Toyota Investor Presentation Deck

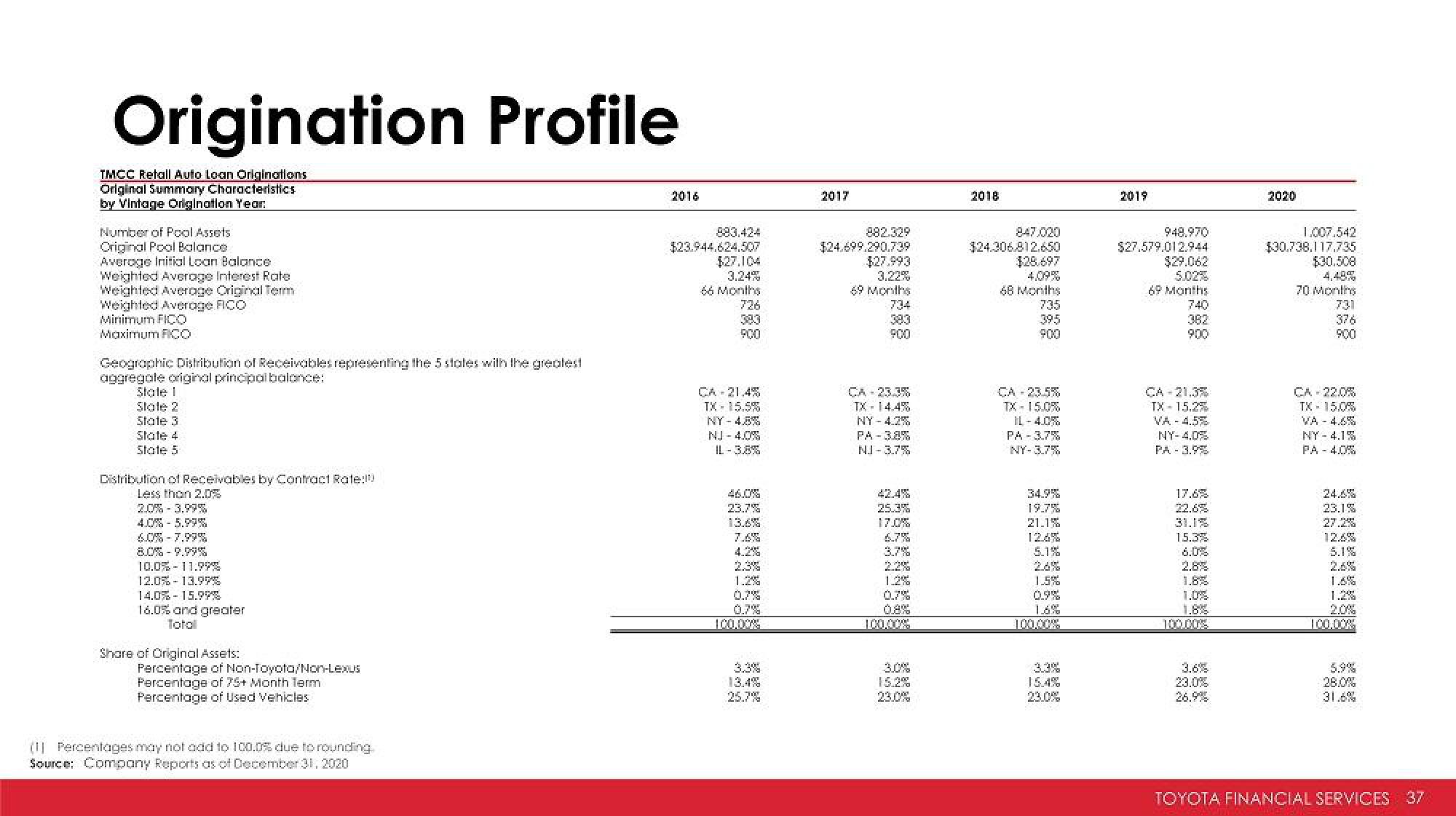

Origination Profile

TMCC Retall Auto Loan Originations

Original Summary Characteristics

by Vintage Origination Year:

Number of Pool Assets

Original Pool Balance

Average Initial Loan Balance

Weighted Average Interest Rate

Weighted Average Original Term

Weighted Average FCO

Minimum FICO

Maximum FICO

Geographic Distribution of Receivables representing the 5 states with the greatest

aggregate original principal balance:

State 1

Stale 2

State 3

State 4

State 5

Distribution of Receivables by Contract Rate!!!!

Less than 2.0%

20%-3.99%

4.0% - 5.99%

60%-7.99%

8.0% -9.99%

10.0% 11.99%

12.0% -13.99%

14.0%-15.99%

16.0% and greater

Total

Share of Original Assets:

Percentage of Non-Toyota/Non-Lexus

Percentage of 75+ Month Term

Percentage of Used Vehicles

(Percentages may not add to 100.0% due to rounding

Source: Company Reports as of December 31, 2020

2016

883.424

$23.944.624.507

$27.104

3.24%

66 Months

726

900

CA 21.4%

TX 15.5%

NY - 4.8%

NJ-4.0%

IL-3.8%

46.0%

23.7%

13.6%

0.7%

13.4%

25.7%

2017

882.329

$24.699.290.739

$27.993

3.22%

69 Months

734

900

CA 23.3%

TX 14.4%

NY-4.2%

PA-3.8%

NJ-3.7%

25.3%

17.0%

3.7%

0.7%

100.00%

3.0%

23.0%

2018

847,020

$24.306.812.650

$28.697

68 Months

735

900

CA 23.5%

TX- 15.0%

IL-4.0%

PA-3.7%

NY-3.7%

34.9%

19.7%

21.1%

126%

5.1%

1.5%

1.6%

100.00%

3.3%

23.0%

2019

948.970

$27.579.012.944

$29.062

5.02%

69 Months

740

382

900

CA-21.3%

TX-15.2%

VA -4.5%

NY-4.0%

PA - 3.9%

17.6%

22.6%

31.1%

15.3%

6.0%

2.8%

1.8%

1.0%

1.8%

100.00%

26.9%

2020

1.007.542

$30.738.117.735

$30.508

70 Months

731

376

900

CA 22.0%

TX 15.0%

VA 4.6%

NY-4.1%

PA 4.0%

23.1%

27.2%

12.4%

5.1%

2.0%

5.9%

28.0%

31.6%

TOYOTA FINANCIAL SERVICES 37View entire presentation