Melrose Results Presentation Deck

Melrose key financial numbers: Balance Sheet currently more conservative than normal

Melrose

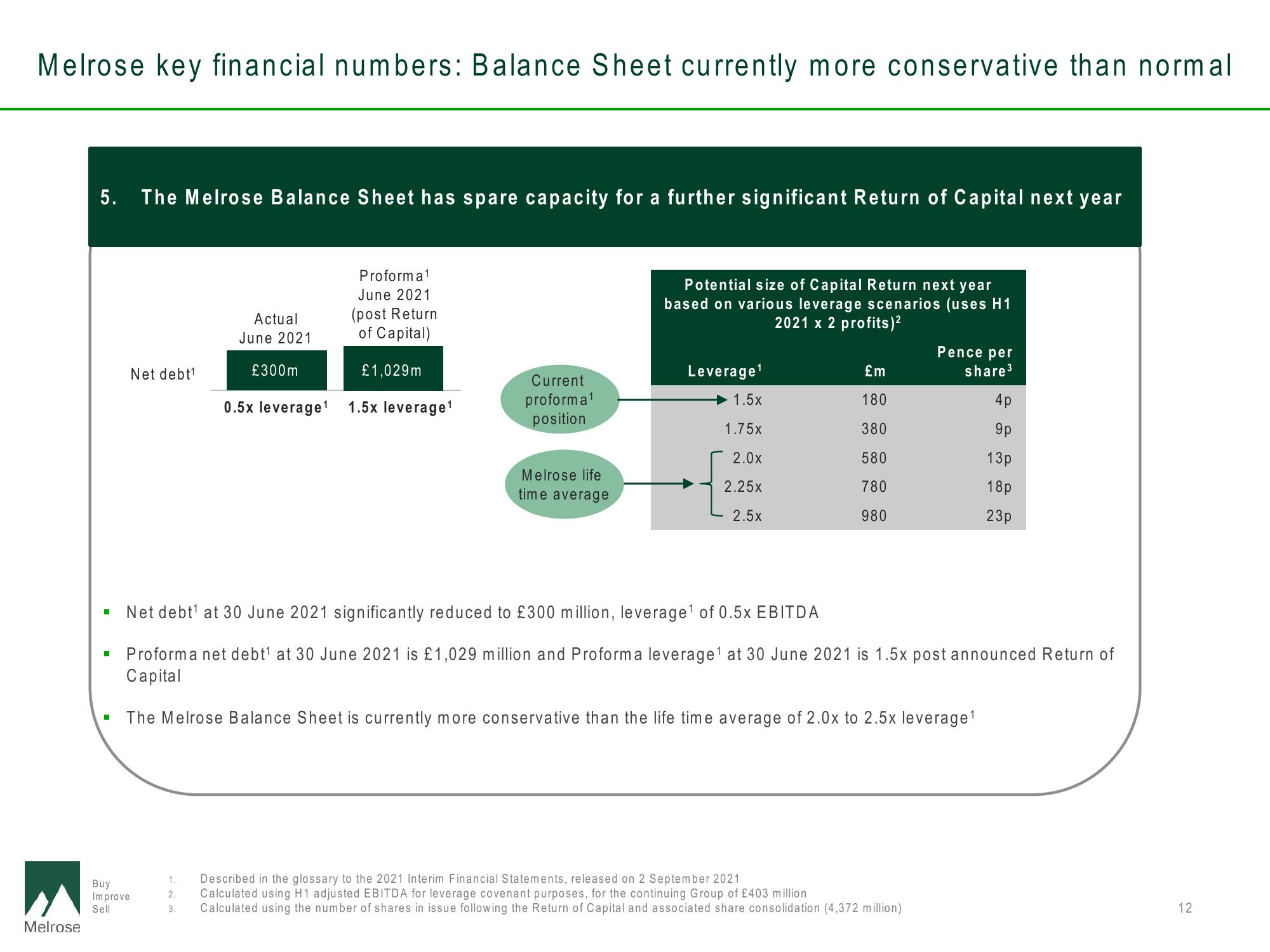

5. The Melrose Balance Sheet has spare capacity for a further significant Return of Capital next year

I

■

I

Net debt¹

Actual

June 2021

£300m

Buy

Improve

Sell

Proforma ¹

June 2021

(post Return

of Capital)

£1,029m

0.5x leverage ¹ 1.5x leverage ¹

Current

proforma¹

position

Melrose life

time average

Potential size of Capital Return next year

based on various leverage scenarios (uses H1

2021 x 2 profits)²

Leverage ¹

1.5x

1.75x

2.0x

2.25x

2.5x

£m

180

380

580

780

980

Pence per

share ³

The Melrose Balance Sheet is currently more conservative than the life time average of 2.0x to 2.5x leverage ¹

Net debt¹ at 30 June 2021 significantly reduced to £300 million, leverage ¹ of 0.5x EBITDA

Proforma net debt¹ at 30 June 2021 is £1,029 million and Proforma leverage¹ at 30 June 2021 is 1.5x post announced Return of

Capital

1.

Described in the glossary to the 2021 Interim Financial Statements, released on 2 September 2021

2. Calculated using H1 adjusted EBITDA for leverage covenant purposes, for the continuing Group of £403 million

3. Calculated using the number of shares in issue following the Return of Capital and associated share consolidation (4,372 million)

4p

9p

13p

18p

23p

12View entire presentation