SpringOwl Activist Presentation Deck

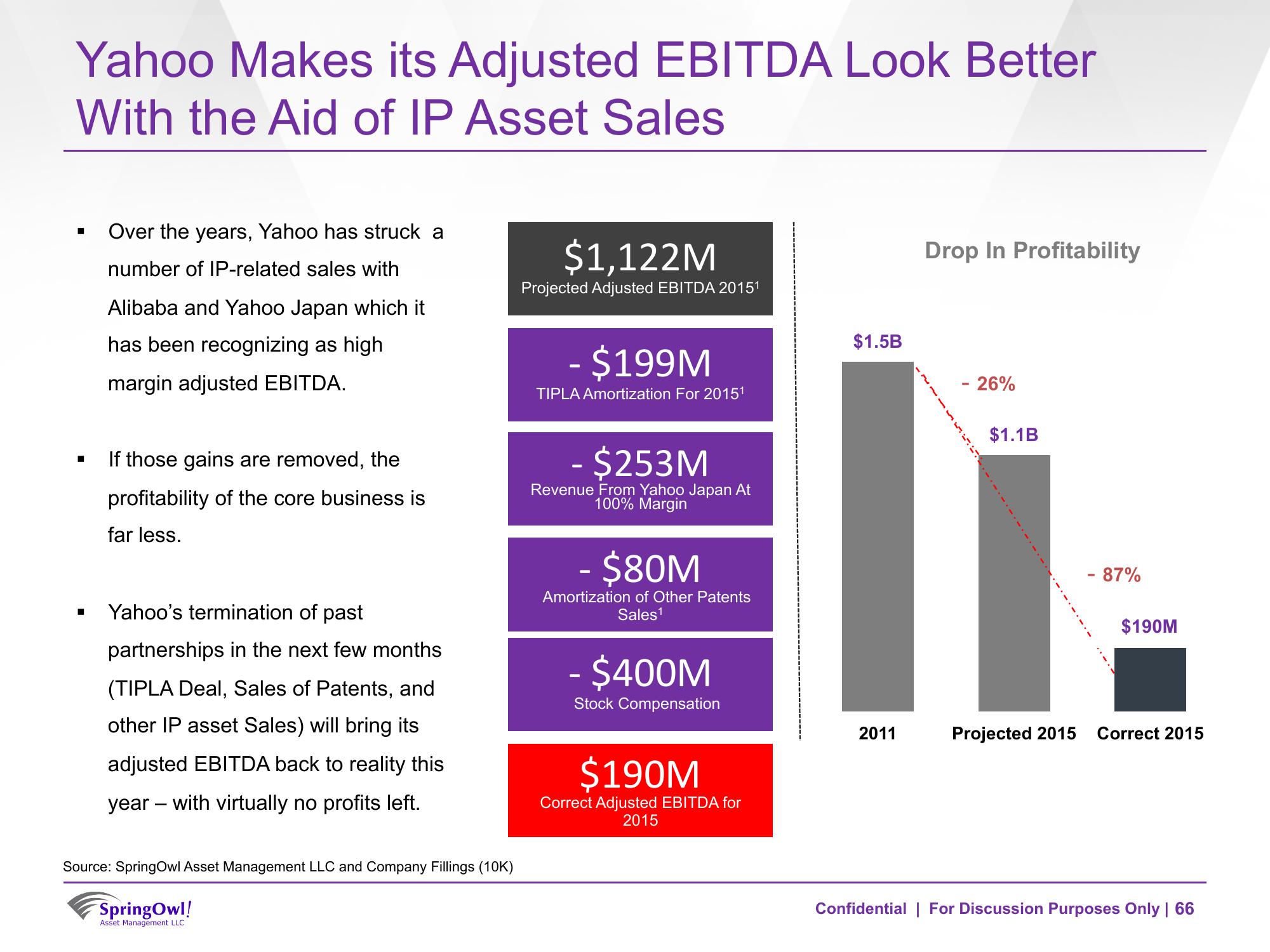

Yahoo Makes its Adjusted EBITDA Look Better

With the Aid of IP Asset Sales

■

Over the years, Yahoo has struck a

number of IP-related sales with

Alibaba and Yahoo Japan which it

has been recognizing as high

margin adjusted EBITDA.

If those gains are removed, the

profitability of the core business is

far less.

Yahoo's termination of past

partnerships in the next few months

(TIPLA Deal, Sales of Patents, and

other IP asset Sales) will bring its

adjusted EBITDA back to reality this

year with virtually no profits left.

Source: SpringOwl Asset Management LLC and Company Fillings (10K)

SpringOwl!

Asset Management LLC

$1,122M

Projected Adjusted EBITDA 20151

- $199M

TIPLA Amortization For 20151

- $253M

-

Revenue From Yahoo Japan At

100% Margin

- $80M

Amortization of Other Patents

Sales¹

- $400M

Stock Compensation

$190M

Correct Adjusted EBITDA for

2015

$1.5B

2011

-=

Drop In Profitability

26%

$1.1B

Projected 2015

- 87%

$190M

Correct 2015

Confidential | For Discussion Purposes Only | 66View entire presentation