Moelis & Company Investment Banking Pitch Book

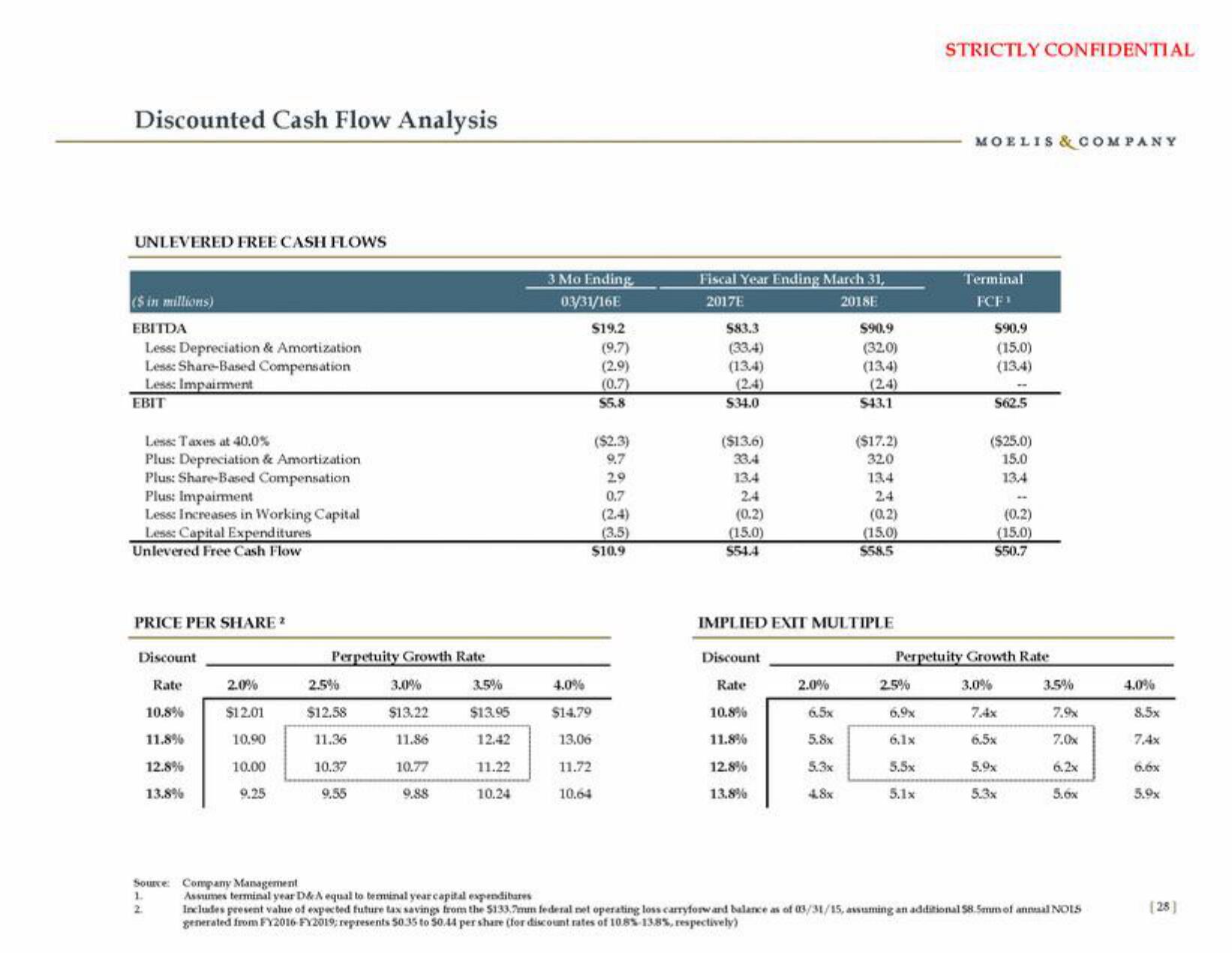

Discounted Cash Flow Analysis

UNLEVERED FREE CASH FLOWS

($ in millions)

EBITDA

Less: Depreciation & Amortization

Less: Share-Based Compensation

Less: Impairment

EBIT

Less: Taxes at 40.0%

Plus: Depreciation & Amortization

Plus: Share-Based Compensation

Plus: Impairment

Less: Increases in Working Capital

Less: Capital Expenditures

Unlevered Free Cash Flow

PRICE PER SHARE 2

Discount

Rate

10.8%

11.8%

12.8%

13.8%

1.

2.

2.0%

$12.01

10.90

10.00

9.25

Source: Company Management

Perpetuity Growth Rate

2.5%

$12.58

11.36

10.37

9.55

3.0%

$13.22

11.86

10.77

9.88

3.5%

$13.95

12.42

11.22

10.24

Assumes terminal year D&A equal to terminal year capital expenditures

3 Mo Ending

03/31/16E

$19.2

(9.7)

(2.9)

(0.7)

$5.8

4.0%

$14.79

13.06

11.72

10.64

($2.3)

9.7

29

0.7

(2.4)

(3.5)

$10.9

Fiscal Year Ending March 31,

2017E

2018E

583.3

(33.4)

(134)

(2.4)

$34.0

($13.6)

33.4

13.4

2.4

(0.2)

(15.0)

$54.4

Discount

Rate

10.8%

11.8%

12.8%

13.8%

2.0%

$90.9

(32.0)

(134)

(24)

IMPLIED EXIT MULTIPLE

6.5x

5.8x

5.3x

4.8x

$43.1

($17.2)

320

13.4

2.4

(0.2)

(15.0)

$58,5

2.5%

STRICTLY CONFIDENTIAL

6.9x

6.1x

5.5x

5.1x

MOELIS & COMPANY

Terminal

FCF¹

$90.9

(15.0)

(13.4)

$62.5

($25.0)

15.0

13.4

Perpetuity Growth Rate

3.0%

(0.2)

(15.0)

$50.7

7.4x

6.5x

5.9x

5.3x

3.5%

7.9x

7.0x

6.2x

5.6x

Includes present value of expected future tax savings from the $133.7mm federal net operating loss carryforward balance as of 03/31/15, assuming an additional 58.5mm of annual NOIS

generated from FY2016-FY2019; represents 50.35 to 50.44 per share (for discount rates of 10.8%-13.8%, respectively)

4.0%

8.5x

6.6x

5.9x

(28)View entire presentation