Dave Results Presentation Deck

Stable credit

performance

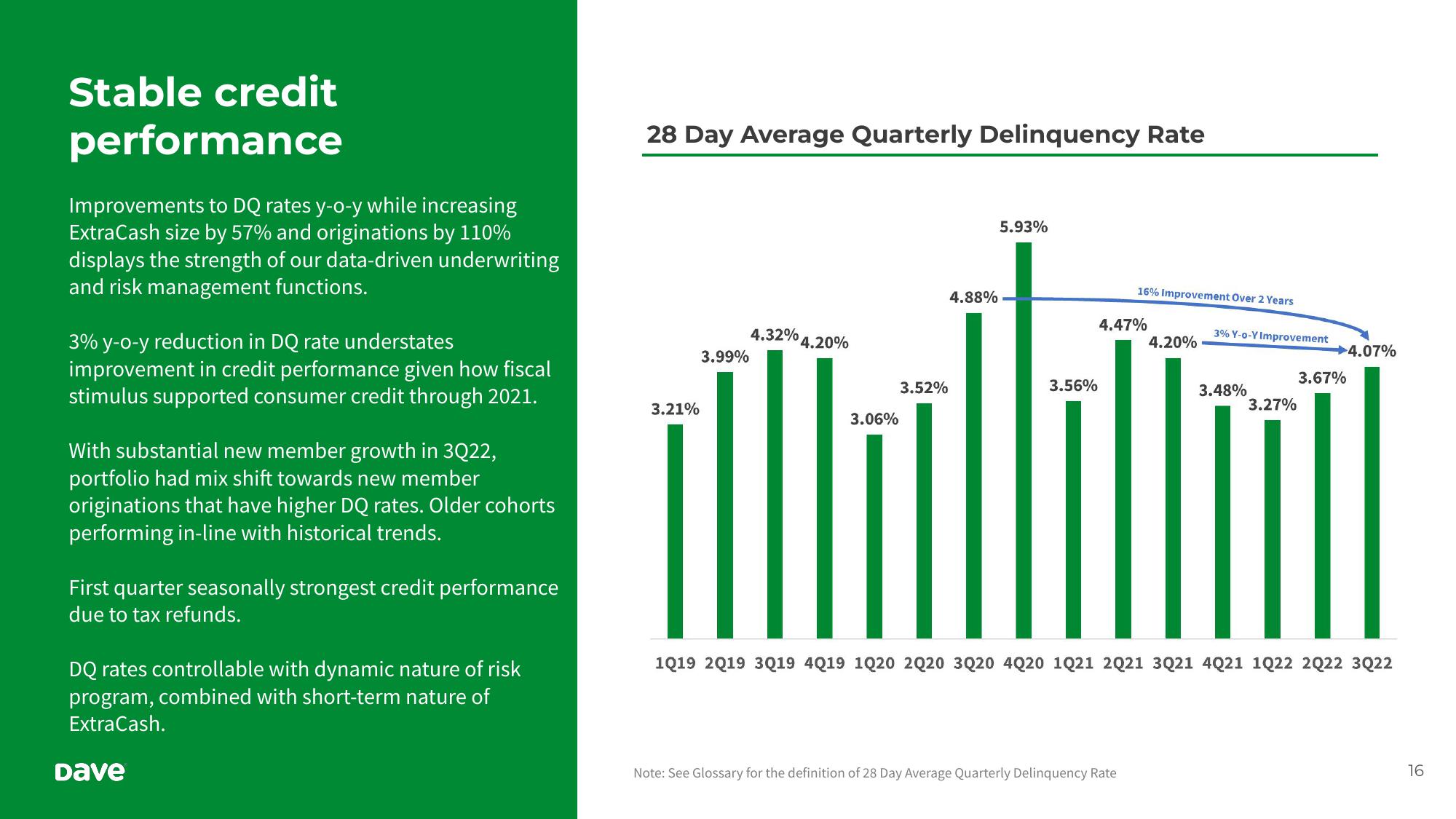

Improvements to DQ rates y-o-y while increasing

ExtraCash size by 57% and originations by 110%

displays the strength of our data-driven underwriting

and risk management functions.

3% y-o-y reduction in DQ rate understates

improvement in credit performance given how fiscal

stimulus supported consumer credit through 2021.

With substantial new member growth in 3Q22,

portfolio had mix shift towards new member

originations that have higher DQ rates. Older cohorts

performing in-line with historical trends.

First quarter seasonally strongest credit performance

due to tax refunds.

DQ rates controllable with dynamic nature of risk

program, combined with short-term nature of

ExtraCash.

Dave

28 Day Average Quarterly Delinquency Rate

3.21%

3.99%

4.32%

4.20%

3.06%

3.52%

4.88%

5.93%

3.56%

16% Improvement Over 2 Years

4.47%

Note: See Glossary for the definition of 28 Day Average Quarterly Delinquency Rate

4.20%

3% Y-o-Y Improvement

3.48%

3.27%

3.67%

4.07%

1Q19 2019 3019 4019 1020 2020 3020 4020 1021 2021 3021 4021 1022 2022 3022

16View entire presentation