Proterra SPAC Presentation Deck

TRANSACTION SUMMARY

2020E

Median:

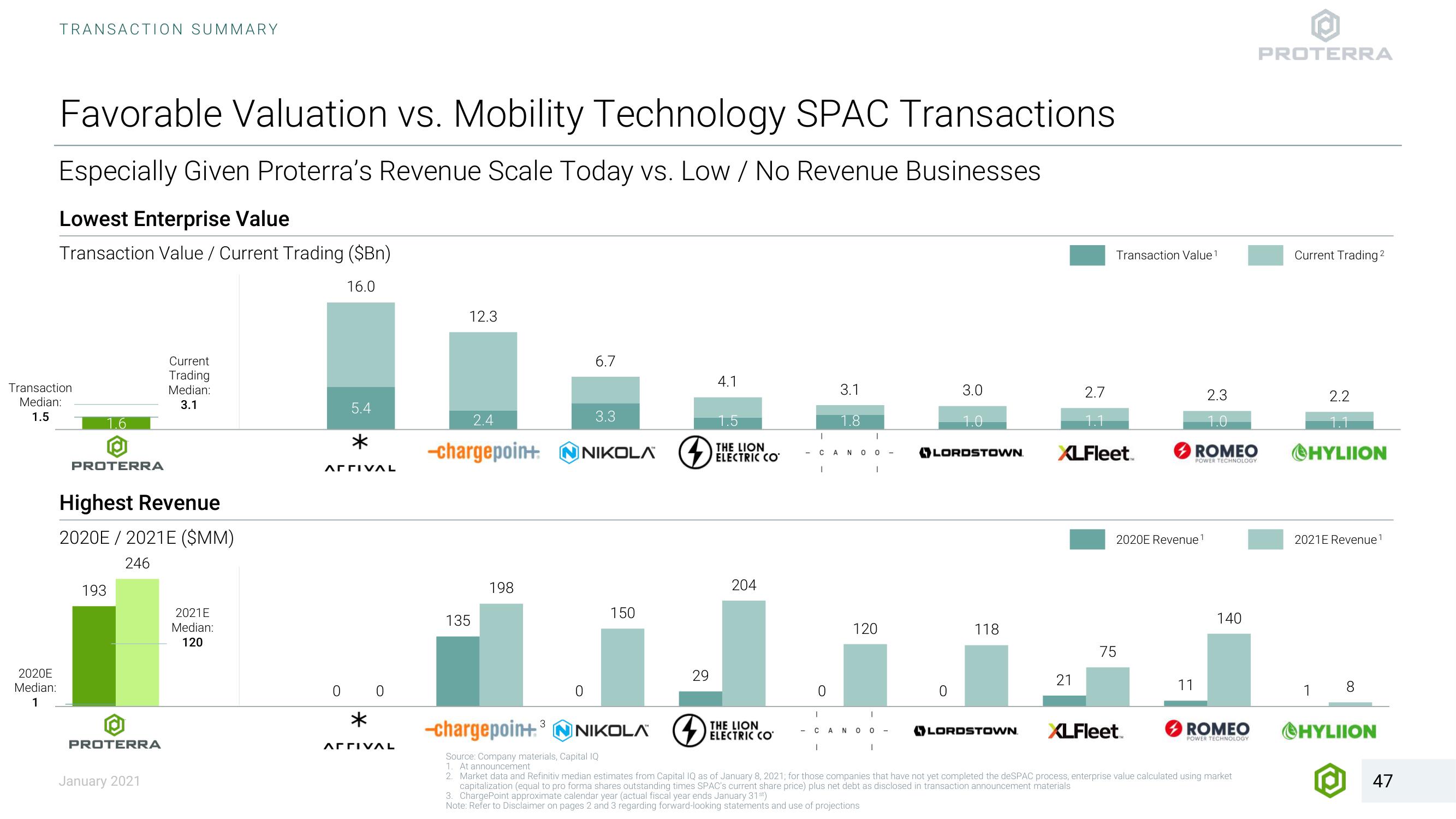

Favorable Valuation vs. Mobility Technology SPAC Transactions

Especially Given Proterra's Revenue Scale Today vs. Low / No Revenue Businesses

Lowest Enterprise Value

Transaction Value / Current Trading ($Bn)

16.0

Transaction

Median:

1.5

1.6

PROTERRA

Highest Revenue

2020E/2021E ($MM)

246

193

PROTERRA

Current

Trading

Median:

3.1

January 2021

2021E

Median:

120

5.4

*

ΑΓΓΙVAL

0 0

ΑΓΓΙVAL

12.3

2.4

3.3

-chargepoin+ N NIKOLA

NIKOLA

135

198

3

6.7

0

150

29

4

4.1

1.5

THE LION

ELECTRIC CO

204

THE LION

ELECTRIC CO

T

I

1

CANO 0

1

0

I

I

3.1

1.8

120

-CANOO-

3.0

1.0

LORDSTOWN.

118

LORDSTOWN.

Transaction Value ¹

2.7

1.1

XLFleet

21

-chargepoin+ NIKOLA

Source: Company materials, Capital IQ

1. At announcement

2. Market data and Refinitiv median estimates from Capital IQ of January 8, 2021, for those companies that have not yet completed the deSPAC process, enterprise value calculated using market

capitalization (equal to pro forma shares outstanding times SPAC's current share price) plus net debt as disclosed in transaction announcement materials

3. ChargePoint approximate calendar year (actual fiscal year ends January 31st)

Note: Refer to Disclaimer on pages 2 and 3 regarding forward-looking statements and use of projections

2020E Revenue ¹

75

2.3

1.0

ROMEO

POWER TECHNOLOGY

11

XLFleet

140

ROMEO

POWER TECHNOLOGY

PROTERRA

Current Trading 2²

2.2

1.1

HYLIION

2021E Revenue ¹

1 8

ⒸHYLIION

47View entire presentation