Credit Suisse Results Presentation Deck

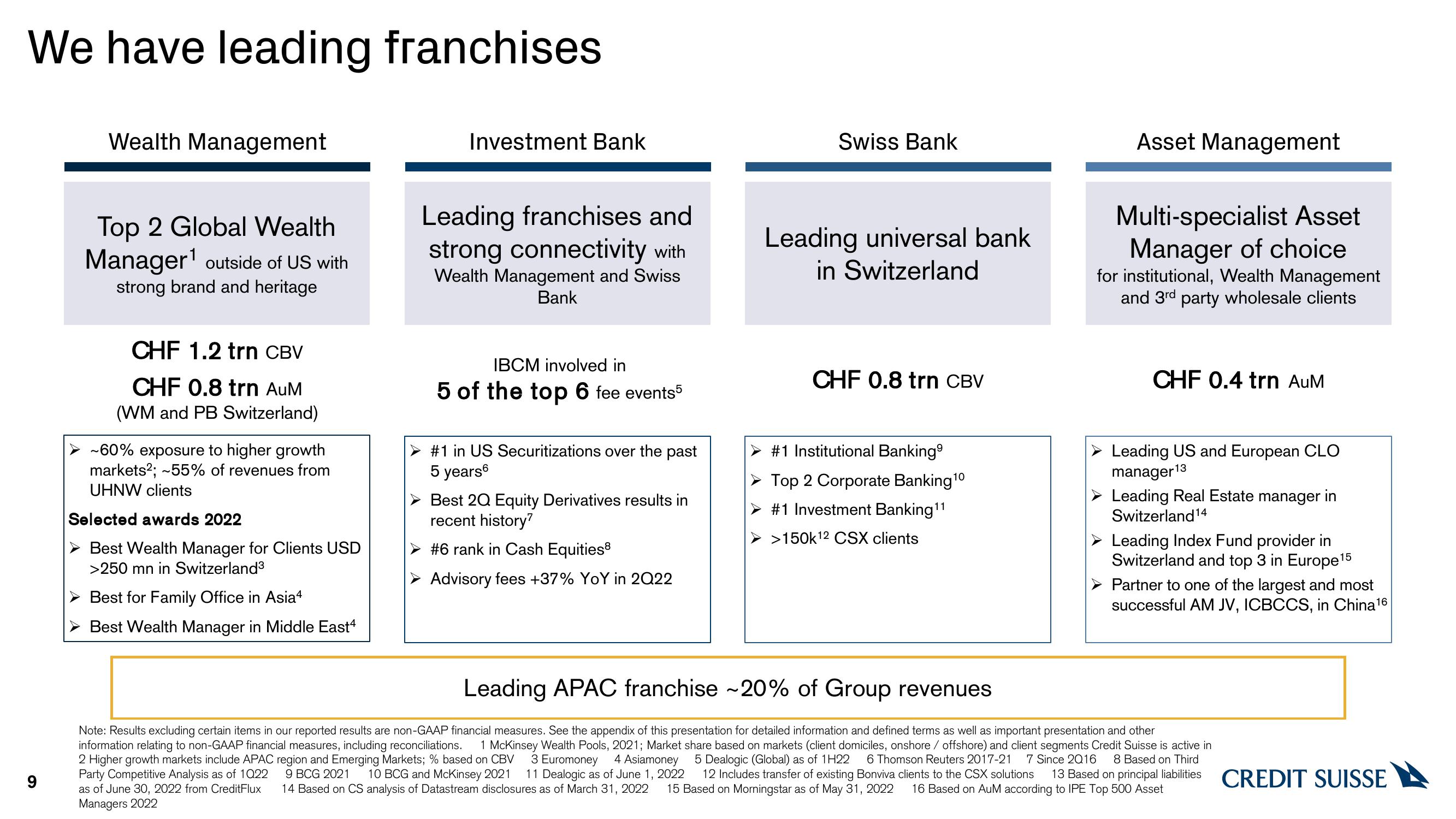

We have leading franchises

9

Wealth Management

Top 2 Global Wealth

Manager¹ outside of US with

strong brand and heritage

CHF 1.2 trn CBV

CHF 0.8 trn AuM

(WM and PB Switzerland)

-60% exposure to higher growth

markets²; ~55% of revenues from

UHNW clients

Selected awards 2022

Best Wealth Manager for Clients USD

>250 mn in Switzerland³

Best for Family Office in Asia4

Best Wealth Manager in Middle East4

Investment Bank

Leading franchises and

strong connectivity with

Wealth Management and Swiss

Bank

IBCM involved in

5 of the top 6 fee events5

#1 in US Securitizations over the past

5 years

Best 2Q Equity Derivatives results in

recent history?

#6 rank in Cash Equities8

Advisory fees +37% YoY in 2Q22

Swiss Bank

Leading universal bank

in Switzerland

CHF 0.8 trn CBV

10

#1 Institutional Banking⁹

Top 2 Corporate Banking ¹0

#1 Investment Banking¹1

>150k¹2 CSX clients

Asset Management

Multi-specialist Asset

Manager of choice

for institutional, Wealth Management

and 3rd party wholesale clients

CHF 0.4 trn AuM

Leading US and European CLO

manager ¹3

13

➤ Leading Real Estate manager in

Switzerland ¹4

➤ Leading Index Fund provider in

Switzerland and top 3 in Europe¹5

➤ Partner to one of the largest and most

successful AM JV, ICBCCS, in China¹6

Leading APAC franchise -20% of Group revenues

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important presentation and other

information relating to non-GAAP financial measures, including reconciliations. 1 McKinsey Wealth Pools, 2021; Market share based on markets (client domiciles, onshore / offshore) and client segments Credit Suisse is active in

2 Higher growth markets include APAC region and Emerging Markets; % based on CBV 3 Euromoney 4 Asiamoney 5 Dealogic (Global) as of 1H22 6 Thomson Reuters 2017-21 7 Since 2016

Party Competitive Analysis as of 1Q22 9 BCG 2021 10 BCG and McKinsey 2021 11 Dealogic as of June 1, 2022 12 Includes transfer of existing Bonviva clients to the CSX solutions 13 Based on principal liabilities

14 Based on CS analysis of Datastream disclosures as of March 31, 2022 15 Based on Morningstar as of May 31, 2022 16 Based on AuM according to IPE Top 500 Asset

8 Based on Third

as of June 30, 2022 from CreditFlux

Managers 2022

CREDIT SUISSEView entire presentation