J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

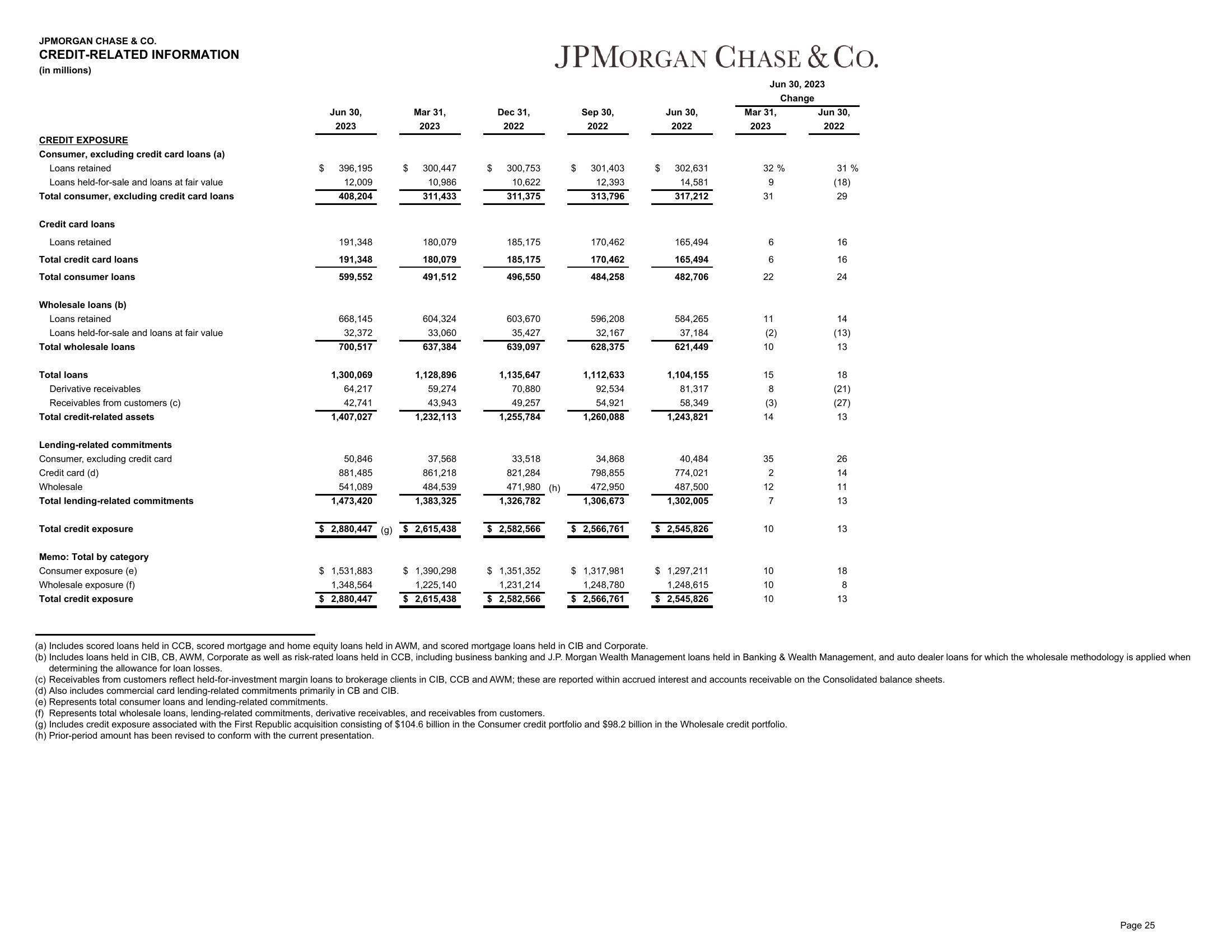

CREDIT-RELATED INFORMATION

(in millions)

CREDIT EXPOSURE

Consumer, excluding credit card loans (a)

Loans retained

Loans held-for-sale and loans at fair value

Total consumer, excluding credit card loans

Credit card loans

Loans retained

Total credit card loans

Total consumer loans

Wholesale loans (b)

Loans retained

Loans held-for-sale and loans at fair value

Total wholesale loans

Total loans

Derivative receivables

Receivables from customers (c)

Total credit-related assets

Lending-related commitments

Consumer, excluding credit card

Credit card (d)

Wholesale

Total lending-related commitments

Total credit exposure

Memo: Total by category

Consumer exposure (e)

Wholesale exposure (f)

Total credit exposure

$

Jun 30,

2023

396,195

12,009

408,204

191,348

191,348

599,552

668,145

32,372

700,517

1,300,069

64,217

42,741

1,407,027

50,846

881,485

541,089

1,473,420

$

$ 1,531,883

1,348,564

$ 2,880,447

Mar 31,

2023

300,447

10,986

311,433

180,079

180,079

491,512

604,324

33,060

637,384

1,128,896

59,274

43,943

1,232,113

37,568

861,218

484,539

1,383,325

$ 2,880,447 (g) $ 2,615,438

$ 1,390,298

1,225,140

$ 2,615,438

$

Dec 31,

2022

300,753

10,622

311,375

185,175

185,175

496,550

603,670

35,427

639,097

1,135,647

70,880

49,257

1,255,784

33,518

821,284

471,980 (h)

1,326,782

$ 2,582,566

JPMORGAN CHASE & CO.

Jun 30, 2023

Change

1,351,352

1,231,214

2,582,566

Sep 30,

2022

$ 301,403

12,393

313,796

170,462

170,462

484,258

596,208

32,167

628,375

1,112,633

92,534

54,921

1,260,088

34,868

798,855

472,950

1,306,673

$ 2,566,761

$1,317,981

1,248,780

2,566,761

$

Jun 30,

2022

302,631

14,581

317,212

165,494

165,494

482,706

584,265

37,184

621,449

1,104,155

81,317

58,349

1,243,821

40,484

774,021

487,500

1,302,005

$ 2,545,826

$ 1,297,211

1,248,615

$ 2,545,826

Mar 31,

2023

32%

9

31

6

6

22

11

(2)

10

15

8

(3)

14

35

2

12

7

10

10

10

10

Jun 30,

2022

31%

(18)

29

16

16

24

14

(13)

13

18

(21)

(27)

13

26

14

11

13

13

18

8

13

(a) Includes scored loans held in CCB, scored mortgage and home equity loans held in AWM, and scored mortgage loans held in CIB and Corporate.

(b) Includes loans held in CIB, CB, AWM, Corporate as well as risk-rated loans held in CCB, including business banking and J.P. Morgan Wealth Management loans held in Banking & Wealth Management, and auto dealer loans for which the wholesale methodology is applied when

determining the allowance for loan losses.

(c) Receivables from customers reflect held-for-investment margin loans to brokerage clients in CIB, CCB and AWM; these are reported within accrued interest and accounts receivable on the Consolidated balance sheets.

(d) Also includes commercial card lending-related commitments primarily in CB and CIB.

(e) Represents total consumer loans and lending-related commitments.

(f) Represents total wholesale loans, lending-related commitments, derivative receivables, and receivables from customers.

(g) Includes credit exposure associated with the First Republic acquisition consisting of $104.6 billion in the Consumer credit portfolio and $98.2 billion in the Wholesale credit portfolio.

(h) Prior-period amount has been revised to conform with the current presentation.

Page 25View entire presentation