OppFi Results Presentation Deck

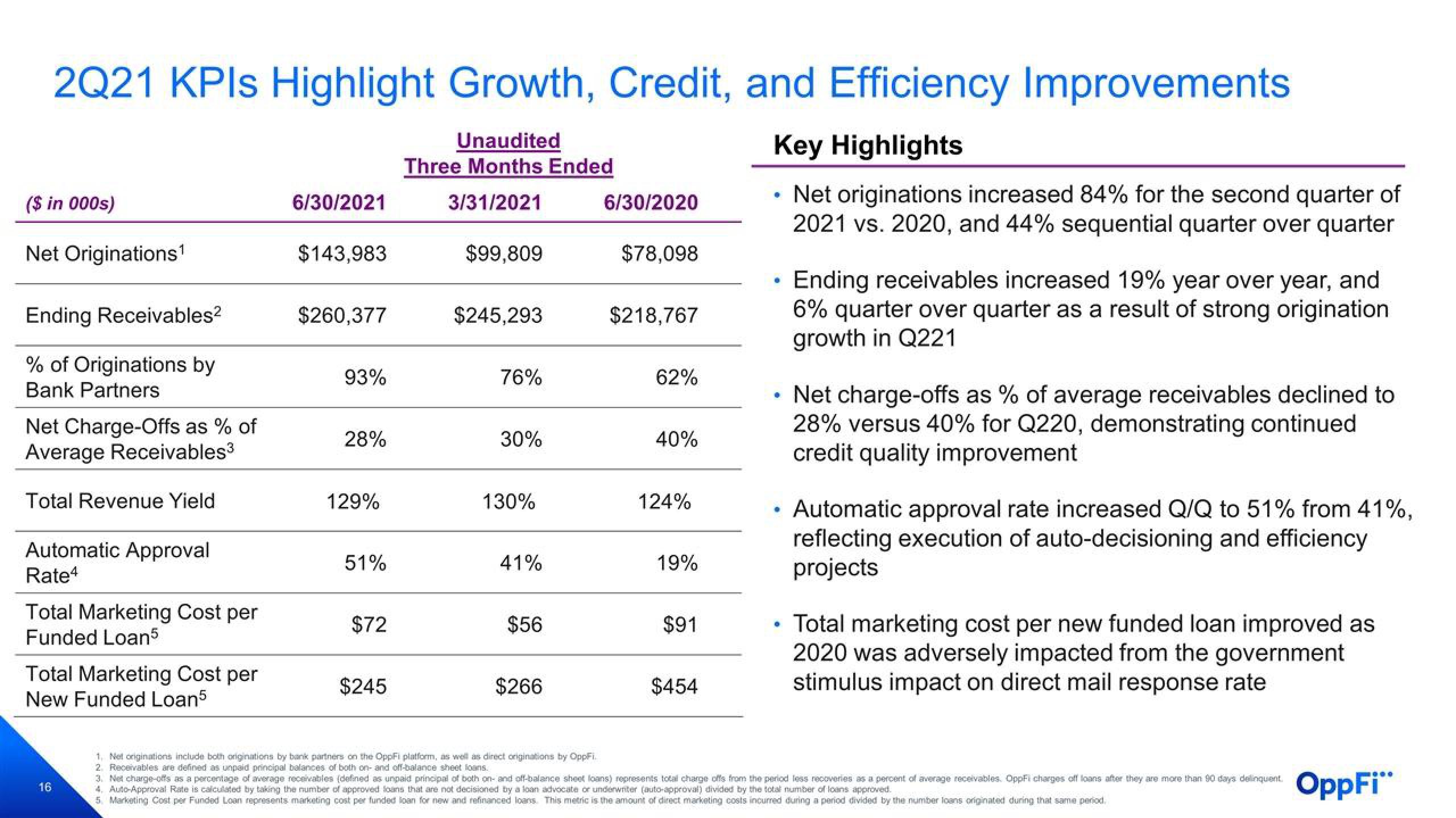

2Q21 KPIs Highlight Growth, Credit, and Efficiency Improvements

Unaudited

Three Months Ended

3/31/2021

($ in 000s)

Net Originations¹

Ending Receivables²

% of Originations by

Bank Partners

Net Charge-Offs as % of

Average Receivables3

Total Revenue Yield

Automatic Approval

Rate4

Total Marketing Cost per

Funded Loan5

Total Marketing Cost per

New Funded Loan5

16

6/30/2021

$143,983

$260,377

93%

28%

129%

51%

$72

$245

$99,809

$245,293

76%

30%

130%

41%

$56

$266

1. Net originations include both originations by bank partners on the OppFi platform, as well as direct originations by OppFi.

2. Receivables are defined as unpaid principal balances of both on- and off-balance sheet loans.

6/30/2020

$78,098

$218,767

62%

40%

124%

19%

$91

$454

Key Highlights

Net originations increased 84% for the second quarter of

2021 vs. 2020, and 44% sequential quarter over quarter

•

U

•

Ending receivables increased 19% year over year, and

6% quarter over quarter as a result of strong origination

growth in Q221

Net charge-offs as % of average receivables declined to

28% versus 40% for Q220, demonstrating continued

credit quality improvement

Automatic approval rate increased Q/Q to 51% from 41%,

reflecting execution of auto-decisioning and efficiency

projects

Total marketing cost per new funded loan improved as

2020 was adversely impacted from the government

stimulus impact on direct mail response rate

3. Net charge-offs as a percentage of average receivables (defined as unpaid principal of both on- and off-balance sheet loans) represents total charge offs from the period less recoveries as a percent of average receivables. OppFi charges off loans after they are more than 90 days delinquent

4. Auto-Approval Rate is calculated by taking the number of approved loans that are not decisioned by a loan advocate or underwriter (auto-approval) divided by the total number of loans approved.

5. Marketing Cost per Funded Loan represents marketing cost per funded loan for new and refinanced loans. This metric is the amount of direct marketing costs incurred during a period divided by the number loans originated during that same period.

OppFi"View entire presentation