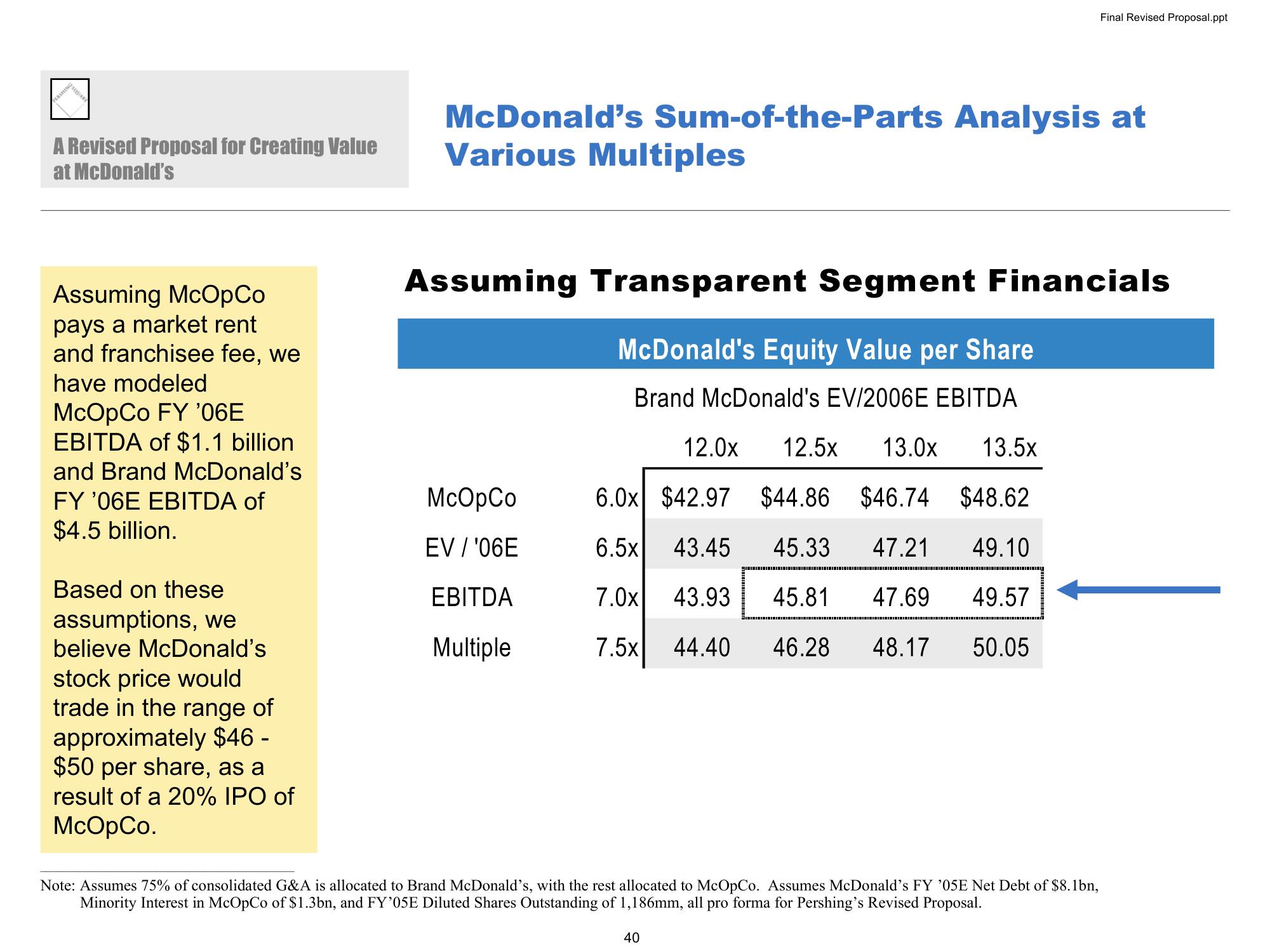

Assuming McOpCo

pays a market rent

and franchisee fee, we

have modeled

McOpCo FY '06E

EBITDA of $1.1 billion

and Brand McDonald's

FY '06E EBITDA of

$4.5 billion.

Based on these

assumptions, we

believe McDonald's

stock price would

trade in the range of

approximately $46 -

$50 per share, as a

result of a 20% IPO of

McOpCo.

McDonald's Sum-of-the-Parts Analysis at

Various Multiples

Assuming Transparent Segment Financials

McDonald's Equity Value per Share

Brand McDonald's EV/2006E EBITDA

McOpCo

EV / '06E

EBITDA

Multiple

12.0x 12.5x 13.0x 13.5x

6.0x $42.97 $44.86 $46.74

$44.86

$46.74

$48.62

6.5x 43.45

45.33

47.21

49.10

7.0x 43.93 45.81 47.69 49.57

7.5x 44.40 46.28 48.17 50.05

Final Revised Proposal.ppt

Note: Assumes 75% of consolidated G&A is allocated to Brand McDonald's, with the rest allocated to McOpCo. Assumes McDonald's FY '05E Net Debt of $8.1bn,

Minority Interest in McOpCo of $1.3bn, and FY'05E Diluted Shares Outstanding of 1,186mm, all pro forma for Pershing's Revised Proposal.

40View entire presentation