Endeavour Mining Investor Presentation Deck

★

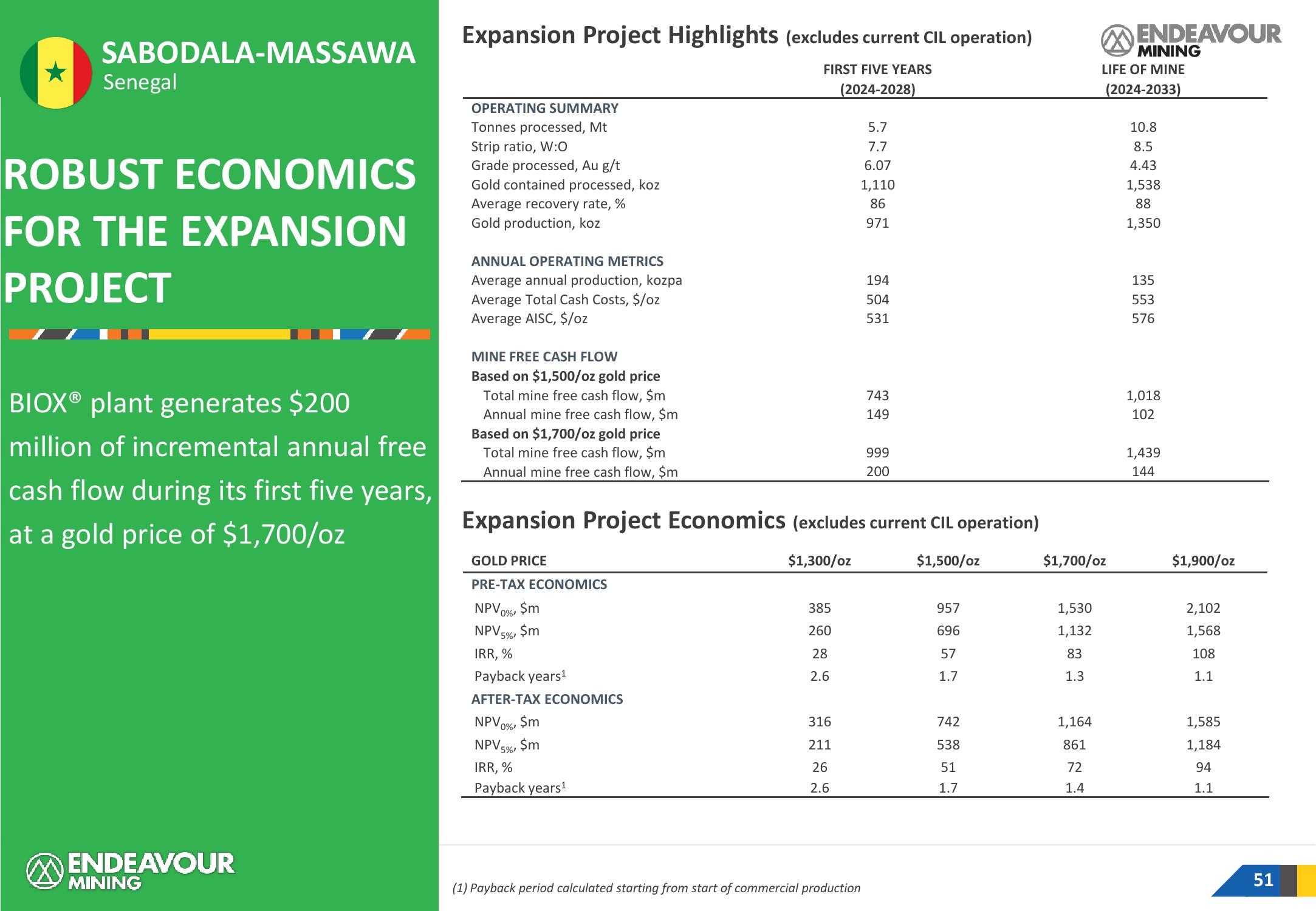

SABODALA-MASSAWA

Senegal

ROBUST ECONOMICS

FOR THE EXPANSION

PROJECT

BIOX® plant generates $200

million of incremental annual free

cash flow during its first five years,

at a gold price of $1,700/oz

ENDEAVOUR

MINING

Expansion Project Highlights (excludes current CIL operation)

FIRST FIVE YEARS

(2024-2028)

OPERATING SUMMARY

Tonnes processed, Mt

Strip ratio, W:0

Grade processed, Au g/t

Gold contained processed, koz

Average recovery rate, %

Gold production, koz

ANNUAL OPERATING METRICS

Average annual production, kozpa

Average Total Cash Costs, $/oz

Average AISC, $/oz

MINE FREE CASH FLOW

Based on $1,500/oz gold price

Total mine free cash flow, $m

Annual mine free cash flow, $m

Based on $1,700/oz gold price

Total mine free cash flow, $m

Annual mine free cash flow, $m

GOLD PRICE

PRE-TAX ECONOMICS

NPV0%, $m

NPV5 $m

5%'

IRR, %

Payback years¹

AFTER-TAX ECONOMICS

NPV 0%

$m

NPV 5%, $m

IRR, %

Payback years¹

Expansion Project Economics (excludes current CIL operation)

$1,300/oz

$1,500/oz

385

260

28

2.6

316

211

26

2.6

5.7

7.7

6.07

(1) Payback period calculated starting from start of commercial production

1,110

86

971

194

504

531

743

149

999

200

957

696

57

1.7

742

538

51

1.7

$1,700/oz

1,530

1,132

83

1.3

1,164

861

72

1.4

ENDEAVOUR

MINING

LIFE OF MINE

(2024-2033)

10.8

8.5

4.43

1,538

88

1,350

135

553

576

1,018

102

1,439

144

$1,900/oz

2,102

1,568

108

1.1

1,585

1,184

94

1.1

51View entire presentation