3Q20 Earnings Call Presentation

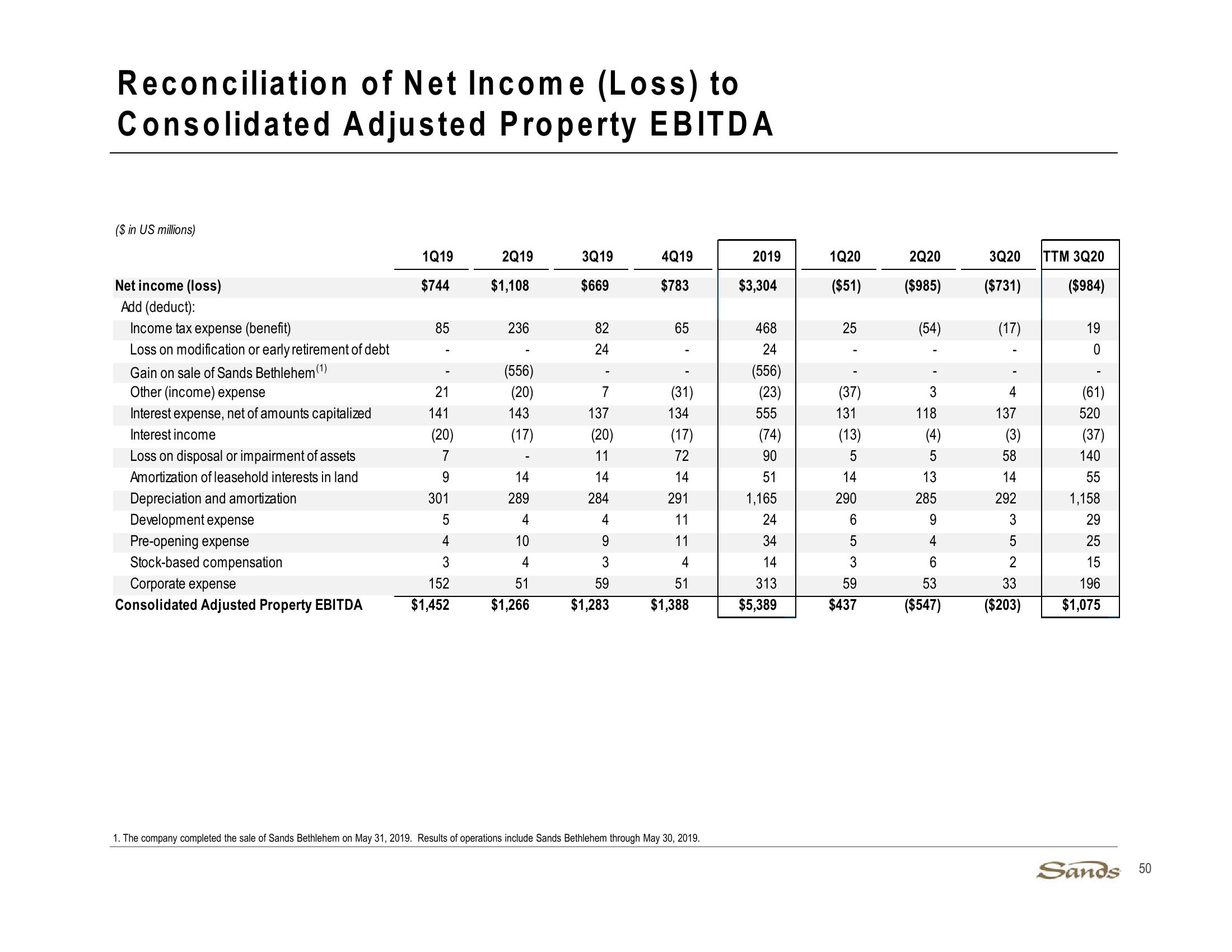

Reconciliation of Net Income (Loss) to

Consolidated Adjusted Property EBITDA

($ in US millions)

Net income (loss)

Add (deduct):

Income tax expense (benefit)

85

236

82

65

Loss on modification or early retirement of debt

24

1Q19

2Q19

3Q19

4Q19

2019

1Q20

2Q20

3Q20

TTM 3Q20

$744

$1,108

$669

$783

$3,304

($51)

($985)

($731) ($984)

25

25

(54)

(17)

19

0

468

24

Gain on sale of Sands Bethlehem

(556)

(556)

Other (income) expense

21

(20)

7

(31)

(23)

Interest expense, net of amounts capitalized

141

143

137

134

555

131

Interest income

(20)

(17)

(20)

(17)

(74)

Loss on disposal or impairment of assets

7

11

72

90

ིཥྱོཡ

(37)

3

4

(61)

118

137

520

(13)

(4)

D

(3)

(37)

5

58

140

Amortization of leasehold interests in land

9

14

14

14

51

14

13

14

55

Depreciation and amortization

301

289

284

291

1,165

290

285

292

1,158

Development expense

Pre-opening expense

Stock-based compensation

Corporate expense

Consolidated Adjusted Property EBITDA

152

$1,452

5435

4

4

11

24

10

9

11

34

4

3

4

14

51

59

51

313

59

6530

53

523

9460

3

29

25

15

196

$1,266

$1,283

$1,388

$5,389

$437

($547)

($203)

$1,075

1. The company completed the sale of Sands Bethlehem on May 31, 2019. Results of operations include Sands Bethlehem through May 30, 2019.

Sands 50View entire presentation