Bakkt Results Presentation Deck

FINANCIAL RESULTS / 2Q22 SUMMARY

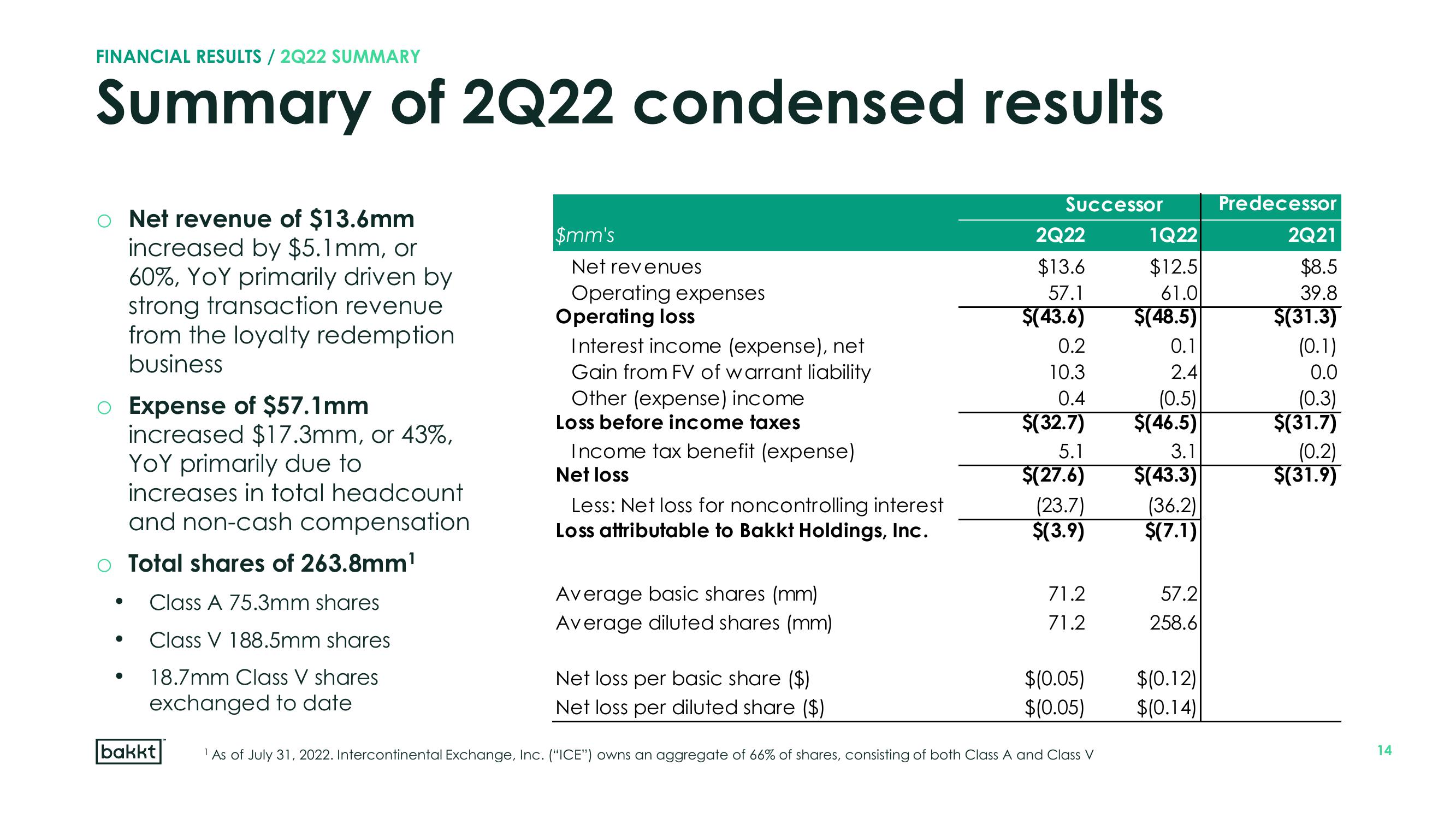

Summary of 2Q22 condensed results

o Net revenue of $13.6mm

increased by $5.1mm, or

60%, YOY primarily driven by

strong transaction revenue

from the loyalty redemption

business

o Expense of $57.1mm

increased $17.3mm, or 43%,

YOY primarily due to

increases in total headcount

and non-cash compensation

O Total shares of 263.8mm¹

●

●

Class A 75.3mm shares

Class V 188.5mm shares

18.7mm Class V shares

exchanged to date

bakkt

$mm's

Net revenues

Operating expenses

Operating loss

Interest income (expense), net

Gain from FV of warrant liability

Other (expense) income

Loss before income taxes

Income tax benefit (expense)

Net loss

Less: Net loss for noncontrolling interest

Loss attributable to Bakkt Holdings, Inc.

Average basic shares (mm)

Average diluted shares (mm)

Net loss per basic share ($)

Net loss per diluted share ($)

Successor

2Q22

$13.6

57.1

$(43.6)

0.2

10.3

0.4

$(32.7)

5.1

$(27.6)

(23.7)

$(3.9)

71.2

71.2

$(0.05)

$(0.05)

¹ As of July 31, 2022. Intercontinental Exchange, Inc. ("ICE") owns an aggregate of 66% of shares, consisting of both Class A and Class V

1Q22

$12.5

61.0

$(48.5)

0.1

2.4

(0.5)

$(46.5)

3.1

$(43.3)

(36.2)

$(7.1)

57.2

258.6

$(0.12)

$(0.14)

Predecessor

2Q21

$8.5

39.8

$(31.3)

(0.1)

0.0

(0.3)

$(31.7)

(0.2)

$(31.9)

14View entire presentation