Marti Investor Presentation Deck

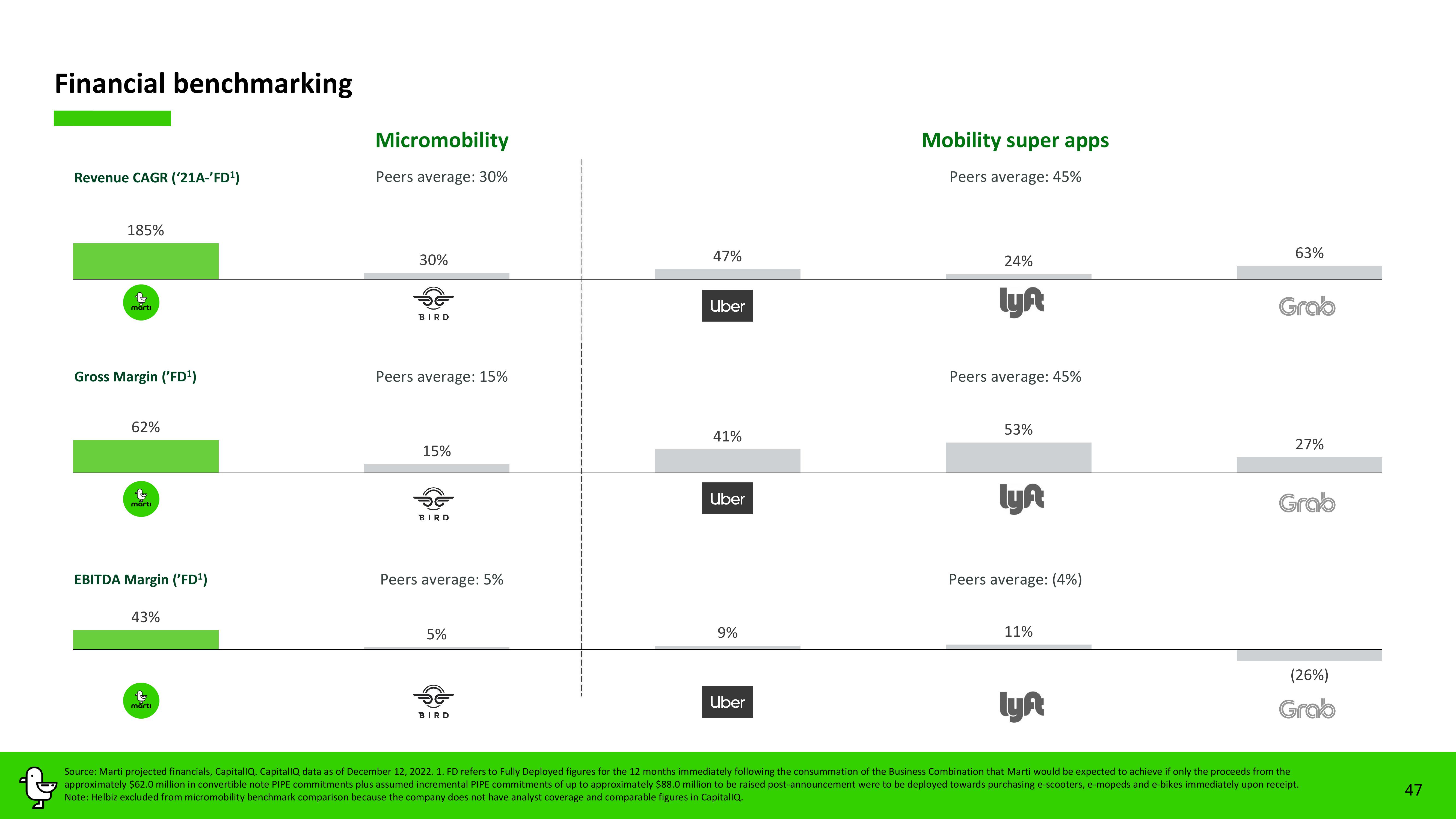

Financial benchmarking

Revenue CAGR ('21A-'FD¹)

185%

&

marti

Gross Margin ('FD¹)

62%

P

marti

EBITDA Margin ('FD¹)

43%

t

marti

Micromobility

Peers average: 30%

30%

BIRD

Peers average: 15%

15%

BIRD

Peers average: 5%

5%

47%

BIRD

Uber

41%

Uber

9%

Uber

Mobility super apps

Peers average: 45%

24%

lyn

Peers average: 45%

53%

lyn

Peers average: (4%)

11%

63%

Grab

27%

Grab

(26%)

Grab

lyn

Source: Marti projected financials, CapitallQ. CapitallQ data as of December 12, 2022. 1. FD refers to Fully Deployed figures for the 12 months immediately following the consummation of the Business Combination that Marti would be expected to achieve if only the proceeds from the

approximately $62.0 million in convertible note PIPE commitments plus assumed incremental PIPE commitments of up to approximately $88.0 million to be raised post-announcement were to be deployed towards purchasing e-scooters, e-mopeds and e-bikes immediately upon receipt.

Note: Helbiz excluded from micromobility benchmark comparison because the company does not have analyst coverage and comparable figures in CapitalIQ.

47View entire presentation