Apollo Global Management Investor Day Presentation Deck

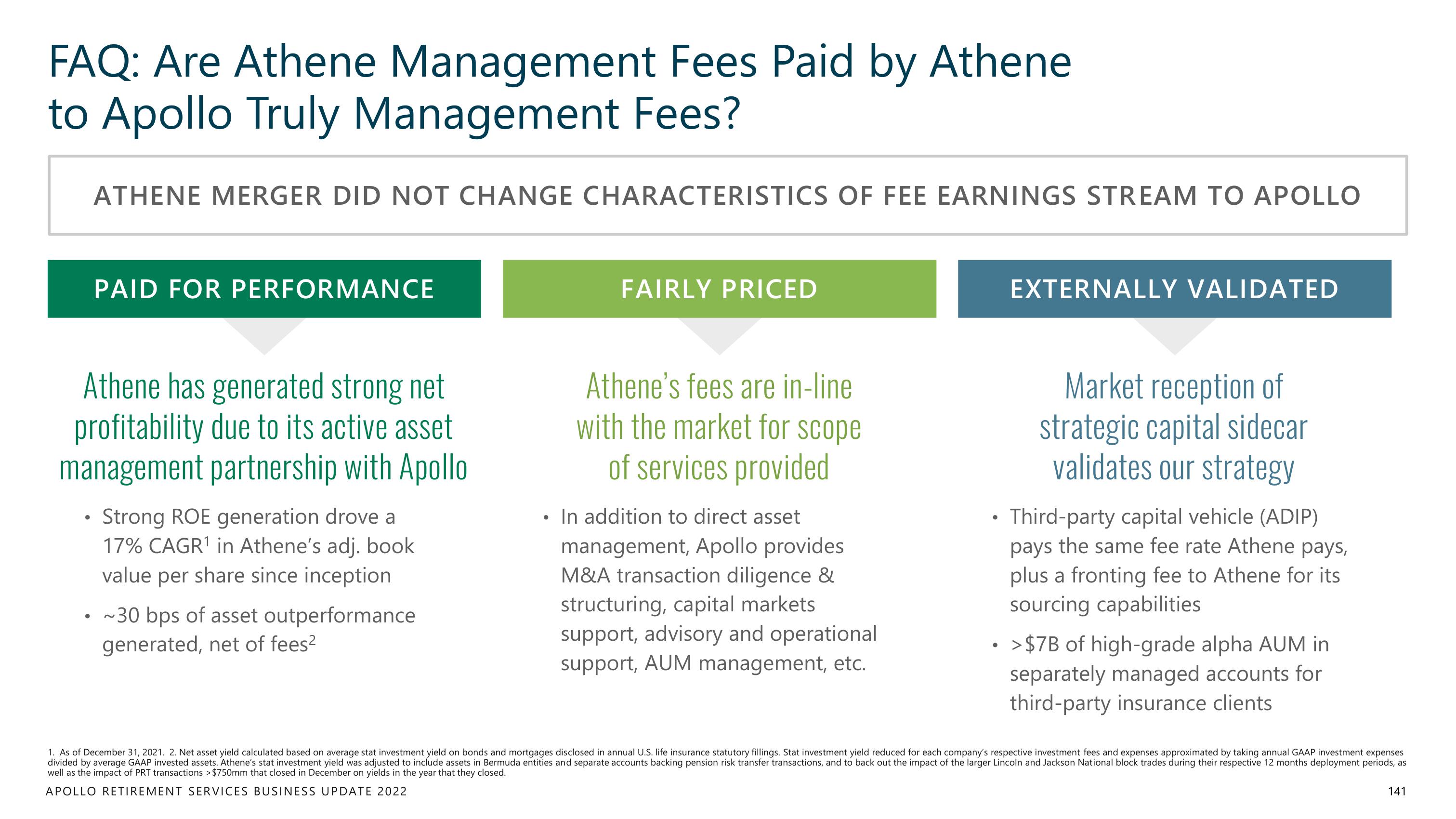

FAQ: Are Athene Management Fees Paid by Athene

to Apollo Truly Management Fees?

●

ATHENE MERGER DID NOT CHANGE CHARACTERISTICS OF FEE EARNINGS STREAM TO APOLLO

Athene has generated strong net

profitability due to its active asset

management partnership with Apollo

●

PAID FOR PERFORMANCE

Strong ROE generation drove a

17% CAGR¹ in Athene's adj. book

value per share since inception

~30 bps of asset outperformance

generated, net of fees²

FAIRLY PRICED

Athene's fees are in-line

with the market for scope

of services provided

• In addition to direct asset

management, Apollo provides

M&A transaction diligence &

structuring, capital markets

support, advisory and operational

support, AUM management, etc.

●

●

EXTERNALLY VALIDATED

Market reception of

strategic capital sidecar

validates our strategy

Third-party capital vehicle (ADIP)

pays the same fee rate Athene pays,

plus a fronting fee to Athene for its

sourcing capabilities

>$7B of high-grade alpha AUM in

separately managed accounts for

third-party insurance clients

1. As of December 31, 2021. 2. Net asset yield calculated based on average stat investment yield on bonds and mortgages disclosed in annual U.S. life insurance statutory fillings. Stat investment yield reduced for each company's respective investment fees and expenses approximated by taking annual GAAP investment expenses

divided by average GAAP invested assets. Athene's stat investment yield was adjusted to include assets in Bermuda entities and separate accounts backing pension risk transfer transactions, and to back out the impact of the larger Lincoln and Jackson National block trades during their respective 12 months deployment periods, as

well as the impact of PRT transactions >$750mm that closed in December on yields in the year that they closed.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

141View entire presentation