LSE Mergers and Acquisitions Presentation Deck

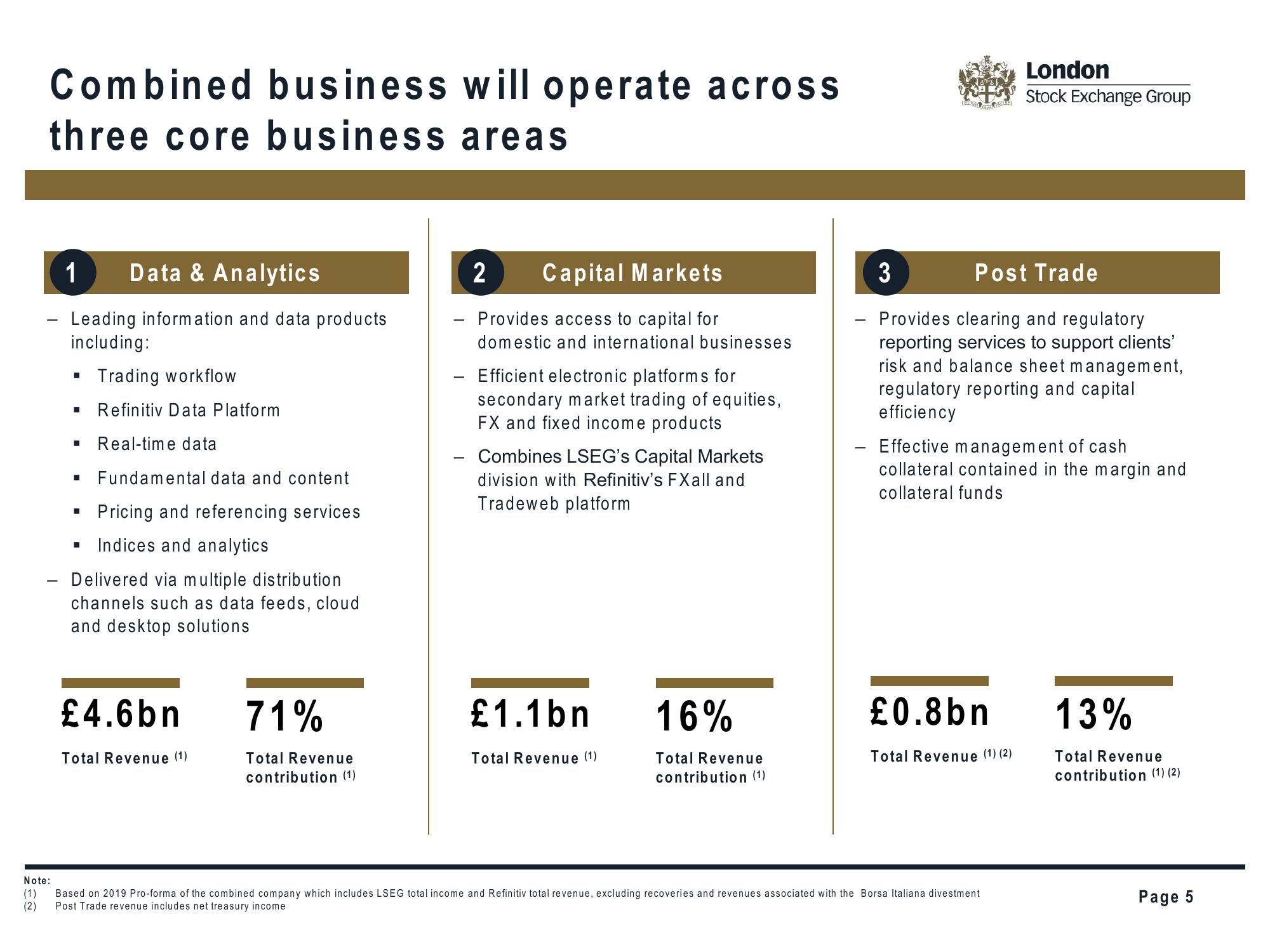

Combined business will operate across

three core business areas

1 Data & Analytics

- Leading information and data products

including:

I

■

Trading workflow

Refinitiv Data Platform

Real-time data

Fundamental data and content

Pricing and referencing services

Indices and analytics

Delivered via multiple distribution

channels such as data feeds, cloud

and desktop solutions

£4.6bn

Total Revenue (1)

71%

Total Revenue

contribution (1)

2

Capital Markets

- Provides access to capital for

domestic and international businesses

- Efficient electronic platforms for

secondary market trading of equities,

FX and fixed income products

Combines LSEG's Capital Markets

division with Refinitiv's FXall and

Tradeweb platform

£1.1bn 16%

Total Revenue (1)

Total Revenue

contribution (1)

3

Post Trade

- Provides clearing and regulatory

reporting services to support clients'

risk and balance sheet management,

regulatory reporting and capital

efficiency

- Effective management of cash

collateral contained in the margin and

collateral funds

£0.8bn

London

Stock Exchange Group

Total Revenue (1) (2)

Note:

(1) Based on 2019 Pro-forma of the combined company which includes LSEG total income and Refinitiv total revenue, excluding recoveries and revenues associated with the Borsa Italiana divestment

(2) Post Trade revenue includes net treasury income

13%

Total Revenue

contribution (1) (2)

Page 5View entire presentation