Morgan Stanley Investment Banking Pitch Book

●

Project Roosevelt

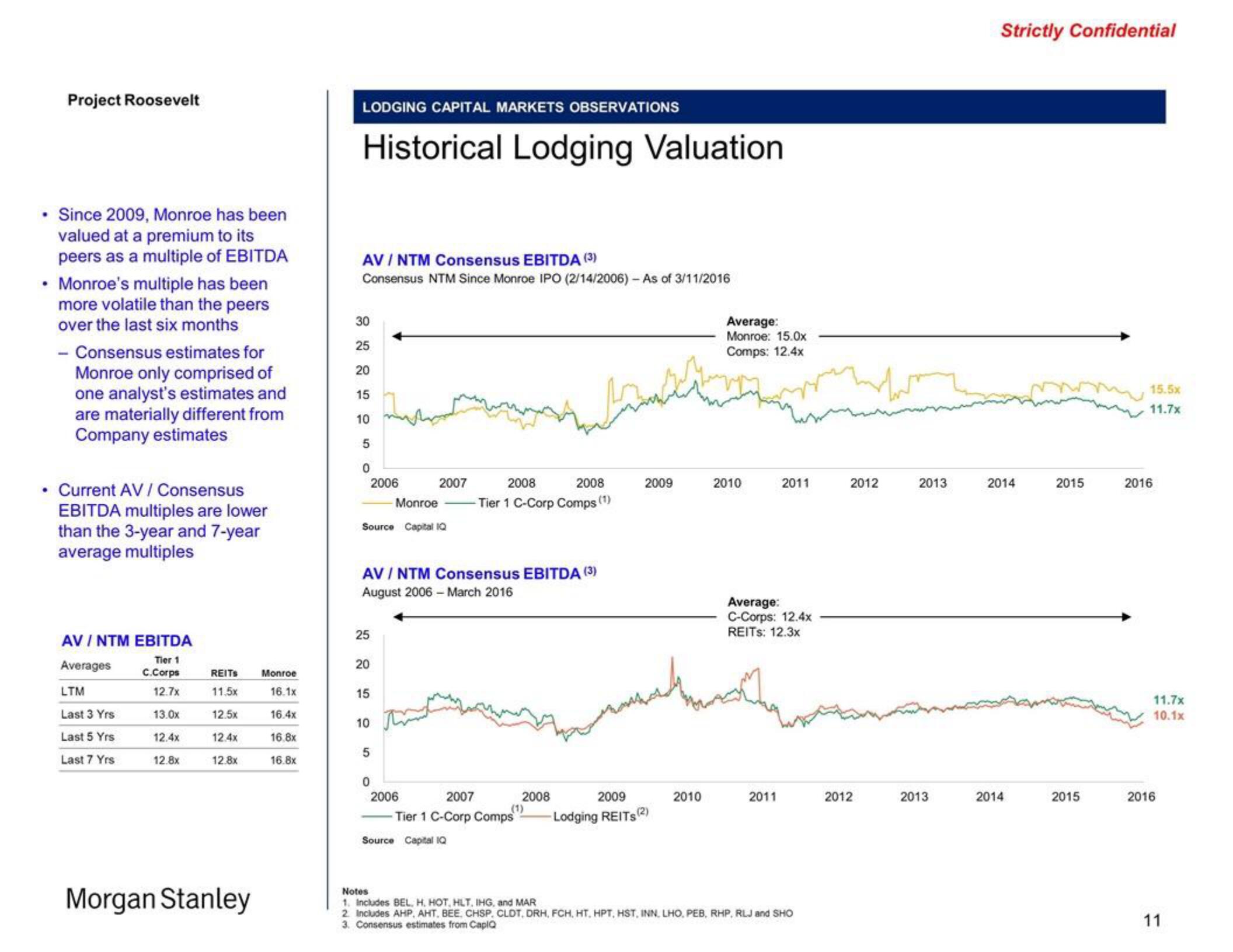

Since 2009, Monroe has been

valued at a premium to its

peers as a multiple of EBITDA

Monroe's multiple has been

more volatile than the peers

over the last six months

- Consensus estimates for

Monroe only comprised of

one analyst's estimates and

are materially different from

Company estimates

• Current AV / Consensus

EBITDA multiples are lower

than the 3-year and 7-year

average multiples

AV / NTM EBITDA

Tier 1

C.Corps

Averages

LTM

12.7x

Last 3 Yrs

13.0x

Last 5 Yrs

12.4x

Last 7 Yrs

12.8x

REITS

11.5x

12.5x

12.4x

12.8x

Morgan Stanley

Monroe

16.1x

16.4x

16.8x

16.8x

LODGING CAPITAL MARKETS OBSERVATIONS

Historical Lodging Valuation

AV / NTM Consensus EBITDA (3)

Consensus NTM Since Monroe IPO (2/14/2006) - As of 3/11/2016

30

25

20

15

10

5

0

Monroe

Source Capital IQ

25

2006

20

15

AV / NTM Consensus EBITDA (3)

August 2006 - March 2016

10

5

2007

0

2006

2007

-Tier 1 C-Corp Comps

2008

2008

-Tier 1 C-Corp Comps (¹)

Source Capital IQ

تا یا سنترال

2008

2009

2009

-Lodging REITS (2)

2010

Average:

Monroe: 15.0x

Comps: 12.4x

2010

2011

Average:

C-Corps: 12.4x

REITS: 12.3x

2011

Notes

1. Includes BEL, H, HOT, HLT, IHG, and MAR

2. Includes AHP, AHT, BEE, CHSP, CLDT, DRH, FCH, HT, HPT, HST, INN, LHO, PEB, RHP, RLJ and SHO

3. Consensus estimates from CaplQ

2012

2012

2013

2013

Strictly Confidential

2014

2014

2015

2015

15.57

11.7x

2016

11.7x

10.1x

2016

11View entire presentation