Spring 2023 Solar Industry Update

New Guidance Issued on 48C

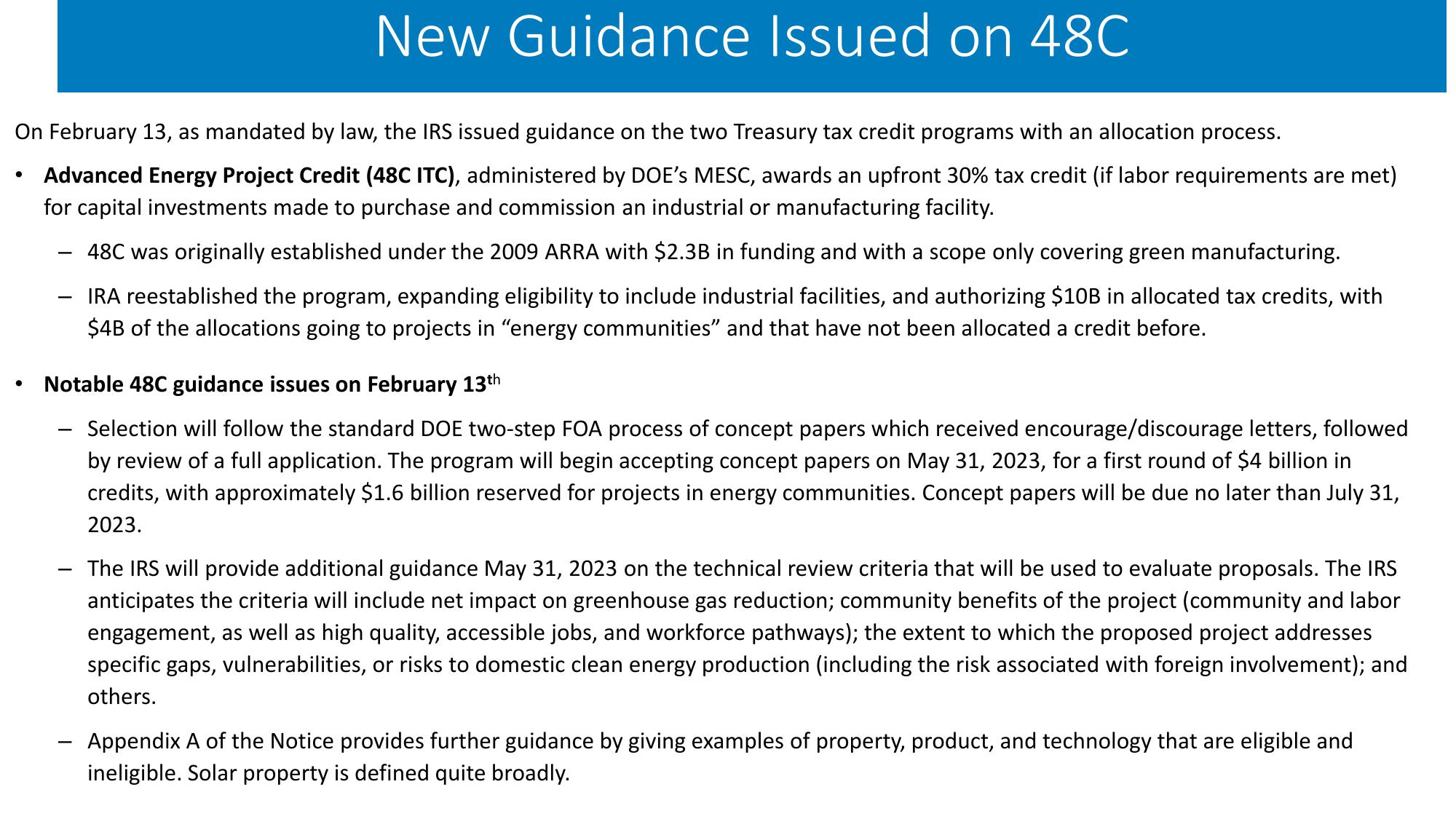

On February 13, as mandated by law, the IRS issued guidance on the two Treasury tax credit programs with an allocation process.

•

•

Advanced Energy Project Credit (48C ITC), administered by DOE's MESC, awards an upfront 30% tax credit (if labor requirements are met)

for capital investments made to purchase and commission an industrial or manufacturing facility.

-

48C was originally established under the 2009 ARRA with $2.3B in funding and with a scope only covering green manufacturing.

IRA reestablished the program, expanding eligibility to include industrial facilities, and authorizing $10B in allocated tax credits, with

$4B of the allocations going to projects in "energy communities" and that have not been allocated a credit before.

Notable 48C guidance issues on February 13th

-

Selection will follow the standard DOE two-step FOA process of concept papers which received encourage/discourage letters, followed

by review of a full application. The program will begin accepting concept papers on May 31, 2023, for a first round of $4 billion in

credits, with approximately $1.6 billion reserved for projects in energy communities. Concept papers will be due no later than July 31,

2023.

The IRS will provide additional guidance May 31, 2023 on the technical review criteria that will be used to evaluate proposals. The IRS

anticipates the criteria will include net impact on greenhouse gas reduction; community benefits of the project (community and labor

engagement, as well as high quality, accessible jobs, and workforce pathways); the extent to which the proposed project addresses

specific gaps, vulnerabilities, or risks to domestic clean energy production (including the risk associated with foreign involvement); and

others.

Appendix A of the Notice provides further guidance by giving examples of property, product, and technology that are eligible and

ineligible. Solar property is defined quite broadly.View entire presentation