Evercore Investment Banking Pitch Book

Preliminary Financial Analysis

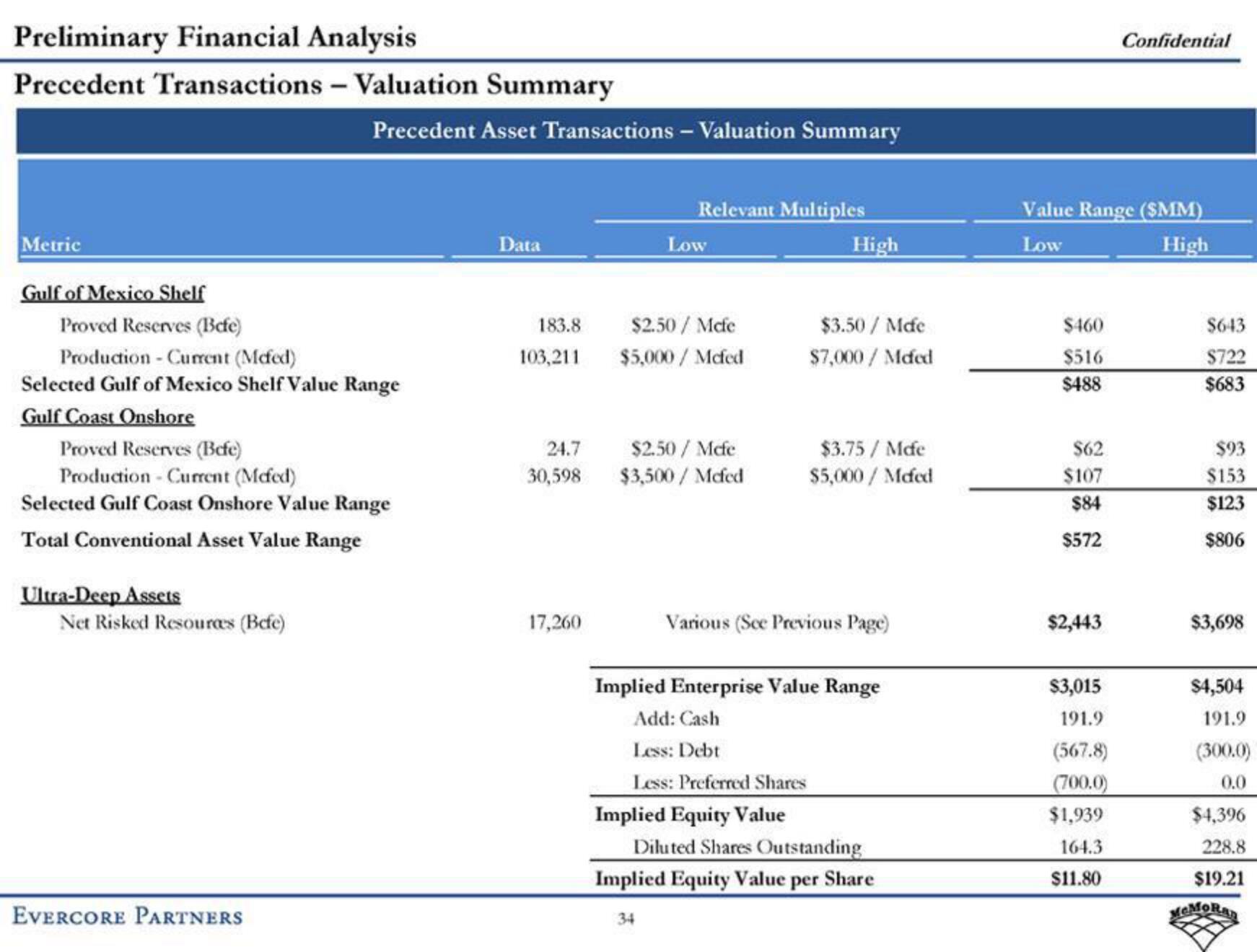

Precedent Transactions - Valuation Summary

Metric

Gulf of Mexico Shelf

Proved Reserves (Befe)

Production - Current (Mcfed)

Selected Gulf of Mexico Shelf Value Range

Gulf Coast Onshore

Proved Reserves (Befe)

Production - Current (Mcfed)

Selected Gulf Coast Onshore Value Range

Total Conventional Asset Value Range

Ultra-Deep Assets

Net Risked Resources (Befe)

Precedent Asset Transactions - Valuation Summary

EVERCORE PARTNERS

Data

183.8

103,211

24.7

30,598

17,260

Relevant Multiples

Low

$2.50 / Mcfe

$5,000 / Mcfed

$2.50 / Mcfe

$3,500/Mcfed

High

$3.50 / Mafe

$7,000/ Mcfed

Implied Equity Value

$3.75 / Mafe

$5,000/ Mcfed

Various (See Previous Page)

Implied Enterprise Value Range

Add: Cash

Less: Debt

Less: Preferred Shares

Diluted Shares Outstanding

Implied Equity Value per Share

34

Value Range (SMM)

Low

High

$460

$516

$488

$62

$107

$84

$572

$2,443

Confidential

$3,015

191.9

(567.8)

(700.0)

$1,939

164.3

$11.80

$643

$722

$683

$93

$153

$123

$806

$3,698

$4,504

191.9

(300.0)

0.0

$4,396

228.8

$19.21

MCMORARView entire presentation