KKR Real Estate Finance Trust Results Presentation Deck

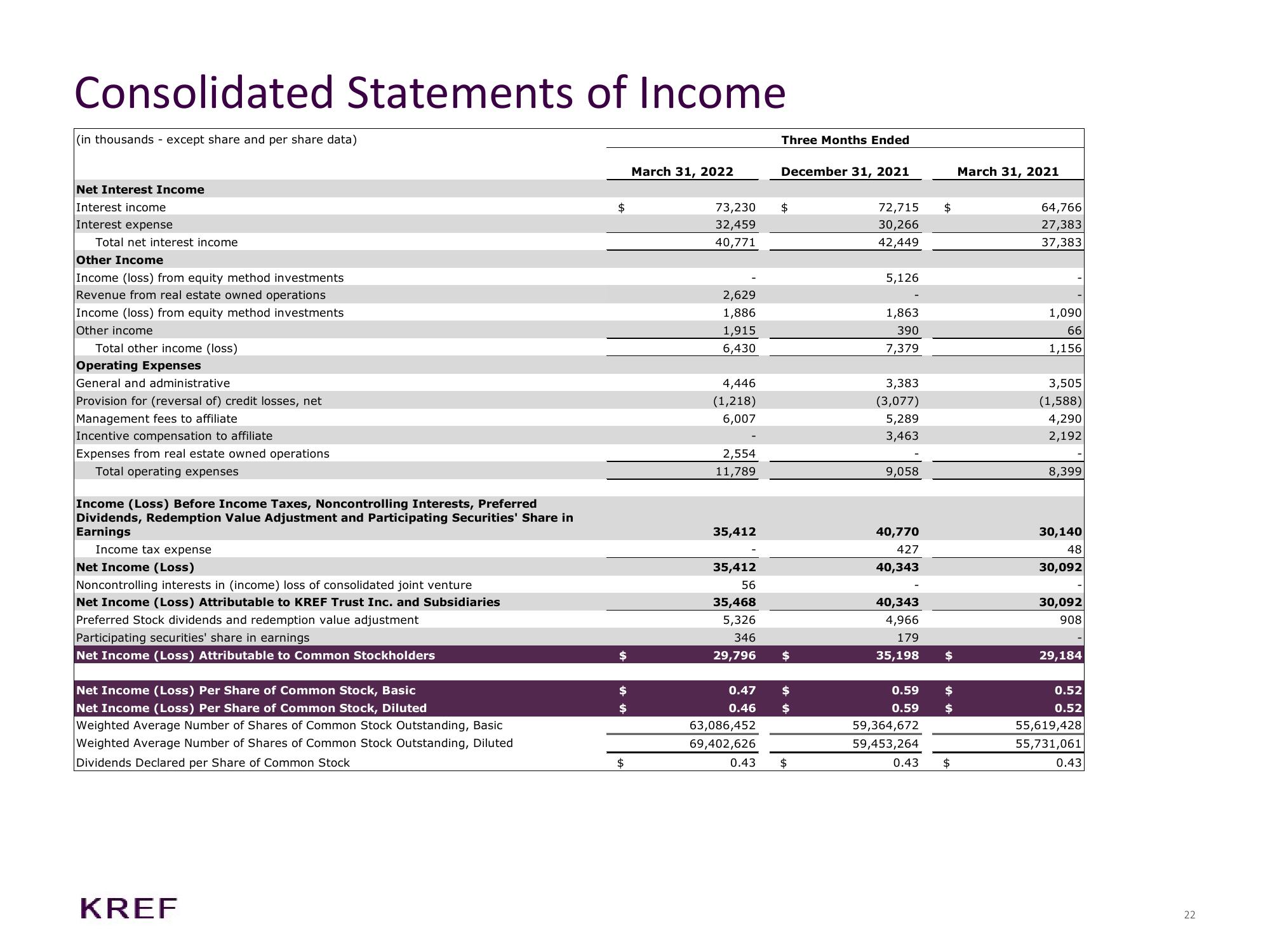

Consolidated Statements of Income

(in thousands - except share and per share data)

Net Interest Income

Interest income

Interest expense

Total net interest income

Other Income

Income (loss) from equity method investments

Revenue from real estate owned operations

Income (loss) from equity method investments

Other income

Total other income (loss)

Operating Expenses

General and administrative

Provision for (reversal of) credit losses, net

Management fees to affiliate

Incentive compensation to affiliate

Expenses from real estate owned operations

Total operating expenses

Income (Loss) Before Income Taxes, Noncontrolling Interests, Preferred

Dividends, Redemption Value Adjustment and Participating Securities' Share in

Earnings

Income tax expense

Net Income (Loss)

Noncontrolling interests in (income) loss of consolidated joint venture

Net Income (Loss) Attributable to KREF Trust Inc. and Subsidiaries

Preferred Stock dividends and redemption value adjustment

Participating securities' share in earnings

Net Income (Loss) Attributable to Common Stockholders

Net Income (Loss) Per Share of Common Stock, Basic

Net Income (Loss) Per Share of Common Stock, Diluted

Weighted Average Number of Shares of Common Stock Outstanding, Basic

Weighted Average Number of Shares of Common Stock Outstanding, Diluted

Dividends Declared per Share of Common Stock

KREF

$

$

$

$

$

March 31, 2022

73,230

32,459

40,771

2,629

1,886

1,915

6,430

4,446

(1,218)

6,007

2,554

11,789

35,412

35,412

56

35,468

5,326

346

29,796

0.47

0.46

63,086,452

69,402,626

Three Months Ended

December 31, 2021

$

$

$

$

0.43 $

72,715

30,266

42,449

5,126

1,863

390

7,379

3,383

(3,077)

5,289

3,463

9,058

40,770

427

40,343

40,343

4,966

179

35,198

$

$

0.59 $

0.59 $

59,364,672

59,453,264

0.43 $

March 31, 2021

64,766

27,383

37,383

1,090

66

1,156

3,505

(1,588)

4,290

2,192

8,399

30,140

48

30,092

30,092

908

29,184

0.52

0.52

55,619,428

55,731,061

0.43

22View entire presentation