Solar Industry Update

10

8

00

6

st

N

U.S. Installation Breakdown

Quarterly: SEIA (GWdc)

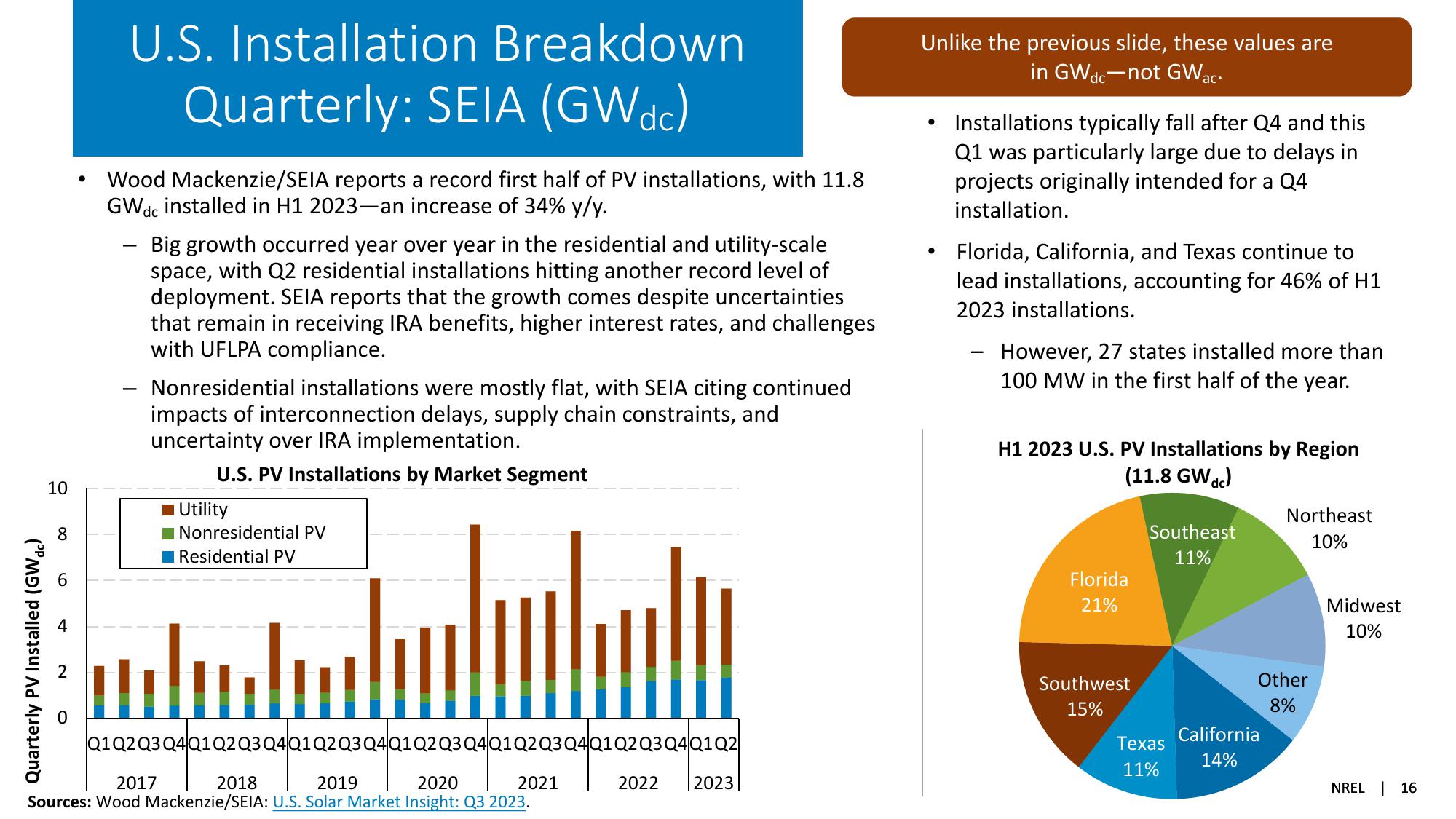

Wood Mackenzie/SEIA reports a record first half of PV installations, with 11.8

GWdc installed in H1 2023-an increase of 34% y/y.

-

Big growth occurred year over year in the residential and utility-scale

space, with Q2 residential installations hitting another record level of

deployment. SEIA reports that the growth comes despite uncertainties

that remain in receiving IRA benefits, higher interest rates, and challenges

with UFLPA compliance.

Nonresidential installations were mostly flat, with SEIA citing continued

impacts of interconnection delays, supply chain constraints, and

uncertainty over IRA implementation.

U.S. PV Installations by Market Segment

Utility

| Nonresidential PV

Residential PV

Unlike the previous slide, these values are

•

in GWdc-not GWac.

Installations typically fall after Q4 and this

Q1 was particularly large due to delays in

projects originally intended for a Q4

installation.

Florida, California, and Texas continue to

lead installations, accounting for 46% of H1

2023 installations.

-

However, 27 states installed more than

100 MW in the first half of the year.

H1 2023 U.S. PV Installations by Region

(11.8 GWdc)

Southeast

11%

Northeast

10%

Florida

21%

Quarterly PV Installed (GWdc)

Q1Q2 Q3 Q4Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2017

2018

2019

2020

2021

Sources: Wood Mackenzie/SEIA: U.S. Solar Market Insight: Q3 2023.

2022

2023

Southwest

15%

Other

8%

Midwest

10%

California

Texas

11%

14%

NREL 16View entire presentation