Shift SPAC Presentation Deck

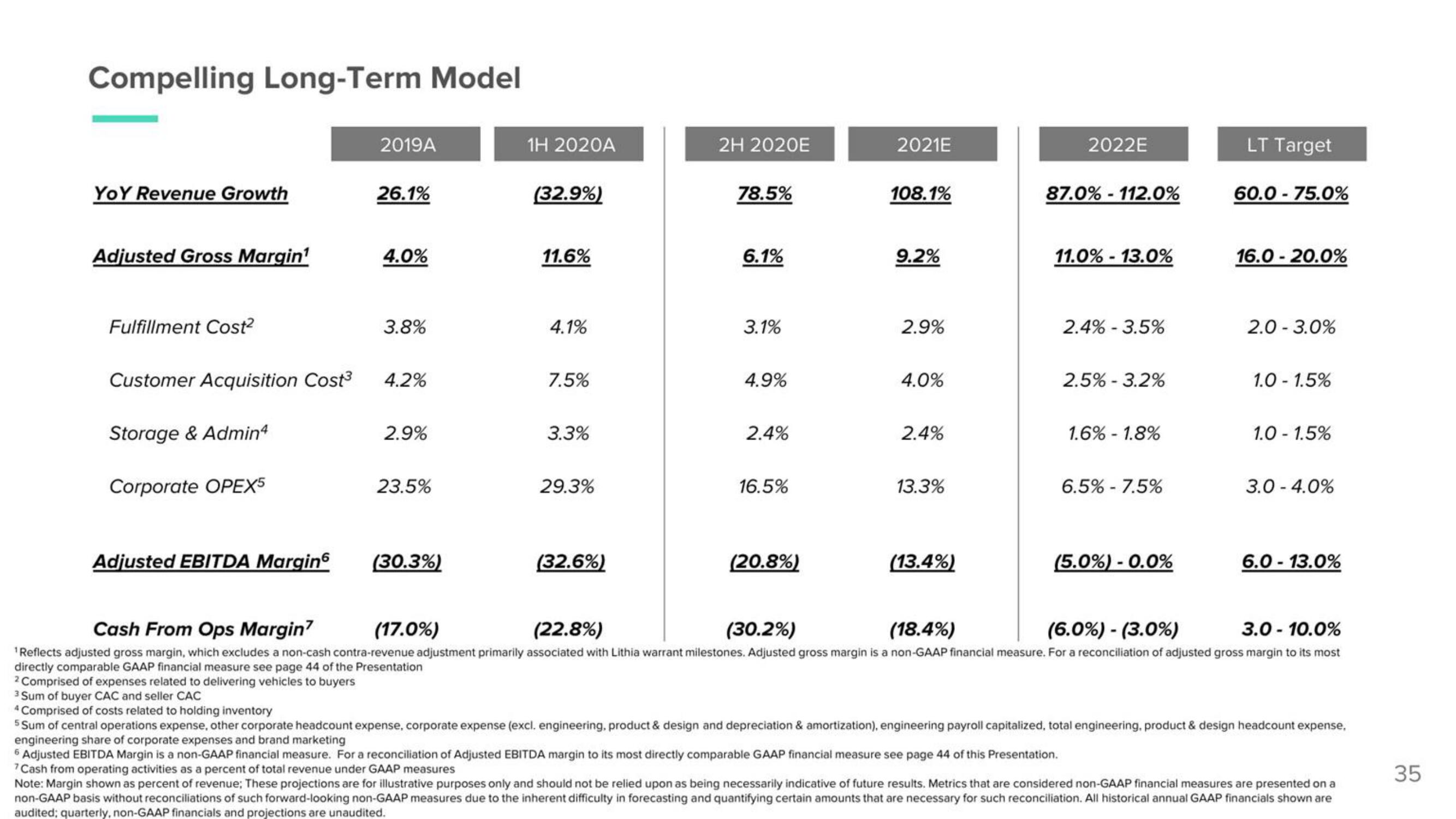

Compelling Long-Term Model

YOY Revenue Growth

Adjusted Gross Margin¹

Fulfillment Cost²

Storage & Admin4

Corporate OPEX5

2019A

Adjusted EBITDA Margin

26.1%

Customer Acquisition Cost³ 4.2%

4.0%

3.8%

2.9%

23.5%

(30.3%)

1H 2020A

(32.9%)

11.6%

4.1%

7.5%

3.3%

29.3%

(32.6%)

2H 2020E

78.5%

6.1%

3.1%

4.9%

2.4%

16.5%

(20.8%)

2021E

108.1%

9.2%

2.9%

4.0%

2.4%

13.3%

(13.4%)

2022E

87.0% - 112.0%

11.0% - 13.0%

2.4% -3.5%

2.5% - 3.2%

1.6% - 1.8%

6.5% -7.5%

(5.0%) - 0.0%

LT Target

60.0-75.0%

16.0-20.0%

2.0 - 3.0%

1.0-1.5%

1.0-1.5%

3.0-4.0%

6.0-13.0%

(17.0%)

(22.8%)

(30.2%)

(18.4%)

(6.0%) - (3.0%)

3.0 - 10.0%

Cash From Ops Margin7

¹Reflects adjusted gross margin, which excludes a non-cash contra-revenue adjustment primarily associated with Lithia warrant milestones. Adjusted gross margin is a non-GAAP financial measure. For a reconciliation of adjusted gross margin to its most

directly comparable GAAP financial measure see page 44 of the Presentation

2 Comprised of expenses related to delivering vehicles to buyers

3 Sum of buyer CAC and seller CAC

4 Comprised of costs related to holding inventory

5 Sum of central operations expense, other corporate headcount expense, corporate expense (excl. engineering, product & design and depreciation & amortization), engineering payroll capitalized, total engineering, product & design headcount expense,

engineering share of corporate expenses and brand marketing

6 Adjusted EBITDA Margin is a non-GAAP financial measure. For a reconciliation of Adjusted EBITDA margin to its most directly comparable GAAP financial measure see page 44 of this Presentation.

7 Cash from operating activities as a percent of total revenue under GAAP measures

Note: Margin shown as percent of revenue; These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. Metrics that are considered non-GAAP financial measures are presented on a

non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. All historical annual GAAP financials shown are

audited; quarterly, non-GAAP financials and projections are unaudited.

35View entire presentation