HashiCorp Results Presentation Deck

Financial Overview & Highlights

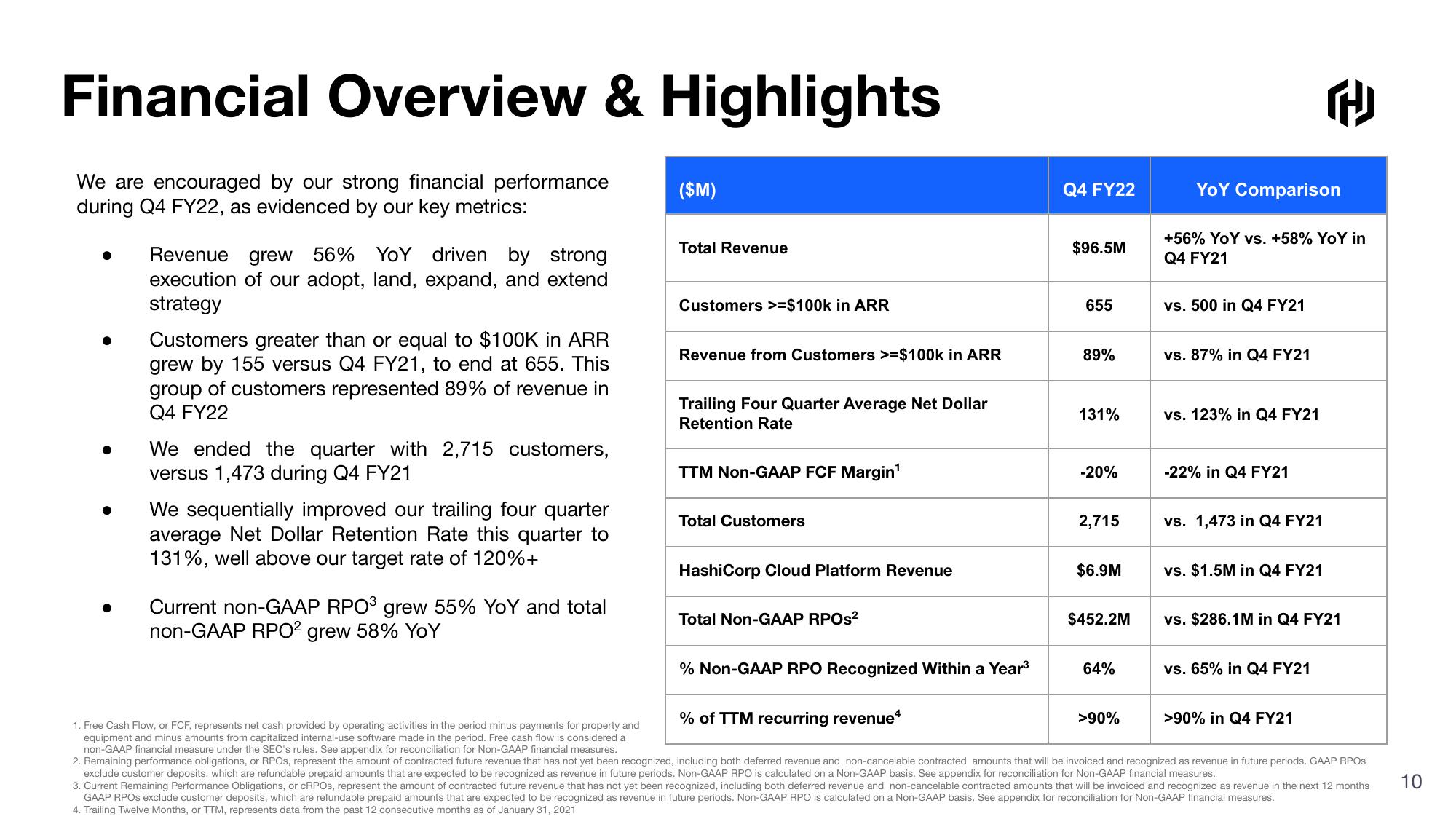

We are encouraged by our strong financial performance

during Q4 FY22, as evidenced by our key metrics:

Revenue grew 56% YoY driven by strong

execution of our adopt, land, expand, and extend

strategy

Customers greater than or equal to $100K in ARR

grew by 155 versus Q4 FY21, to end at 655. This

group of customers represented 89% of revenue in

Q4 FY22

We ended the quarter with 2,715 customers,

versus 1,473 during Q4 FY21

We sequentially improved our trailing four quarter

average Net Dollar Retention Rate this quarter to

131%, well above our target rate of 120%+

Current non-GAAP RPO³ grew 55% YoY and total

non-GAAP RPO² grew 58% YoY

($M)

Total Revenue

Customers >=$100k in ARR

Revenue from Customers >=$100k in ARR

Trailing Four Quarter Average Net Dollar

Retention Rate

TTM Non-GAAP FCF Margin¹

Total Customers

HashiCorp Cloud Platform Revenue

Total Non-GAAP RPOs²

% Non-GAAP RPO Recognized Within a Year³

Q4 FY22

$96.5M

655

89%

131%

-20%

2,715

$6.9M

$452.2M

64%

>90%

YoY Comparison

+56% YoY vs. +58% YoY in

Q4 FY21

vs. 500 in Q4 FY21

vs. 87% in Q4 FY21

vs. 123% in Q4 FY21

-22% in Q4 FY21

vs. 1,473 in Q4 FY21

vs. $1.5M in Q4 FY21

2

vs. $286.1M in Q4 FY21

vs. 65% in Q4 FY21

% of TTM recurring revenue4

1. Free Cash Flow, or FCF, represents net cash provided by operating activities in the period minus payments for property and

equipment and minus amounts from capitalized internal-use software made in the period. Free cash flow is considered a

non-GAAP financial measure under the SEC's rules. See appendix for reconciliation for Non-GAAP financial measures.

2. Remaining performance obligations, or RPOs, represent the amount of contracted future revenue that has not yet been recognized, including both deferred revenue and non-cancelable contracted amounts that will be invoiced and recognized as revenue in future periods. GAAP RPOS

exclude customer deposits, which are refundable prepaid amounts that are expected to be recognized as revenue in future periods. Non-GAAP RPO is calculated on a Non-GAAP basis. See appendix for reconciliation for Non-GAAP financial measures.

3. Current Remaining Performance Obligations, or cRPOS, represent the amount of contracted future revenue that has not yet been recognized, including both deferred revenue and non-cancelable contracted amounts that will be invoiced and recognized as revenue in the next 12 months

GAAP RPOs exclude customer deposits, which are refundable prepaid amounts that are expected to be recognized as revenue in future periods. Non-GAAP RPO is calculated on a Non-GAAP basis. See appendix for reconciliation for Non-GAAP financial measures.

4. Trailing Twelve Months, or TTM, represents data from the past 12 consecutive months as of January 31, 2021

>90% in Q4 FY21

10View entire presentation