HBT Financial Results Presentation Deck

Company Snapshot

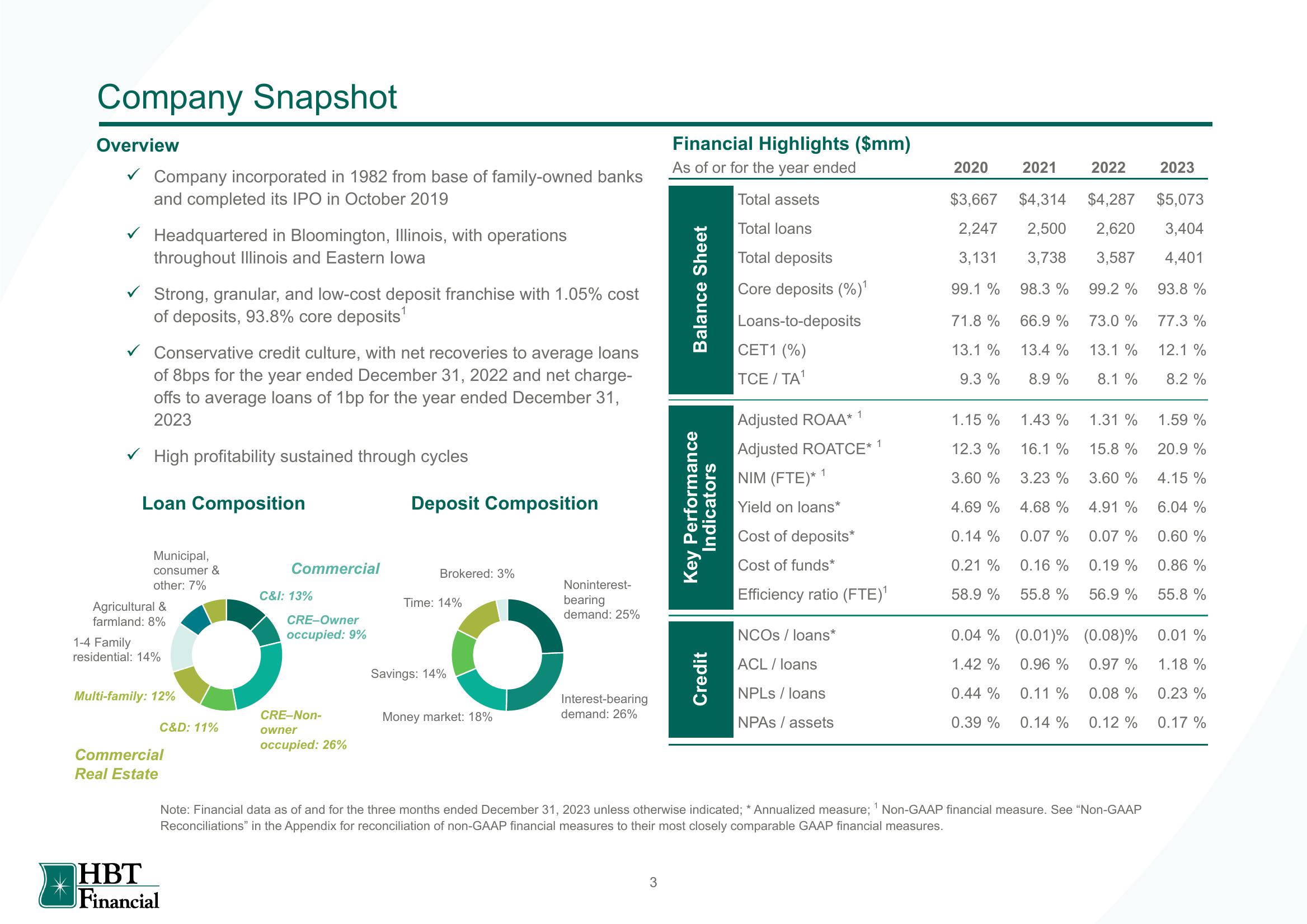

Overview

✓ Company incorporated in 1982 from base of family-owned banks

and completed its IPO in October 2019

✓ Headquartered in Bloomington, Illinois, with operations

throughout Illinois and Eastern lowa

Strong, granular, and low-cost deposit franchise with 1.05% cost

of deposits, 93.8% core deposits¹

✓ Conservative credit culture, with net recoveries to average loans

of 8bps for the year ended December 31, 2022 and net charge-

offs to average loans of 1bp for the year ended December 31,

2023

✓ High profitability sustained through cycles

Loan Composition

Municipal,

consumer &

other: 7%

Agricultural &

farmland: 8%

1-4 Family

residential: 14%

Multi-family: 12%

C&D: 11%

Commercial

Real Estate

Commercial

HBT

Financial

C&I: 13%

CRE-Owner

occupied: 9%

CRE-Non-

owner

occupied: 26%

Deposit Composition

Brokered: 3%

Time: 14%

Savings: 14%

Noninterest-

bearing

demand: 25%

O

Money market: 18%

Interest-bearing

demand: 26%

Financial Highlights ($mm)

As of or for the year ended

3

Balance Sheet

Key Performance

Indicators

Credit

Total assets

Total loans

Total deposits

Core deposits (%) ¹

Loans-to-deposits

CET1 (%)

TCE / TA¹

Adjusted ROAA*

Adjusted ROATCE* 1

NIM (FTE)* 1

Yield on loans*

Cost of deposits*

Cost of funds*

Efficiency ratio (FTE)¹

1

NCOS / loans*

ACL / loans

NPLs / loans

NPAS/assets

1

2021

$3,667 $4,314 $4,287

2,247

3,131

99.1 %

2,500 2,620

3,738 3,587

98.3 % 99.2 %

73.0 %

13.1 %

8.1 %

71.8%

13.1 %

9.3 %

2020

1.15%

12.3 %

3.60 %

4.69 %

0.14%

0.21%

58.9 %

0.04%

1.42%

0.44 %

0.39 %

66.9%

13.4%

8.9 %

1.43%

16.1 %

3.23 %

4.68 %

0.07 %

0.16%

55.8 %

(0.01) %

0.96 %

0.11 %

0.14 %

2022

1.31 %

15.8 %

3.60 %

4.91 %

0.07 %

0.19 %

56.9 %

Note: Financial data as of and for the three months ended December 31, 2023 unless otherwise indicated; * Annualized measure; Non-GAAP financial measure. See "Non-GAAP

Reconciliations" in the Appendix for reconciliation of non-GAAP financial measures to their most closely comparable GAAP financial measures.

(0.08) %

0.97 %

0.08 %

0.12 %

2023

$5,073

3,404

4,401

93.8 %

77.3 %

12.1 %

8.2 %

1.59%

20.9 %

4.15 %

6.04 %

0.60%

0.86 %

55.8%

0.01%

1.18 %

0.23%

0.17%View entire presentation