Hanmi Financial Results Presentation Deck

Total Balance

Average

Median

(3)

Top Quintile Balance

Top Quintile Loan Size

Top Quintile Average

Top Quintile Median

Owner

Occupied

$719

$0.94

$0.30

$538

$1.1 or more

$3.54

$2.00

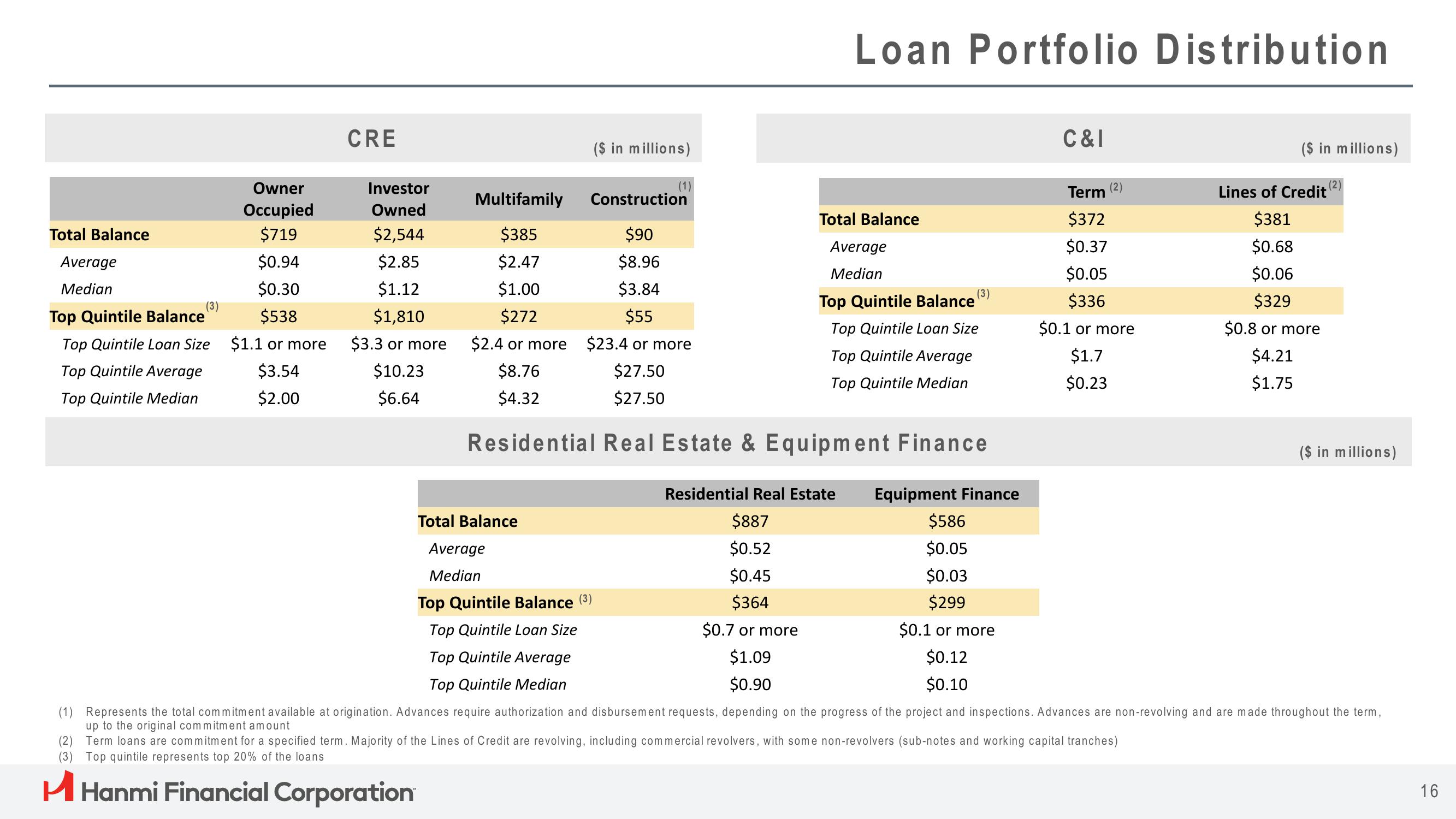

CRE

Investor

Owned

$2,544

$2.85

$1.12

$1,810

$3.3 or more

$10.23

$6.64

Total Balance

Average

Median

($ in millions)

Top Quintile Balance (³)

Top Quintile Loan Size

Top Quintile Average

Top Quintile Median

(1)

Multifamily

Construction

$385

$90

$2.47

$8.96

$1.00

$3.84

$272

$55

$2.4 or more

$23.4 or more

$8.76

$27.50

$4.32

$27.50

Residential Real Estate & Equipment Finance

Loan Portfolio Distribution

Total Balance

Average

Median

Residential Real Estate

$887

$0.52

$0.45

$364

$0.7 or more

$1.09

$0.90

(3)

Top Quintile Balance

Top Quintile Loan Size

Top Quintile Average

Top Quintile Median

Equipment Finance

$586

$0.05

$0.03

$299

$0.1 or more

$0.12

$0.10

C&I

(2)

Term

$372

$0.37

$0.05

$336

$0.1 or more

$1.7

$0.23

($ in millions)

Lines of Credit

$381

$0.68

$0.06

$329

$0.8 or more

$4.21

$1.75

(2)

($ in millions)

(1) Represents the total commitment available at origination. Advances require authorization and disbursement requests, depending on the progress of the project and inspections. Advances are non-revolving and are made throughout the term,

up to the original commitment amount

(2) Term loans are commitment for a specified term. Majority of the Lines of Credit are revolving, including commercial revolvers, with some non-revolvers (sub-notes and working capital tranches)

(3) Top quintile represents top 20% of the loans

H Hanmi Financial Corporation

16View entire presentation