Q4 2020 Investor Presentation

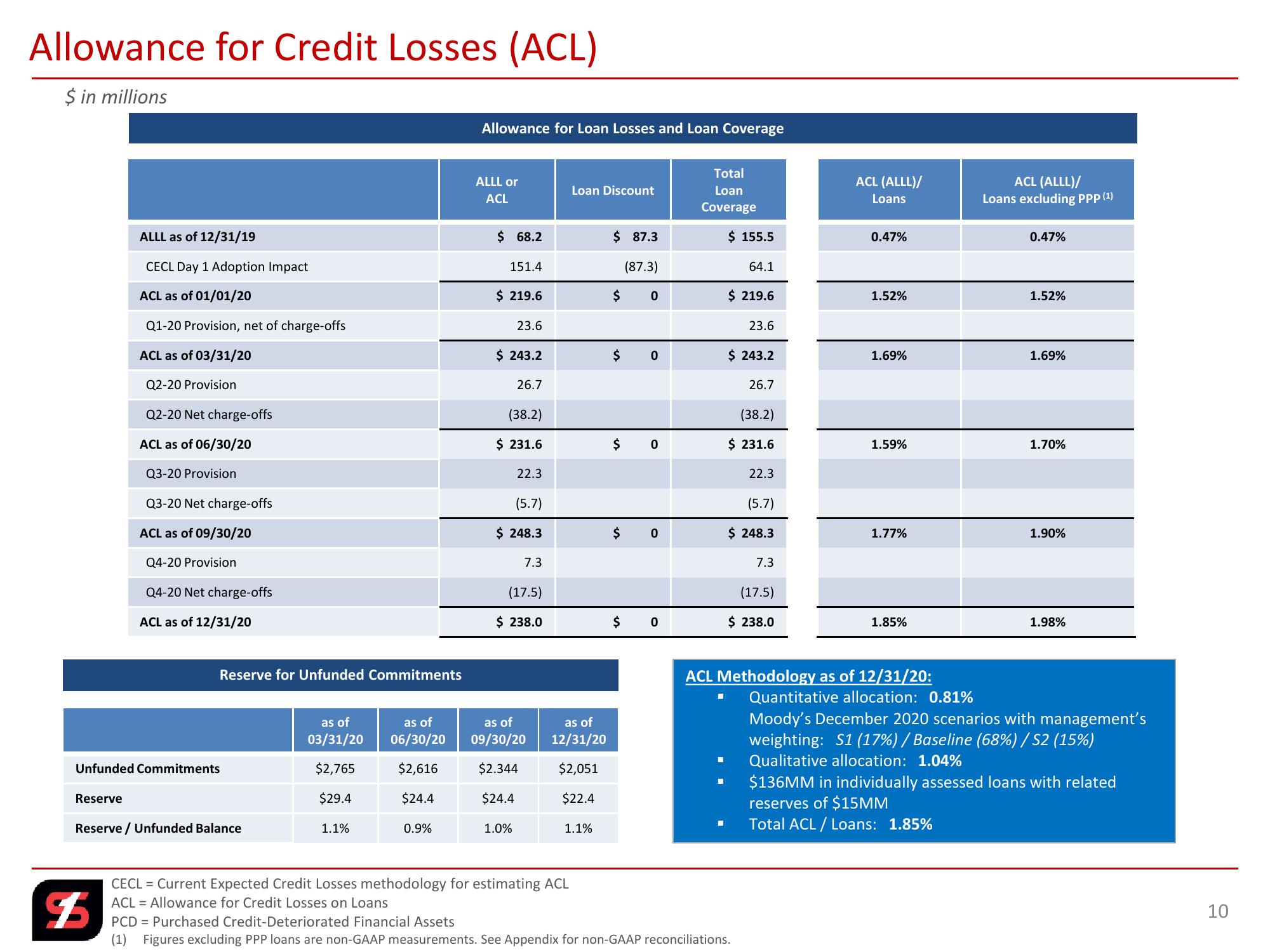

Allowance for Credit Losses (ACL)

$ in millions

Allowance for Loan Losses and Loan Coverage

Total

ALLL or

ACL

Loan Discount

Loan

Coverage

ACL (ALLL)/

Loans

ACL (ALLL)/

Loans excluding PPP (1)

ALLL as of 12/31/19

$ 68.2

$ 87.3

$ 155.5

0.47%

0.47%

CECL Day 1 Adoption Impact

151.4

(87.3)

64.1

ACL as of 01/01/20

Q1-20 Provision, net of charge-offs

ACL as of 03/31/20

$ 219.6

$

0

$ 219.6

1.52%

1.52%

23.6

23.6

$ 243.2

$

0

$ 243.2

1.69%

1.69%

Q2-20 Provision

26.7

26.7

Q2-20 Net charge-offs

ACL as of 06/30/20

Q3-20 Provision

Q3-20 Net charge-offs

ACL as of 09/30/20

(38.2)

(38.2)

$ 231.6

$

0

$ 231.6

1.59%

1.70%

22.3

22.3

(5.7)

(5.7)

$ 248.3

$

0

$ 248.3

1.77%

1.90%

Q4-20 Provision

7.3

7.3

Q4-20 Net charge-offs

ACL as of 12/31/20

(17.5)

(17.5)

$ 238.0

$ 0

$ 238.0

1.85%

1.98%

Reserve for Unfunded Commitments

as of

12/31/20

ACL Methodology as of 12/31/20:

Quantitative allocation: 0.81%

Moody's December 2020 scenarios with management's

weighting: S1 (17%) / Baseline (68%) / S2 (15%)

☐ Qualitative allocation: 1.04%

☐ $136MM in individually assessed loans with related

reserves of $15MM

Total ACL / Loans: 1.85%

as of

03/31/20

as of

06/30/20

as of

09/30/20

Unfunded Commitments

$2,765

$2,616

$2.344

$2,051

Reserve

$29.4

$24.4

$24.4

$22.4

Reserve/Unfunded Balance

1.1%

0.9%

1.0%

1.1%

CECL = Current Expected Credit Losses methodology for estimating ACL

ACL = Allowance for Credit Losses on Loans

$

PCD

Purchased Credit-Deteriorated Financial Assets

(1) Figures excluding PPP loans are non-GAAP measurements. See Appendix for non-GAAP reconciliations.

10View entire presentation