Melrose Results Presentation Deck

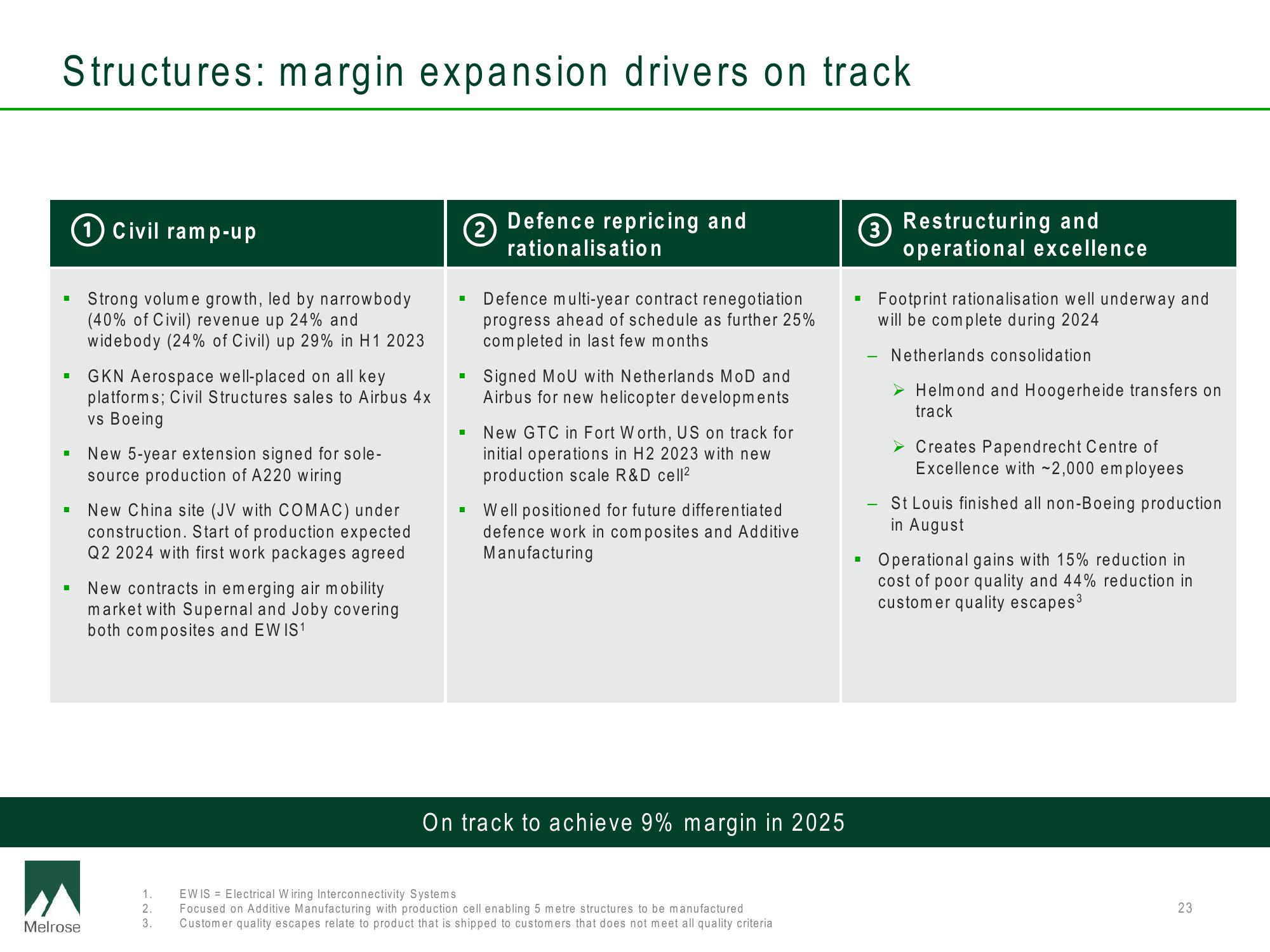

Structures: margin expansion drivers on track

I

■

■

Melrose

1 Civil ramp-up

Strong volume growth, led by narrowbody

(40% of Civil) revenue up 24% and

widebody (24% of Civil) up 29% in H1 2023

GKN Aerospace well-placed on all key

platforms; Civil Structures sales to Airbus 4x

vs Boeing

New 5-year extension signed for sole-

source production of A220 wiring

New China site (JV with COMAC) under

construction. Start of production expected

Q2 2024 with first work packages agreed

New contracts in emerging air mobility

market with Supernal and Joby covering

both composites and EW IS1

123

■

1.

2

Defence repricing and

rationalisation

Defence multi-year contract renegotiation

progress ahead of schedule as further 25%

completed in last few months

Signed MoU with Netherlands MoD and

Airbus for new helicopter developments

New GTC in Fort Worth, US on track for

initial operations in H2 2023 with new

production scale R&D cell²

Well positioned for future differentiated

defence work in composites and Additive

Manufacturing

EW IS Electrical Wiring Interconnectivity Systems

Focused on Additive Manufacturing with production cell enabling 5 metre structures to be manufactured

3. Customer quality escapes relate to product that is shipped to customers that does not meet all quality criteria

On track to achieve 9% margin in 2025

■

■

3

-

Restructuring and

operational excellence

Footprint rationalisation well underway and

will be complete during 2024

Netherlands consolidation

➤ Helmond and Hoogerheide transfers on

track

Creates Papendrecht Centre of

Excellence with ~2,000 employees

St Louis finished all non-Boeing production

in August

Operational gains with 15% reduction in

cost of poor quality and 44% reduction in

customer quality escapes³

23View entire presentation