Deutsche Bank Results Presentation Deck

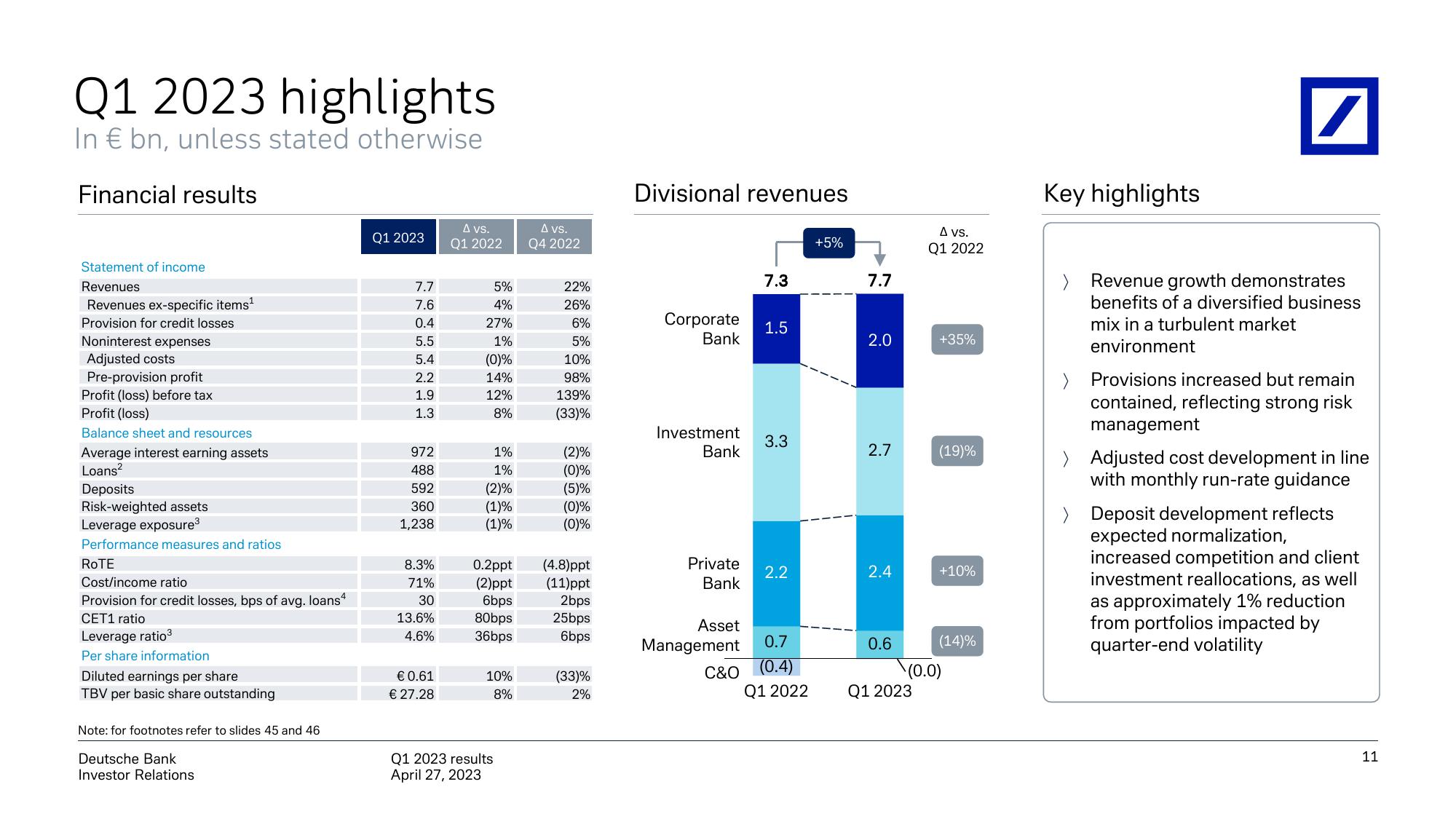

Q1 2023 highlights

In € bn, unless stated otherwise

Financial results

Statement of income

Revenues

Revenues ex-specific items¹

Provision for credit losses

Noninterest expenses

Adjusted costs

Pre-provision profit

Profit (loss) before tax

Profit (loss)

Balance sheet and resources

Average interest earning assets

Loans²

Deposits

Risk-weighted assets

Leverage exposure³

Performance measures and ratios

ROTE

Cost/income ratio

Provision for credit losses, bps of avg. loans4

CET1 ratio

Leverage ratio³

Per share information

Diluted earnings per share

TBV per basic share outstanding

Note: for footnotes refer to slides 45 and 46

Deutsche Bank

Investor Relations

Q1 2023

7.7

7.6

0.4

5.5

5.4

2.2

1.9

1.3

972

488

592

360

1,238

8.3%

71%

30

13.6%

4.6%

€ 0.61

€ 27.28

A vs.

Q1 2022

5%

4%

27%

1%

(0)%

14%

12%

8%

1%

1%

(2)%

(1)%

(1)%

(2)ppt

6bps

80bps

36bps

10%

8%

A vs.

Q4 2022

Q1 2023 results

April 27, 2023

22%

26%

0.2ppt (4.8)ppt

(11)ppt

6%

5%

10%

98%

139%

(33)%

(2)%

(0)%

(5)%

(0)%

(0)%

2bps

25bps

6bps

(33)%

2%

Divisional revenues

Corporate

Bank

Investment

Bank

Private

Bank

7.3

1.5

3.3

2.2

Asset

Management 0.7

C&O (0.4)

Q1 2022

+5%

7.7

2.0

2.7

2.4

0.6

A vs.

Q1 2022

Q1 2023

+35%

(19)%

+10%

(14)%

(0.0)

Key highlights

>

/

Revenue growth demonstrates

benefits of a diversified business

mix in a turbulent market

environment

> Provisions increased but remain

contained, reflecting strong risk

management

> Adjusted cost development in line

with monthly run-rate guidance

> Deposit development reflects

expected normalization,

increased competition and client

investment reallocations, as well

as approximately 1% reduction

from portfolios impacted by

quarter-end volatility

11View entire presentation