Zegna SPAC Presentation Deck

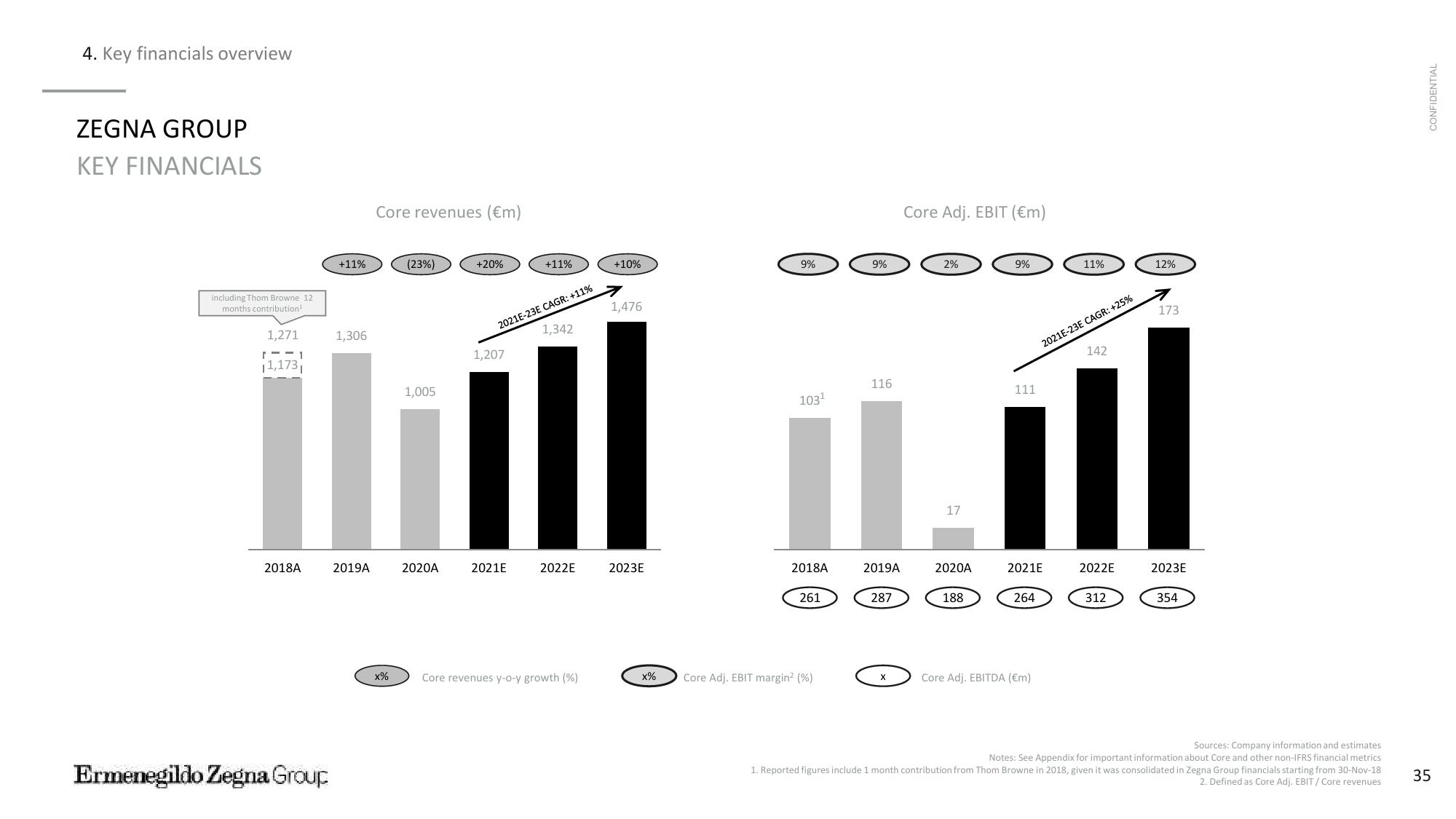

4. Key financials overview

ZEGNA GROUP

KEY FINANCIALS

including Thom Browne 12.

months contribution¹

2018A

+11%

1,306

1,271

1-1

11,1731

il

Ermenegildo Zegna Group

Core revenues (€m)

2019A

(23%)

1,005

2020A

+20%

2021E-23E CAGR: +11%

1,207

+11%

2021E

1,342

2022E

x% Core revenues y-o-y growth (%)

+10%

1,476

2023E

x%

9%

103¹

2018A

261

Core Adj. EBIT margin² (%)

9%

116

2019A

287

Core Adj. EBIT (€m)

2%

17

2020A

188

9%

111

2021E

264

Core Adj. EBITDA (€m)

11%

2021E-23E CAGR: +25%

142

2022E

312

12%

7

173

2023E

354

Sources: Company information and estimates

Notes: See Appendix for important information about Core and other non-IFRS financial metrics

1. Reported figures include 1 month contribution from Thom Browne in 2018, given it was consolidated in Zegna Group financials starting from 30-Nov-18

2. Defined as Core Adj. EBIT/ Core revenues

CONFIDENTIAL

35View entire presentation